Plum is one of a number of fintech startups reimagining how we manage our finances online, in the form of an AI-driven or ‘smart’ chatbot. However, unlike competitors that exist primarily as standalone apps, the London startup (for now, at least) has decided to bet big on Facebook Messenger.

The thinking, explains co-founder Victor Trokoudes, who was previously an early employee at international money transfer company TransferWise, is that Facebook Messenger is already one of the places that Plum’s millennial target users reside. With the social network expected to launch friend-to-friend payments in Europe soon, he thinks it will increasingly become somewhere they’ll interact with their money too.

“With Facebook introducing payments into Messenger next year, Messenger is set to create a platform to further disrupt banks,” says Trokoudes. “Why use your banking app when you can pay your friends via the app and also add a service like Plum which allows you to take control of all aspects of your financial life?”.

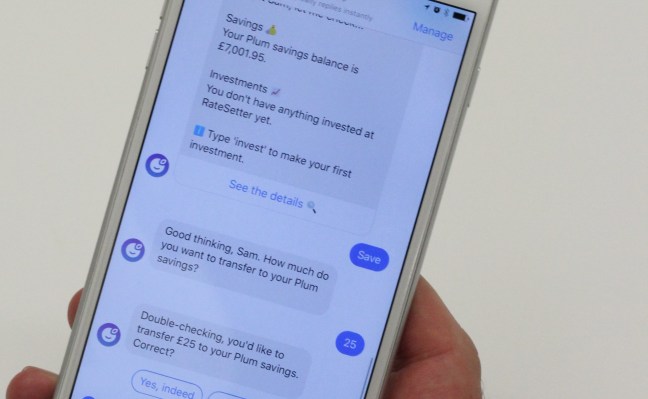

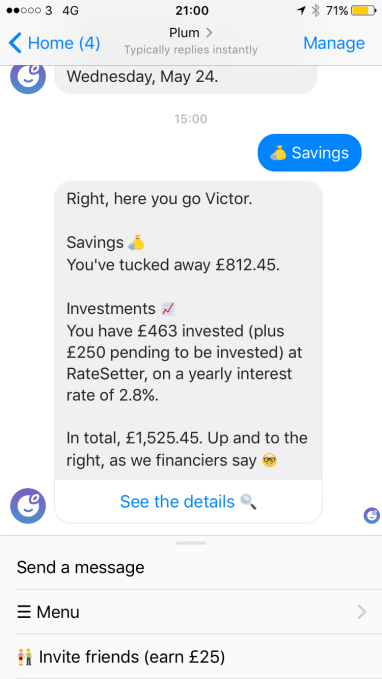

At launch, Plum billed itself as the first Facebook Messenger chatbot that enables you to start saving small amounts of money effortlessly. The chatbot connects to your bank account and Plum’s AI learns your spending habits, allowing it to automatically deposit small amounts of money into your Plum savings account every few days.

It has since partnered with Ratesetter to enable your Plum ‘micro’ savings to actually earn a decent 3% interest rate via the option to invest all or some of it into the peer-to-peer lending platform. A typical bank’s current account usually earns no interest at all. The Ratesetter integration is an attempt to rectify this, and potentially turns the banking model on its head: instead of a bank lending out your deposits and keeping most or all of the return, you can do the same.

However, savings and investments is only two pillars of Plum’s proposition. Trokoudes says the next area the chatbot will tackle is ensuring that you “don’t get ripped off on financial products,” such as loans, overdraft, utilities, and insurance. This will see it launch a ‘switching’ service as early as next month to make it painless to switch to a cheaper and greener energy provider.

“We are going to make you aware if you are being ripped off by your utility provider, your bank overdraft or overpaying on a loan and then Plum will ask you if you would like to switch. All you will have to do is reply ‘Yes’,” says the Plum founder.

“We are going to make you aware if you are being ripped off by your utility provider, your bank overdraft or overpaying on a loan and then Plum will ask you if you would like to switch. All you will have to do is reply ‘Yes’,” says the Plum founder.

I also understand the startup is pairing up with Habito to help users find a better deal on their current or future mortgage.

It’s all part of what Trokoudes and others in fintech describe as the re-bundling of financial services, but in a way that puts the user in control. Direct competitors include other chatbot personal finance managers (PFMs), such as Cleo, Chip and Ernest.

But it’s really a space being attacked on multiple fronts, from the incumbent banks themselves to challenger and so-called neo banks, and something like Curve’s all-your-cards-in-one approach. Upcoming legislation in the form of the EU’s PSD2 and the U.K.’s Open Banking, which forces the banks to open up their data to new entrants, is only going to expedite this re-bundling gold rush even further.

“When I left TransferWise in 2016 I felt all fintech verticals were disrupted and felt that the natural next real fintech innovation was to unify these disruptions into one complete offering,” adds Trokoudes. “Two major developments over the next few months are set to make this possible. Firstly, the opening up of consumers transactional data through PSD2 and secondly, maybe less obvious, the fact that Facebook Messenger will emerge as a platform for P2P payments”.