Today was Y Combinator’s 24th Demo Day, where the accelerator shows off its fresh companies to investors. International, AI and hardware products were the emergent themes of the 52 companies that launched on Day 1. You can check out our picks for the top 7 startups from today.

“The international tour seemed to work,” says YC president Sam Altman, who helped put on Startup School events across the globe to boost the accelerator’s recruiting. “We visited more countries than we ever did before,” Altman notes. “These are fantastic companies from around the world. If we make it so these companies don’t want to come to the U.S. and create jobs because of the visa situation, what a loss for the country.”

The presentation room at Mountain View’s Computer History Museum was more densely packed with investors than ever before thanks to smaller chairs. YC’s emphasis on diversity both amongst its staff and the companies who demoed was readily apparent. “You always need to start at the top of the funnel with the partners who pick the startups,” Altman said, alluding to the lack of women and people of color at most venture capital firms.

Here’s an overview of all 52 of the startups that launched at today’s Y Combinator Winter 2017 Demo Day 1. Also be sure to read our picks of the top 7 startups from Day 1, plus all the companies that launched on Demo Day 2 and our Day 2 top picks.

—

AON3D – 3D printers for industrial manufacturing

Injection mold plastic manufacturing isn’t flexible or fast enough, but getting started with 3D printers is too expensive. AON3D makes a $15,000 3D printer that costs just $15 per pound of materials that it says can outperform traditional $150,000 3D printers with more pricey materials. It uses Peek, a revolutionary plastic it says is as strong as metal. It’s already shipped 33 printers and booked $450,000 in revenue with 60 percent margins. By making 3D printing 10X cheaper, AON3D can move from printers for prototyping into the $30 billion full-scale industrial manufacturing market.

Pantheon – Letting anyone make a VR game

Building game in VR typically takes a long time, so it’s hard to test out different game mechanics to find something fun to play. Pantheon has built a VR game creation tool where you can pull in shapes, sculpt them to your liking, add textures to create a VR world, then drag-and-drop in simple game mechanics. Creators can then instantly publish their VR game to the Pantheon platform, which is hoping to become the central hub for casual VR games by amassing a ton of titles. Ten games were made on Pantheon in the just the first week as it aims to evolve into the YouTube of VR gaming, where aspiring game makers share their wares.

Origin – Keurig for smoothies

Origin built a kiosk for offices that lets employees buy pre-packed pods from a freezer and make them into fresh juice smoothies silently in 30 seconds. It works similarly to a Keurig coffee machine, but Origin thinks it can use its smoothie maker as a Trojan horse to sell more food and other items inside the 188,000 offices in the U.S. Right now it earns a 56 percent margin on the $2.99 pods, recoups the kiosk cost in 7 weeks and now has $30,000 in monthly recurring revenue as it grows 50 percent weekly. Fellow juice maker startup Juicero has run into slow demand for its expensive machine and juice subscriptions. But Origin’s in-office commerce model and cheaper pods could have a different fate if the juice tastes right.

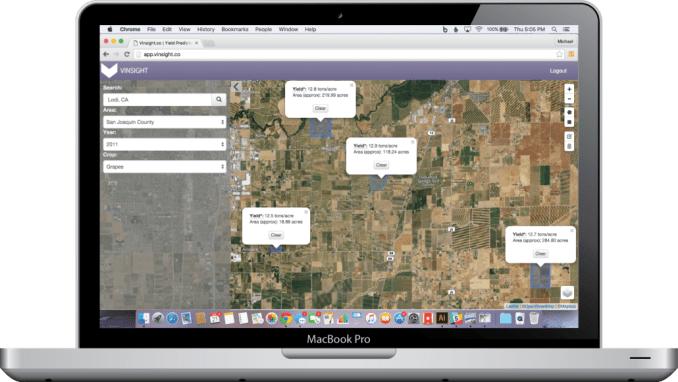

Vinsight – Crop yield forecasting

Vinsight uses machine learning, satellite imagery, weather data and historical reports to offer crop yield forecasts it says are 4X better than alternatives. U.S. farmers lose $11 billion a year due to bad forecasting that’s often done with gut instinct, and pencil and paper. They overestimate and sign deals to produce quantities they can’t fulfill, wiping out profits. Vinsight charges $25 per acre and is already being used by the world’s largest winery and the second largest almond producer. It’s eyeing a $4 billion market to give farmers actual insights that earn them money, not just more photos of their crops.

Read more about Vinsight on TechCrunch

Neema – Banking for the unbanked

Neema lets anyone cash checks instantly via phone, send money to family overseas and have a debit card. The startup makes it easy for the unbanked to join the modern economy while avoiding high fees associated with check cashing stores, Western Union and overdrafting. Neema partners with banks, remittance services and debit card providers on the backend to provide security and reliability, while building a front end specifically designed for the 70 million underbanked Americans and legions more abroad. Neema has already generated $30,000 in revenue from its 1,000 users in Israel, and is now launching in the U.S. to disrupt greedy financial services that prey on the poor.

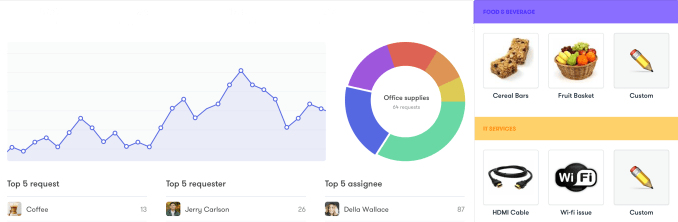

Hivy – Office management commerce platform

Hivy builds software that lets employees submit directly to their office managers things they want to buy for their office, such as food or equipment. These managers can approve the purchases, which are instantly fulfilled by 45 vendors that are already integrated directly into the Hivy platform. Now Slack, Eventbrite, Gigster and more companies are using Hivy to quick get employees Lacroix beverages, laptop chargers or furniture. Hivy both charges offices and vendors a monthly software subscription and takes a commission on every purchase. With a $400 billion per year U.S. market for office management expenses, Hivy could manage a ton of spend if it can convince managers that it makes their lives easier.

Read more about Hivy on TechCrunch

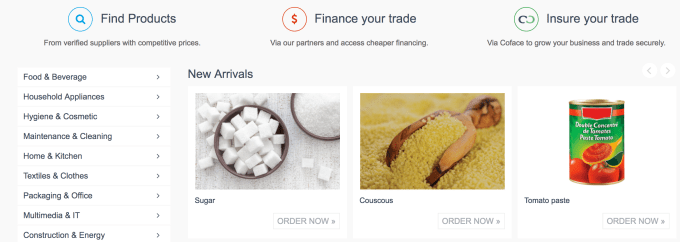

WaystoCap – The Alibaba of Africa

WaystoCap offers a business-to-business marketplace for big shipments of consumer goods across Africa. Most existing attempts at the space look more like Craigslist without integrated payments, and a lack of trust and insurance scare away buyers and suppliers. WaystoCap works with financiers to lets buyers finance their purchases, and Coface to insure suppliers. This lets WaystoCap charge a 3.5 percent commission on all transactions. It’s now selling in 10 countries, and is already profitable, with an average $1,000 margin on each order. China once seemed like a risky market for B2B shipping before Alibaba began to dominate, and now WaystoCap wants to standardize trade in Africa.

Read more about WaystoCap on TechCrunch

Clover Intelligence – Voice analytics for sales

Seventy percent of customer interactions happen over phone calls, yet they don’t have the same optimization technologies as email, which accounts for just 10 percent. Clover analyzes voice interactions to provide recommendations on sales strategy. It can recognize if sales people are only talking about product features instead of benefits, or if they’re pushing to close the sale at the wrong time. The software saves time for managers, which typically spend half their weeks listening in on calls, filling out score cards and making recommendations without data. Clover says one publicly traded client saw a 300 percent increase in its sales call conversion rates. It charges $150 per seat per month, and next Clover wants to move into customer service, success and compliance as it tries to own the enterprise voice space.

Kangpe – Health insurance for Africa

Costly, unnecessary hospital visits drive up insurance premiums beyond the buying power of most people in Africa. Kangpe combines telemedicine with health insurance to make premiums cheaper. When someone thinks they’re sick, they connect with a doctor via the Kangpe app or SMS; 70 percent don’t end up needing to go to a hospital, and the 30 percent that do are covered by Kangpe’s insurance. It already has the telemedicine app and is now building out its network of local clinics. Since big insurers can’t adapt to telemedicine fast enough, Kangpe could win lots of business in the $5 billion a year health insurance market in Africa, and thinks it can grow that market to $20 billion by being more affordable.

Read more about Kangpe on TechCrunch

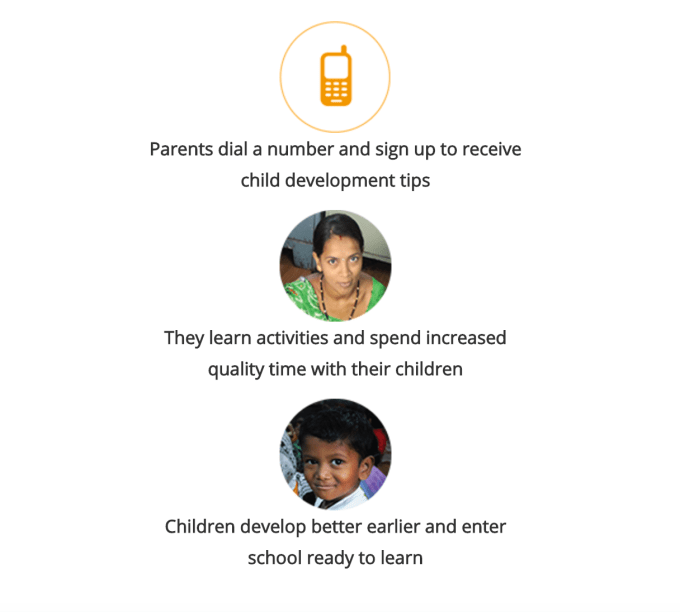

Dost Education – Making literacy affordable

There are 150 million illiterate women in India who have trouble educating their children, leading to a cycle of illiteracy. Dost is a nonprofit where people sign up to get regular audio calls that instruct them how to teach their kids in preparation for kindergarten. These lessons are simple for parents to understand and share with kids, which has led to 3X more home education by its users and a 0.5-grade level increase for their children. Dost costs parents $0.91 a month, so the nonprofit is sustainable, and now it just needs startup capital to build out its lesson plans and infrastructure.

Cambridge Bio-Augmentation Systems – Plug-and-play standard for human bionics

CBAS wants to be the USB port for the human body. The startup has developed a low-cost implant that can connect any bionic device, like artificial limbs, to any part of the body, and give patients control of their prostheses. It also created the first live streaming nerve implant to gather data from a pig’s leg. CBAS wants to be the standard on which all bionic implants build. Just for amputees, this could be a $9 billion a year market, and now 10 companies have switched to the CBAS standard.

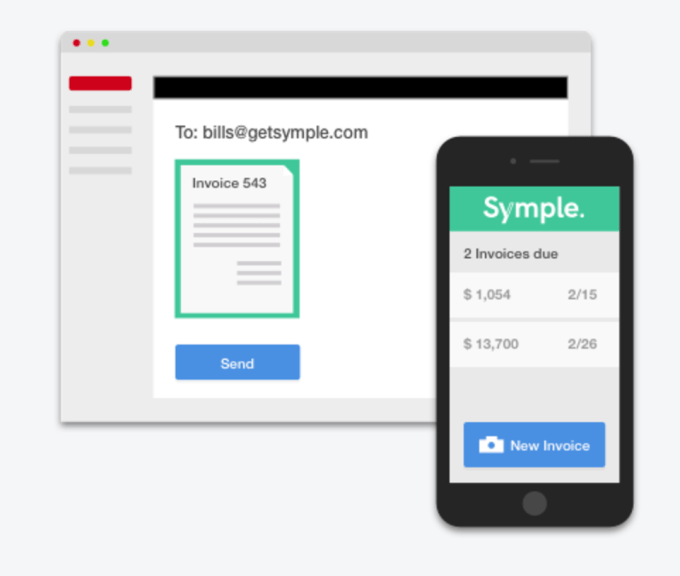

Symple – Venmo for B2B payments

There are 5 billion checks written and mailed per year for business-to-business payments in the U.S. Symple lets users take a photo of an invoice to digitize them and pay right through the app. It now has 219 companies on board, and it’s growing virally as businesses force their vendors to sign up. Symple charges $4 per invoice, but waves fees for the first six months to boost growth. It could become a $20 billion business if it can convince companies to ditch paper for a quicker, easier digital alternative.

Read more about Symple on TechCrunch

Cowlar – Fitbit for cows

It’s way smarter than it sounds. Cowlar makes a special collar for cows that tracks their temperature, activity and other data, and makes it available to farmers. It can recognize a cow with an infected hoof from the change in its gait, or identify that a cow is pregnant and will eventually produce milk. Cowlar costs $69 per cow with a $3 per month subscription, and provides a solar-powered “cow router” that collects data from the collars. It already has 600 cows on the platform, with 7,200 on the waitlist, and has alerted farmers about 103 sick cows. It already has the opportunity to build an $11 billion business on milk cows, and could enter the 3X-bigger beef cow market next. While the idea might seem ridiculous, cows are a huge part of the economy, and more data on them leads to more revenue from them.

Wifi.com.ng – ISP for Africa

There are 120 million middle class people in Africa with smartphones, but only 12 million have broadband at home. Wifi.com.ng builds solar Wi-Fi transmission towers that can support 1,500 homes with Wi-Fi at 30 percent of the price of mobile data. It now has 35 towers and earns back the infrastructure cost in 7 months. The startup has $1.2 million annual recurring revenue, and is growing 25 percent per month. Africa doesn’t have the phone lines or roads to run traditional cables, and satellites and drones won’t work in dense cities, so Wi-Fi is the answer. Wifi.com.ng believes it can become the Comcast of Africa.

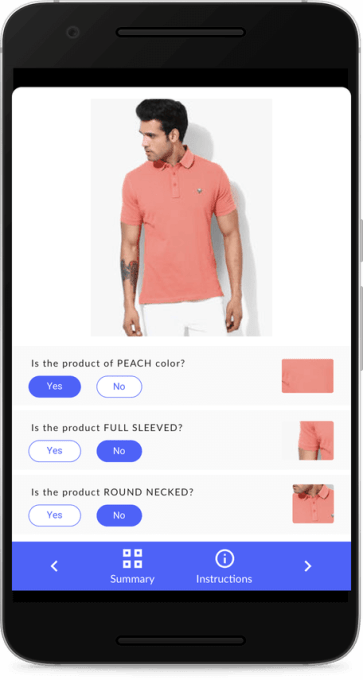

Playment – Mechanical Turk for enterprise

When e-commerce businesses need to label products, they either use scalable but lower-quality Mechanical Turk, or accurate but expensive and unscalable outsourcing systems like Accenture. Playment utilizes a mobile app to let task workers do labeling on the go, while using software to ensure accuracy, check worker qualifications and filter out spam. India’s Flipkart fired Accenture and gave the $300,000 contract to Playment. It claims to be 10X faster and 50 percent cheaper thanks to its mobile work desk, and is attacking a $150 billion outsourcing market.

Read more about Playment on TechCrunch

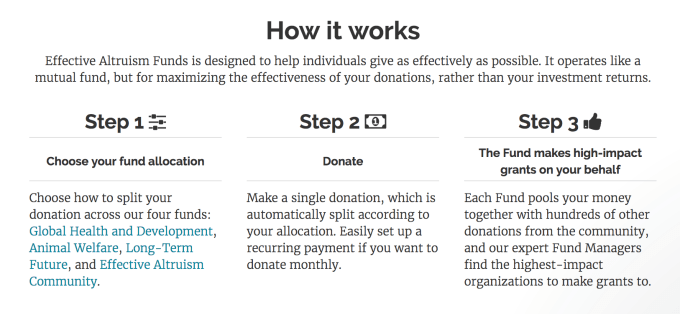

Effective Altruism – Finds you the best charities

Giving to charity without doing intense research is like burning money, because a study showed that 75 percent of social programs have zero or negative impact. Effective Altruism does the legwork for you. You sign up, choose causes you care about like global poverty or animal treatment, and make a donation. Effective Altruism finds the charities with the most positive impact in those areas and routes the donation for you for free. It believes it could provide donors 400X more impact per dollar, and could boost charitable giving by increasing confidence that the money gets good done.

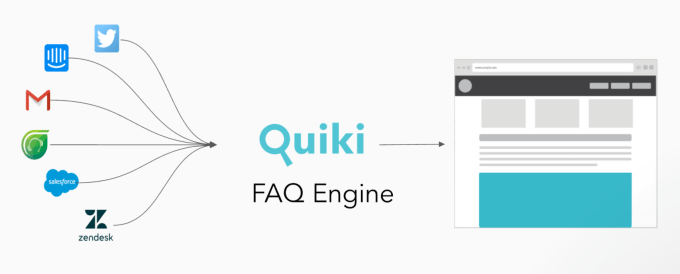

Quiki – Intelligent FAQs

Seventy-two percent of customers prefer online self-service for customer support to talking to the company directly, and self-service FAQs are much cheaper than call center support staff. Quiki uses natural language processing to turn previous conversations between support reps and customers into FAQs everyone can access. It’s already turned 2,000 questions into FAQs that can boost a company’s SEO along with customer satisfaction.

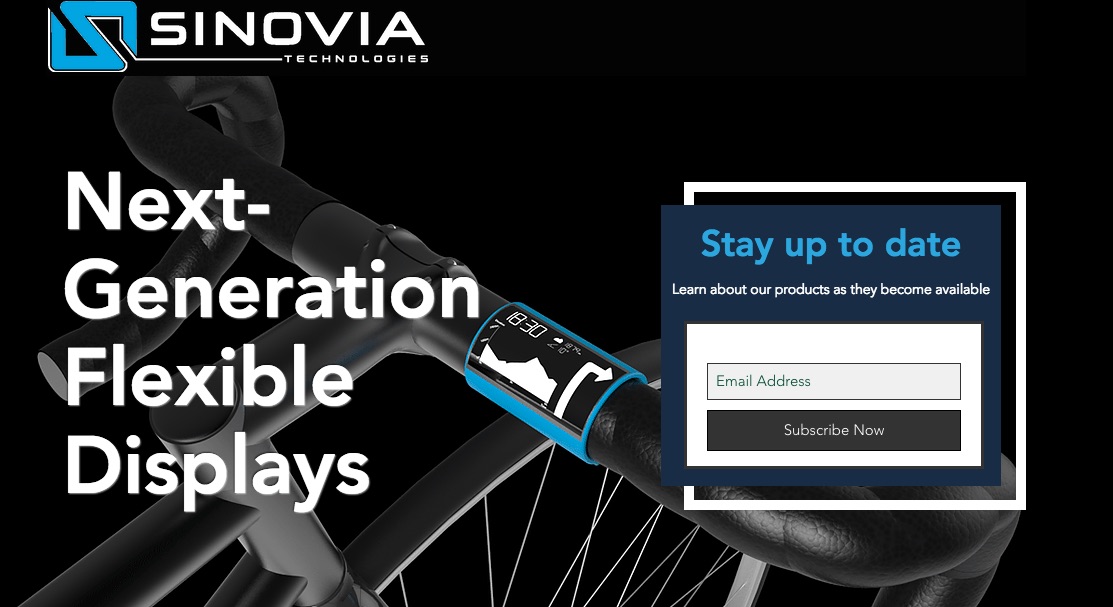

Sinovia Technologies – Next-gen OLED displays

OLED displays are better than standard LCD displays, but also more expensive. Sinovia wants to be the supplier of every small display everywhere by making these OLED displays 80 percent cheaper. The displays are also paper-thin, flexible and transparent. For example, you could get a bike display that wraps around your handlebars using Sinovia’s patented technology. The founding team is a group of Stanford Ph.D.s and plan to disrupt the more than $15 billion OLED display market with a sweet spot entry point in wearables. The company already has LOIs from Fuseproject, Astro and Striive.

BuyPower – A bill payment platform for Africa

Africa is fast adopting new technologies and BuyPower aims to be the PayPal for Africa, starting with Nigeria. PayPal had eBay, but BuyPower has what co-founder Asehinde Oladipo says is something better, reduction of people waiting in lines to pay their bills. The startup already has 40 percent market share in the cities in which it operates, with 150,000 monthly paying users. It takes a 4 percent cut from each user and says it is profitable, taking on the $14 billion electricity market in the country. It plans to launch a peer-to-peer payment service soon and then “become PayPal, that’s it!”

ServX – Uber for auto repair in India

YC seems to be on a theme of emerging markets this time around, and ServX is part of that trend with an on-demand auto repair startup. As co-founder Akansh Sinha explains the service, you book an auto repair through the app, a driver picks it up, takes it to the shop and fixes it. But ServX also aims to provide trust in the market with vetted repair shops that will fix your car with high-quality parts and you only pay when you are satisfied with the job. The founder says ServX is profitable and has grown 52 percent month-over-month since launching in January 2106. In just the last week, ServX has completed 6,000 repairs, putting it at a $3.3 million revenue run rate, according to Sinha.

Clear Genetics – Automated genetic counseling

There are more than 45,000 genetic tests out there now, but most require a prescription and an appointment with a genetic counselor. The problem is there is a shortage of genetic counselors. Clear Genetics thinks it may have created the future of genetic counseling by telling you which tests you need and giving you the results without the need to chat with a counselor first. The genetics software gathers patient data, pairs it with other data and tells them the results. If a patient needs further counseling for more serious issues it refers them to a counselor. So far the company is operational in Israel for pregnancy genetic counseling, serving 60 percent of the market, but genetic counseling as a whole is a $5 billion market in the U.S., and even bigger throughout the world.

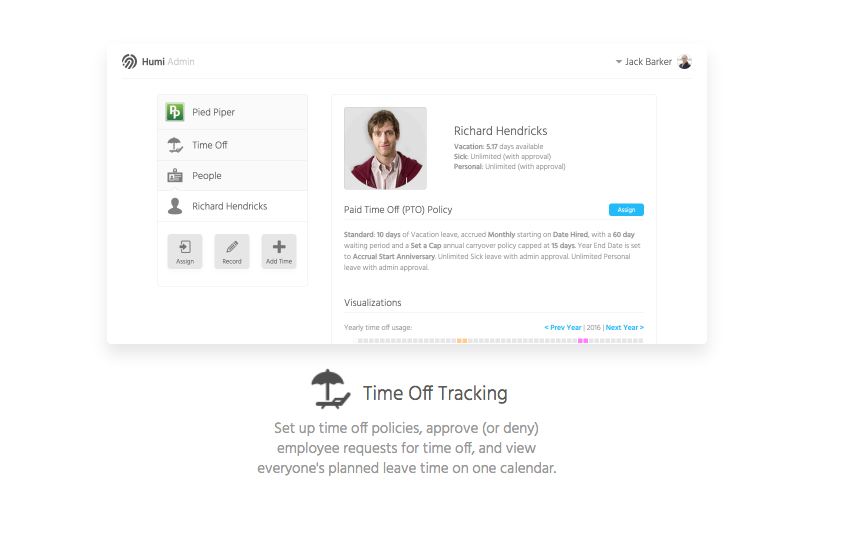

Humi – the “Gusto” for Canada

Employee benefits management is big business and Humi aims to provide these types of HR services in the cloud to Canadians for free. Canada, says Humi, is wide open, and with plenty of small to medium businesses paying out more than $10 million to providers. It has already added 650 companies with a $300,000 ARR.

BloomAPI – Automated access to health records

Just thinking about the pain of gathering all health records in one digital place can induce headaches for anyone dealing with our current healthcare system, but BloomAPI aims to take on this enormous issue by simplifying the medical records release process by digitizing medical records. Right now it can take up to 12 phone calls and costs the insurance company $17 every time you ask for a medical record transfer request. Insurance companies buy BloomAPI and then install the software. The software is free to doctors and has already gained access to 1 million records in its eight-month existence, claiming to be one of the largest repositories of medical records. After replacing faxing, Bloom says it will be able to own the market by owning the data.

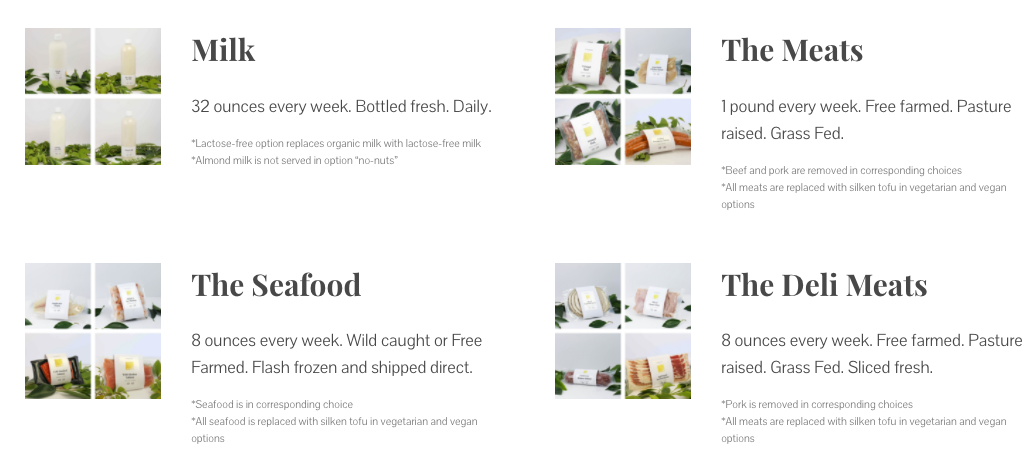

Movebutter – Blue Apron for groceries

A self-described “online Trader Joes” sounds like it might just be another Instacart or some version of FarmFreshtoYou. And as the founder of Movebutter says, the margins are super low. But Movebutter says it can make 40 percent margins. That’s because it sells fewer items that you buy more of, with a $32,000 weekly revenue. It also ships straight to your door one week of groceries of just 20 items you might usually buy. It ships to 40 states and claims to be the biggest grocery store in the country now.

Volans-i – B2B drone delivery

Amazon promised consumer drone delivery via Amazon PrimeAir but you likely don’t need a toothbrush in your backyard via drone. Businesses, however, do need deliveries fast, and volans-i aims to speedily deliver those shipments door-to-door via drone. For example, a company may need a certain part delivered to keep up with production. Volans-i steers its drones to this company with up to 50 lbs of payload going 1,000 miles — or 15,000 shipments per year per customer, according to the company. Volans-i’s team comes from strong industry backgrounds including Northrup Grumman, and the company believes it can save time and money for a number of business categories, including high-tech, aviation, medical, oil and gas, automotive and manufacturing.

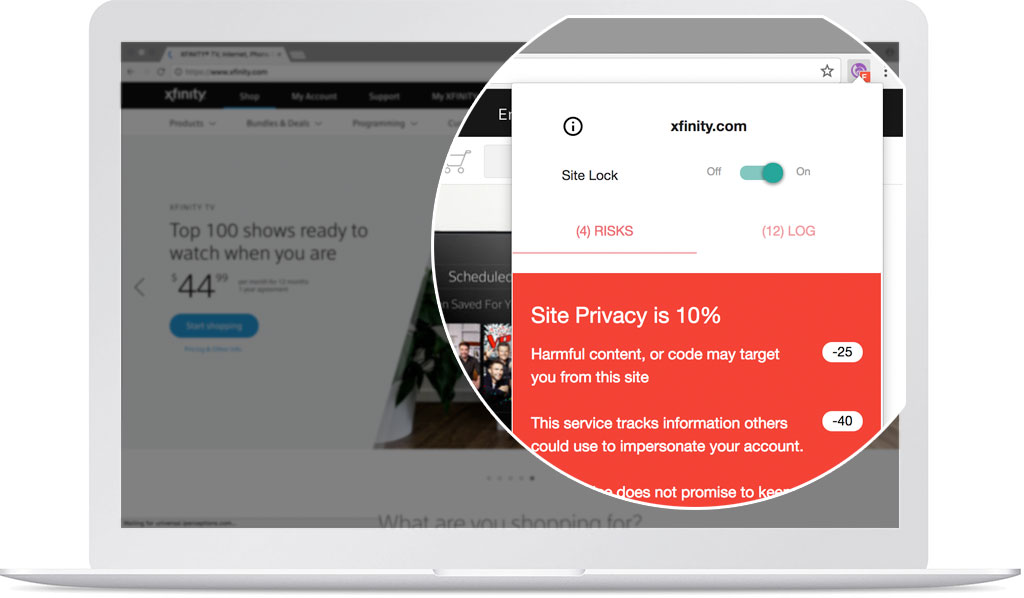

Apozy – Software aiming to stop phishing and malware

Phishing and malware are the single biggest issues for businesses worldwide, and one of the largest VC firms in the world was recently attacked. The founder says he knows how to hack anyone in the audience because he worked as an ethical hacker. More malicious hackers use similar-looking sites to trick you into giving away your password. Apozy is a browser extension that detects a suspicious link and will warn you when a site is fake. It is also creating the world’s largest database of zero-day attacks for the possibly 76,000 companies that don’t have a solution to getting hacked. It’s still early days but, so far, eight companies have adopted Apozy in the last three weeks.

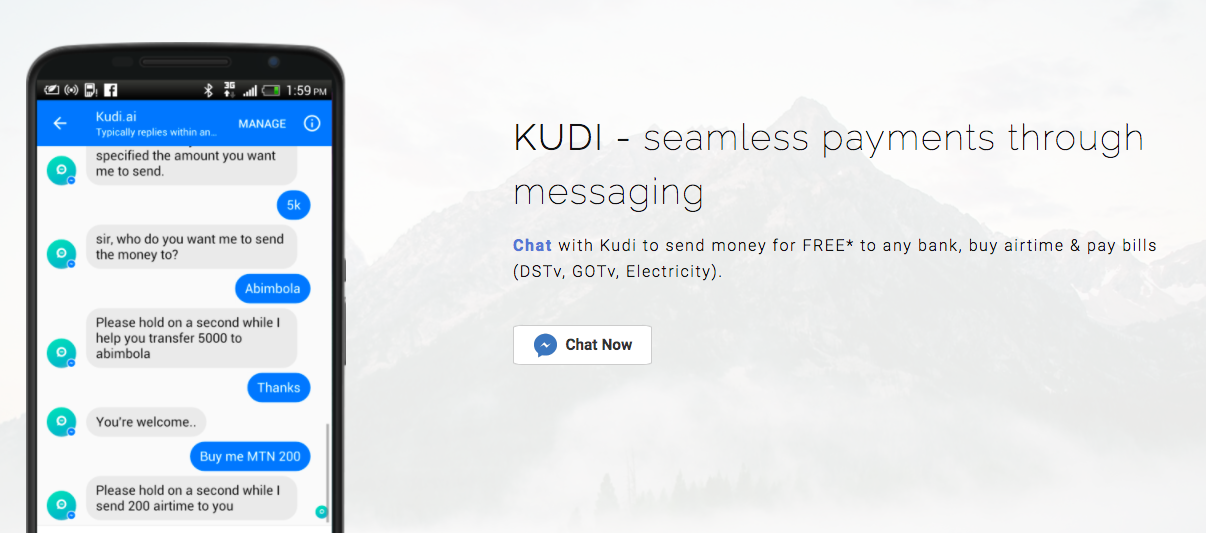

Kudi – Bill payment through mobile messaging in Africa

Venmo and PayPal have penetrated the U.S. market, but Kudi aims to do the same in Africa — but over chat. There are 900 million mobile phones in Africa and people hardly install new apps, but 90 percent of payments happen offline. Not because they don’t have phones but because most solutions “suck,” according to the founder. Using Kudi, people send a message they want the money to move from one place to another and Kudi will process the request. The company launched in January 2017 and is growing 70 percent weekly. It also has partnered with Nigeria’s largest bank, with more than 10 million customers in a $12 billion market in Nigeria alone. The team also seems to know their stuff when it comes to banking and technology, as it is a bunch of fintech experts working in Europe and Africa for the last 5 years.

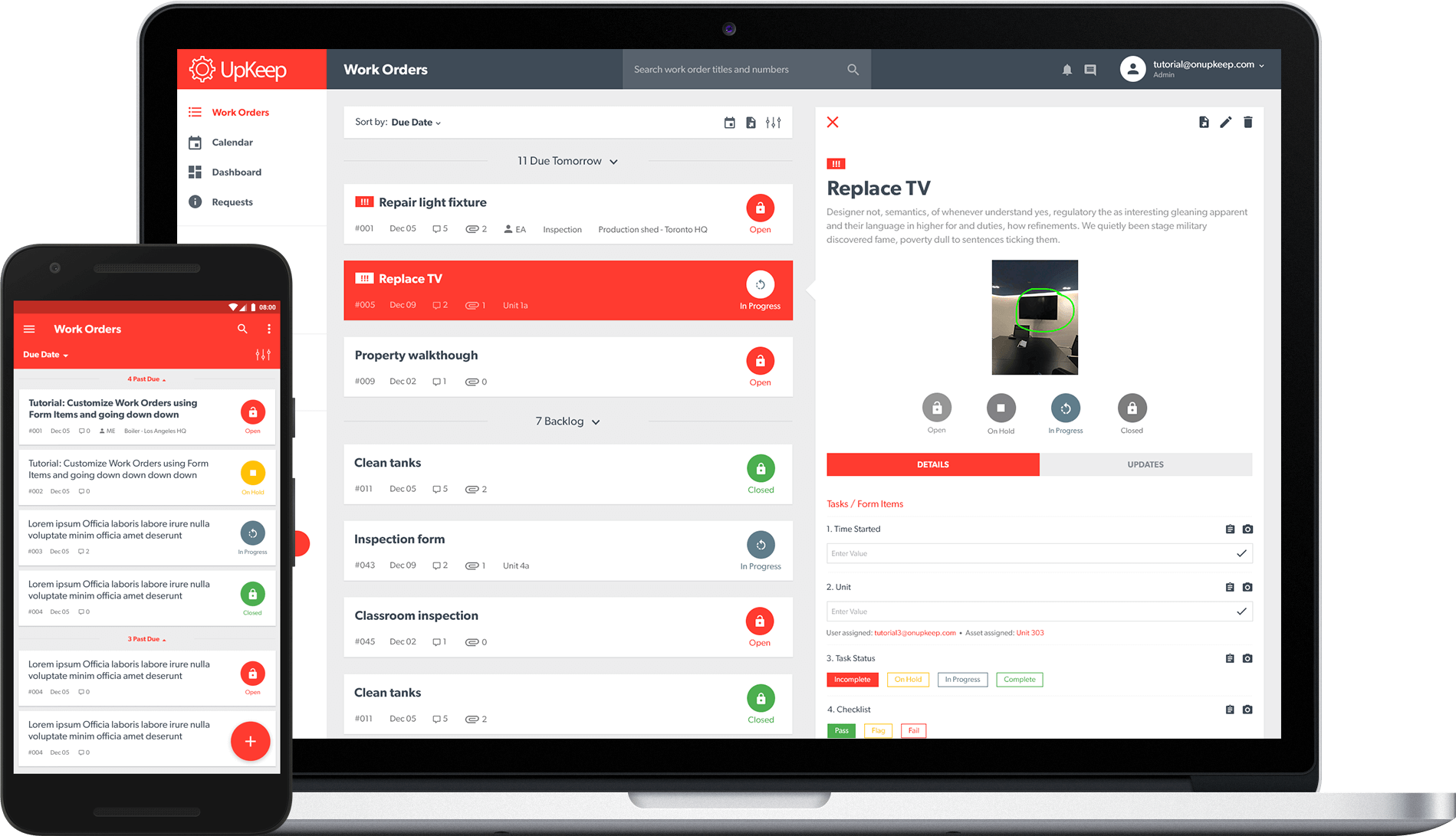

UpKeep Maintenance Management – Maintenance software for small to medium businesses

UpKeep is designed to keep technicians happy by creating easier solutions, including simple barcode scanning applications, task management and inventory management accessible through a mobile device. Why does this matter? Founder Ryan Chan says it’s a huge pain to have several steps written on paper by several people throughout the process, leaving lots of room for possible mistakes. However, UpKeep works by snapping a picture and taking notes as technicians are out in the field, eliminating the need to write it down several times. It is cash-flow positive and has more than 300 paying customers, 95 percent of which came in organically. The company now has more than $405,000 in ARR and is growing 20 percent month-over-month.

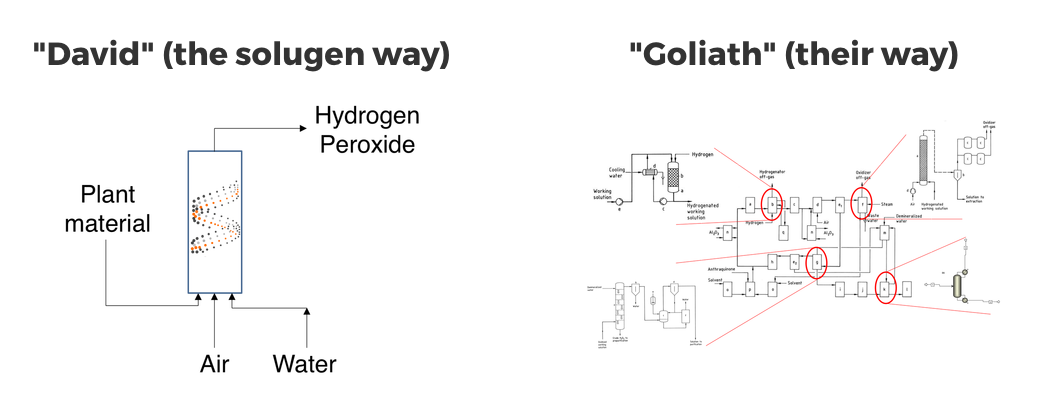

Solugen – Converting plant sugars into hydrogen peroxide

Scientists border on alchemy these days and Solugen is a good example. The startup processes plant sugars in a new way to make hydrogen peroxide, a solution used by many industries — and is even in the chair we all sat in at YC Demo Day. Solugen says this process is cleaner, safer and purer than anything else on the market. Currently, hydrogen peroxide costs a lot and easily explodes, causing dangerous working conditions. However, Solugen’s pilot project cost just $7,000 at small scale, cutting costs on the product and on shipping costs. But peroxide is only the first entry point. Solugen plans to make more cleantech products using its cheaper process, and currently has $120,000 ARR.

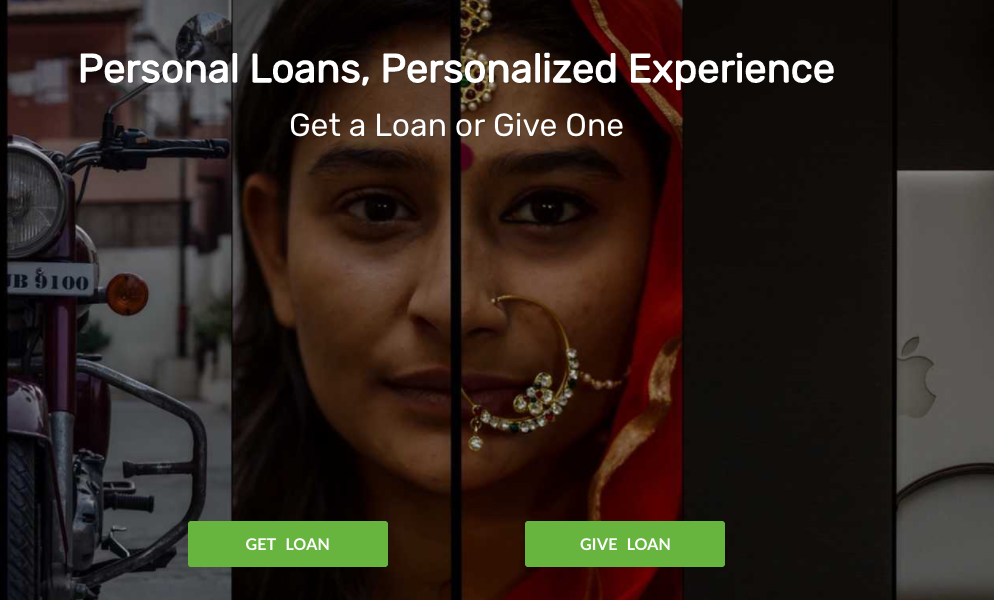

Credy – Peer-to-peer lending in India

Lending is a new concept for India, and Credy intends to capture this market using biometric identification for fraud protection. India holds an enormous $50 billion potential lending market that will double by 2020. India is also “credit hungry,” according to co-founder Pratish Gandhi. Credy also supports real-time credit scores and provides paperless zero fraud protection lending. Founded by two former Goldman Sachs VPs with 15 years of experience between them, so far Credy has received 350 loan applications.

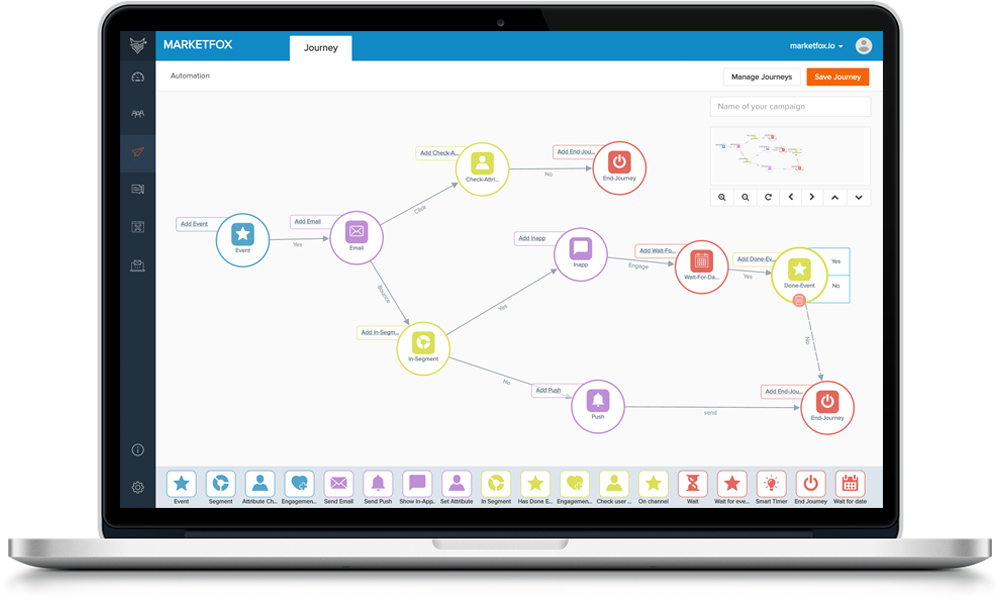

Marketfox – Marketing automation

Marketfox helps optimize for mobile and website by helping marketers acquire users through web push and in-app, as well as cutting through the marketing silos. It does this by tracking users across devices rather than on just your laptop or just your phone. The founder previously sold his business to Freshdesk and Marketfox is currently growing 18 percent week-over-week and claims to be increasing customer’s rev by 30 percent so far.

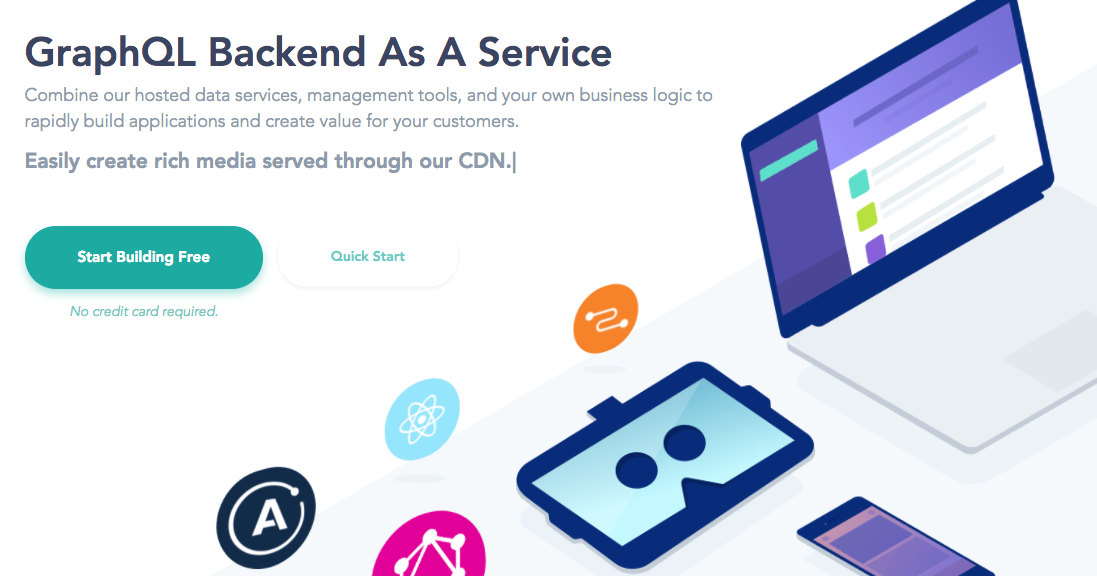

Scaphold.io – One API for all your clouds

Do you need a universal API? Scaphold.io is building one for you to cut down on complicated integrations. Maintaining integrations is a time-consuming and costly process, but Scaphold.io handles all of that maintenance behind the scenes while translating them to make sense for your needs. It solves the problem using GraphQL, is growing 30 percent month-over-month and has already pulled in partnerships with companies like National Geographic and Visa, as well as handles more than 200 integrations of platforms “every day.”

Mere Coffee – A coffee machine for your small to medium business

If you are like most business people you likely already have a coffee machine at your office. But the founder doesn’t like pod coffee as it “tastes terrible” and isn’t environmentally friendly. However, Mere promises a superior experience with its champion machine using compostable single-serve whole bean coffee. The company promises to bring your business the best beans on a weekly basis, and provides the machine to create a craft-brew experience. It has already conducted a paid beta and makes a 50 percent margin on its subscription service. It is now rolling out to the Bay Area and says it is getting traction from several tech startups.

Delee – A blood test for circulating tumor cells

Cancer is one of the biggest killers in the U.S. and Delee aims to take on the “emperor of all maladies” with a blood test device able to isolate tumor cells. The patent-pending device aims to personalize cancer treatments based on a new approach.The founding team comes from Stanford and the Rochester Institute of Technology and works in biomedical engineering; the startup has already run a successful clinical trial using 15 patients, isolating tumor cells for 13 of them. Delee aims to take on bigger companies working in the same space, like Grail, and take on a $2 billion market.

REZI – “OpenDoor for leases”

REZI rovides a new model for owners to ensure they will be able to rent out their rental properties. It can generate rental offers for tenants in seconds and pays rent to property owners upfront, reducing the risk they face. The whole thing is powered by a product called Morpheus, which prices tenant risk and models vacancy risk. In the first seven weeks since launching, the company has completed 12 transactions and received two term sheets for $35 million of debt back by its leases.

Algoriz – AI that turns ideas into automated trading algorithms

Algoriz allows traders to turn ideas into trading algorithms without having to hire a programmer or wait weeks for custom code. The company allows traders to tag their ideas in English, which it turns into code on the spot. Since launching in March, Algoriz has signed up 500 professional traders on the platform who are implementing their strategies. It’s also received a letter of intent from a $200 million hedge fund to use its platform.

AlemHealth – Building a radiologist in a box using machine learning

AlemHealth is building a platform that will bring better radiology diagnosis to emerging markets. While there are thousands of CTs and X-rays in emerging markets, less than 20 percent are read by radiologists. Using machine learning, AlemHealth hopes to solve that problem. By attaching to CT machines in Nigeria, AlemHealth is collecting data and sending those scans to radiologists all around the world. It’s getting paid $1 per scan today, while also adding those scans to its database.

Wifi Dabba – Building India’s largest wireless ISP

There are 800 million Indians who are being ignored by local ISPs today because their cellular data or ISP data plans are too expensive. Wifi Dabba is trying to change that by building a network of Wi-Fi hotspots in tea stores around the country. The company brings hardwired lines to those shops and enables them to sell affordable Wi-Fi access to customers. Stores become break-even for WiFi Dabba after four months on the network and the company makes 30 percent of all Wi-Fi sales. Wifi Dabba has partnered with the local regulator TRAI to roll out more broadly, and it hopes to become the default Wi-Fi option blanketing cities throughout the country.

LitHit – A smart target for shooting sports

LitHit combines technology, shooting and gaming all into one. The company is targeting the 20 million target shooters in the U.S., with a combined hardware and subscription software business. By partnering with shooting ranges, the company is hoping to attract users to buy its smart targets and subscribe to its online shooting games.

Trade – Building Africa’s commodity exchange

Trade wants to kick the middlemen out of the exchange of commodities in Africa. Today, those middlemen take between 50 percent to 70 percent out of the sales of goods there. By creating a marketplace, Trade connects both sides and takes just 6 percent of all sales. With just five commodities the company is targeting to start, Trade estimates West Africa is potentially a $3 billion market for the company.

Rippling – A better way to onboard new employees

Whenever a new employee is hired, a company has a list of 100 to 200 things you need to do to get them up and running. Now HR departments only need to click hire and Rippling will do everything else. From setting up employees with payroll to getting them their company-issued laptop to getting them signed up for email, Slack and all the other cloud services a business might use, Rippling takes care of it.

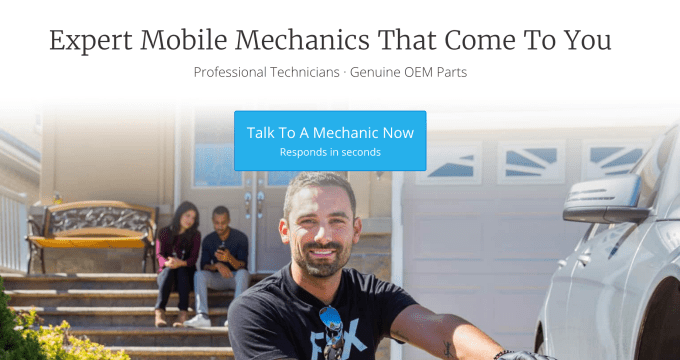

Fiix – Uber for auto repair

Fiix sends licensed auto mechanics to customers’ homes, allowing repairs to happen within 3 hours. Eighty percent of all repairs can be done in a customers’ driveways, but mechanics usually work at shops because they can’t get their own customers. Fiix fixes that, by connecting mechanics directly with customers, and lowering costs by 30 percent off shop rates. The company has 38 percent per-unit margins and is growing 41 percent monthly over the past year.

Token Transit – Mobile app to pay for public transportation

Token Transit sells its service to public transit agencies, allowing riders to pay for transit with a mobile app. People spend $150 billion a year on public transit, but very few local agencies enable mobile payments. The company provides a cheaper way for agencies to allow riders to pay, reducing the need for expensive machinery those agencies need to maintain. Token Transit has signed on eight public transit agencies and is live in Reno, where it already makes up 7 percent of all ticket sales and has more than 1,000 monthly active riders.

Millibatt – Customizable battery technology

Millibatt sells small, inexpensive custom batteries to consumer electronic manufacturers. The company touts batteries that last 10 times longer than existing technologies at one-tenth the tooling costs traditional battery providers would charge. The company estimates that there will be 75 billion new consumer electronics devices that will need batteries in the coming years, and they want to service that market.

Supr Daily – Daily milk delivery service in India

More than 100 million Indians get fresh milk delivered every day, and Supr Daily wants to be the delivery service that reaches all of them. The company operates what it says is the first farm-to-home milk marketplace, cutting out middlemen to reduce costs and providing a better quality of product. The company is growing at 40 percent month over month and has 98 percent retention for its subscription service. It sees the milk market as a $13 billion market, but it’s looking to use that as a launching point to reach the $115 billion grocery market in India.

Indee – Hardware for gene delivery

Indee provides a new way to use CRISPR to edit the genome of cells. Current methods of editing genes include using viruses or electroporation, but Indee uses microturbulence to dissolve molecules within a cell. It currently is targeting a $1.5 billion addressable market for immunotherapy, but sees that market growing to $9 billion as the market improves.

Riley – Lead qualification as a service

Companies that buy leads can use Riley as their first point of contact. It will respond to all inbound leads within two minutes, 24 hours a day and seven days a week. That not only increases conversion rates, but Riley also helps to score leads for customers so they know what the hottest leads are. The first market Riley is going after is real estate agents, who spend $6 billion a year on leads each year, but the company also plans to go after the insurance, car sales and mortgage lending markets.

InnaMed – Connected home blood-testing device

One in four patients leaving the hospital after being treated for heart failure are re-admitted in the next 30 days. InnaMed helps reduce those rates by helping doctors monitor patients’ health with inexpensive, connected blood-testing devices. By automating and scaling the best practices of hospitals, the company hopes to go after a $17 billion market.

Firsthand – Inexpensive, self-service retail kiosks

Firsthand allows companies, cafes and bars to monetize their extra space by installing inexpensive, self-service retail kiosks. Each kiosk costs just $300 to make, but pay for themselves in less than a month. The company is taking the same approach as the 7 million vending machines in the U.S., but producing 10 times the margins on products sold. At the same time, Firsthand captures retail foot traffic and demographic data to make sure the right products are being sold in the right place.

No Lean Season – Travel grants to reduce hunger

No Lean Season is a nonprofit designed to solve seasonal poverty. For a few months each year, poor farmers are unable to make money. No Lean Season gives poor farmers a bus ticket to other areas where workers are needed, allowing them to find work and generate $200 in income instead of going hungry.

DocTalk – WhatsApp for Indian doctors and patients

In India, it is impossible for patients to get a quick response to their questions, as doctors there don’t want to answer them without getting paid. DocTalk provides a way for doctors to make money for answering those questions, and takes 50 percent of all revenues made by them. The company is now making $720 per doctor per month, but it costs just $40 to acquire those doctors.

Boxouse – Productized rental homes

Boxouse is trying to give homeowners a way to make extra money by renting out small, factory-built homes that they can place in their yard. The company installs those small guest homes and splits the revenue from renters with those who own the property. Units are profitable within the first year that they are live.