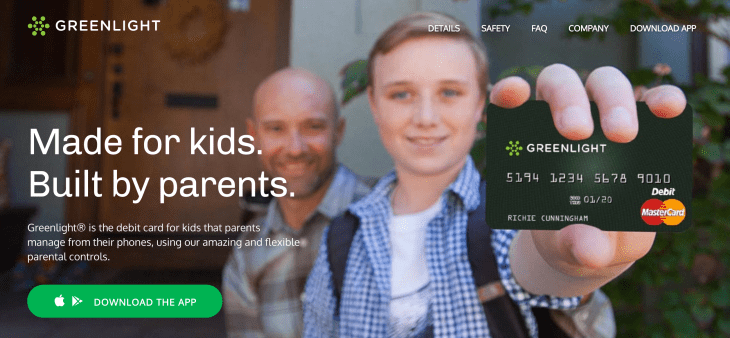

Greenlight, a three-year-old, Atlanta, Ga.-based startup, is trying to solve a problem that any parent of an elementary or junior high school student can well understand: how to give kids money without worrying that they’ll lose it or spend it on something they shouldn’t.

It isn’t the first reloadable, prepaid card. MasterCard, Visa and American Express each offer parent-friendly debit cards, among other outfits. But Greenlight — backed with seed funding from its executive team and a startup incubator at Georgia Tech called the Advanced Technology Development Center — is hoping to take on these giants by adding every imaginable bell and whistle to its FDIC-insured offering, as well as making its pricing affordable and straightforward.

Because I have a seven- and nine-year-old — both of whom reliably lose whatever money I give them for field trips and the like — I was curious to learn more. Co-founder Johnson Cook answered some of my questions earlier this week.

TC: Greenlight is a nice idea, but it has plenty of competition. How does what you’re offering differ from what’s out there already?

JC: [We think] Greenlight is the first card with store-level controls — in other words, the ability for a parent to give a child a specific amount that he or she can spend at a specific store or website — like Starbucks, Chick-fil- A, the neighborhood market store, Amazon.com. We found that the ability to choose the specific stores where their kids can shop really resonated with parents.

TC: What are some of the card’s other features?

JC: Parents can automate allowances very easily in the app. We’re also rolling out a Greenlight Savings account and Greenlight Giving, which will give parents and their kids a full view of their finances across spending, savings and giving. We’re very focused on empowering parents to raise their kids to be financially smart: to learn to spend wisely, the importance of saving so they can cover unexpected expenses, how to build wealth through investing, and the importance of credit.

TC: What about notifications? I’d think these would be pretty important to parents.

JC: Parents are instantly alerted any time the card is used, letting them know how much was spent and where. And notifications are customizable for both parents and their kids. You can receive notifications for when purchases are made, transactions are declined, the child makes a new request, low balances, funds transfers, for when the card is turned on or off, and messages received.

TC: You charge $4.99 per family per month for up to five kids. How did you settle on that particular price point, and why do a monthly fee versus take some percentage from each transaction?

JC: We have two revenue streams: the subscription fee and the card interchange revenue from the card spend. While some card products try to exist only from interchange revenue, we don’t believe that kids are spending that much per month. We also discussed charging per card, but want to encourage families to get all of their kids — and both parents — using Greenlight, so we decided to go for a per-family price to quickly acquire market share and get big faster.

TC: Can kids use this as debit card? Can they access cash from an ATM if they’re in a situation where a vendor takes cash only?

JC: Right now we’ve found that most parents prefer that ATM access and cash-back is disabled. We do plan to eventually enable parents to set a specific amount that their child can withdraw from an ATM for parents who want that ability.

TC: Say a kid calls from somewhere needing money; can a parent transfer funds to the card immediately?

JC: Everything in Greenlight is instant. As soon as you approve spending in the app, the card is instantly updated. Kids can be standing in the checkout line and realize they don’t have enough money and make a request. As long as the parent is ready to approve it, their card is updated instantly.

TC: What age children are you targeting? I’d think junior high and high school kids wouldn’t need this; they have mobile phones and Apple Pay.

JC: We went to market expecting the sweet spot to be kids ages 10 to 18, and so far our average age of kids that parents are signing up is 12. The most common story we hear is that as soon as kids get their first mobile phone, the kids start to be more independent, spending more time with their friends without their parents, and that’s when families start running into the problem that Greenlight solves.

TC: A VC tells me you’re raising $3 million right now.

JC: Correct.

TC: How would you describe the fundraising scene in Atlanta. Do you feel you need to talk with Silicon Valley and East Coast venture investors after a seed round, generally speaking?

JC: Atlanta investors are awesome, but we’ve definitely seen the need to go outside Atlanta — mainly to the Bay Area and New York — to find investors experienced with B2C startups and consumer brands. That said, Atlanta is a hotbed for fintech, so we’re talking to some local investors who haven’t done much consumer but are interested in Greenlight because of the fintech angle.

TC: What’s been a common reaction while you’ve been pitching? What are VCs most focused on?

JC: VCs are most excited about the opportunity to build a huge consumer brand associated with empowering families to raise financially smart kids. This consumer is underserved by the banks, and schools don’t teach kids this type of stuff. There aren’t any good products with a user experience designed specifically for parents to teach their kids how to be smart with money.

[To answer your other question], the VCs we’ve met with have all wanted to see our customer acquisition cost. The good news is we acquired 1,200 customers in our first couple weeks and our average CAC is well below where we thought we would be starting.

TC: I understand you have three kids. Are they customers?

JC: Yes, and having kids ages 11, 8, and 5, I can tell you Greenlight solves a very real consumer problem that I live with every day. Having a company that’s so personal is bringing me closer to my family, too. My 8- year-old, the future entrepreneur, is constantly coming up with ideas. “Dad, we should advertise Greenlight inside school buses,” and “Dad, we need a Super Bowl commercial, don’t we?”