There are several apps on the market that help you track your spending (Parity), save money (Pennies), or invest (Moneybox) using basic machine learning. Now an ambitious startup wants to do all three.

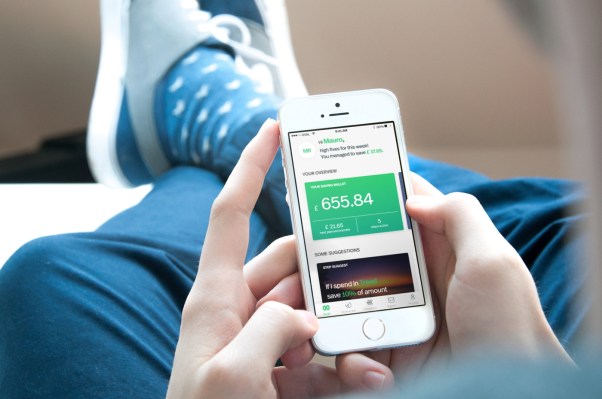

Based out of London, new startup Oval (Apple, Android) will combine expense tracking, saving, and investing into one app, while also adding a social element by enabling its community of users to share tips and suggestions to one another. In other words, trying to harness the “collective intelligence” of both its platform and its users combined.

Oval aims to help users grow their savings in less time by teaching them to monitor spending habits and make saving virtually automatic. The company has raised €1.2M in funding, backed by Italy’s Gruppo Intesa SanPaolo, b-ventures, an incubator from Japan’s DOCOMO Digital and Bertoldi Group Family Office .

So how does it work?

Oval users achieve savings using commands that tell Oval to make a deposit into the app’s secure digital savings account each time there is new income or spending in a linked account. Oval says the system is based on the latest research from financial experts and behavioural economists.

Users are to make financial decisions through a combination of technological solutions and the suggestions and advice of other users.

There are three types of programs: round-ups that save the spare change from transactions, percentage saving that puts aside an amount equal to a fixed percentage of a transaction or income, and fixed amount saving which saves an amount chosen by the user each time a transaction is made at a specific merchant or on a specific category or user tag.

Benedetta Arese Lucini, Oval’s CEO, says “We want to create a new platform for people to both help themselves and help others as they identify intelligent strategies to save.”

It’s the sort of thing banks certainly do not do for us at the moment.

According to the latest Aviva Family and Finances report, the average British household maintains just over £3,000 in savings and investments, but one-in-four UK households has less than £100 pounds saved.

However, Oval says that during its closed beta trial, the average amount saved by users over the past 3 months is just over £400, or about £135 pounds per month. And Oval users seem to be improving their ability to save as they get used to the platform.

Oval was founded by Benedetta Arese Lucini, former CEO of Uber Italy, with Claudio Bedino and Edoardo Benedetto, co-founders of do-it-yourself crowdfunding platform Starteed.com, and Simone Marzola, longtime expert in machine learning and artificial intelligence with previous startups and now Oval’s CTO.