It’s here! Snap — which confidentially filed for its IPO late last year — has released its public filing through the Securities and Exchange Commission. It’s going to be listed on the NYSE as “SNAP.”

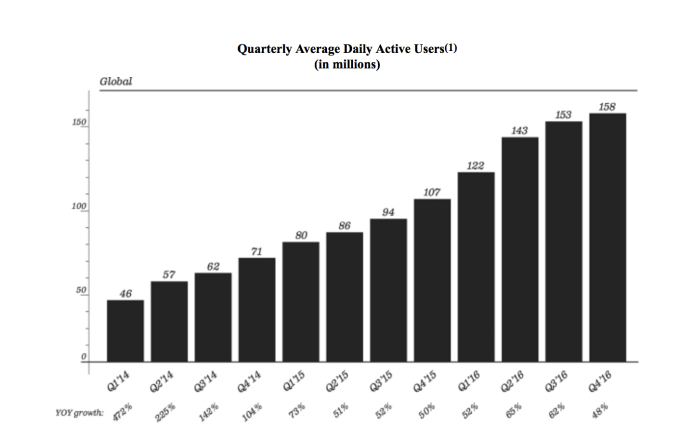

This is another incremental step in the process of going public, but it’s probably the most important because we’re finally getting our first glimpse at the financial guts of the company. Snapchat has gone from a zeitgeist-y app among a younger audience to one with more than 150 million daily users — and one with a strong pitch to advertisers based on the engagement of the app.

Snap is expected to go public at a valuation north of $25 billion in early March, making it not only the first tech IPO of the year but also one of the largest in a while. That means Snap is not only setting itself up as a bellwether for future consumer tech IPOs, but also for the tech IPO market in general. We’re also getting a glimpse into what Snap is acknowledging as existential threats for the company, which could give us a sense of where things are headed for ad-driven companies in public markets.

But, now we have the data, and we can get a better sense of where the app is going. We’re updating this post as we get more information, so be sure to refresh periodically. Let’s get started!

Financials

Last year, leaked documents revealed that Snapchat would generate $350 million in revenue for 2016 and was projecting $1 billion in revenue for 2017. It looks like the company came in ahead of the projections for last year at around $400 million. That’s up from $59 million in revenue generated in 2015 — a nearly 6x jump.

In the fourth quarter last year, Snap brought in $165.7 million in revenue, up from $32.7 million in revenue in the fourth quarter in 2015. Its losses, however, are widening rapidly. In Q4 the company lost around $170 million, up from losses of around $98 million in the fourth quarter of 2015. On the year, Snap lost around $515 million, up from losses of $373 million in 2015.

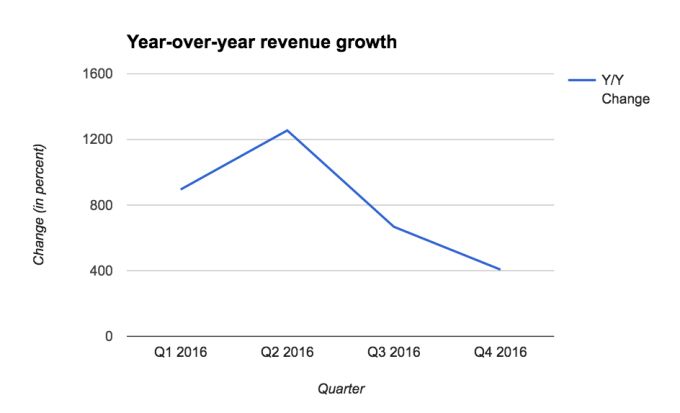

While it’s natural given that Snapchat has a short history of monetizing its service, it’s still growing its revenue at a healthy clip — though that’s starting to slow dramatically.

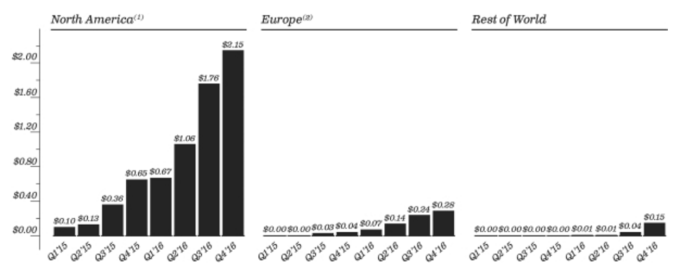

International revenue, too, represents a tiny fraction of its business. Snap brought in $14.7 million in revenue in the fourth quarter last year from Europe, up from $1.3 million. It brought in $5.7 million from the rest of the world outside of Europe and North America in the fourth quarter, whereas the year before it brought in effectively no revenue.

Not unexpectedly, Snap has had to invest heavily not only in research and product development but also infrastructure. An app that prides itself on engagement through the use of video and photos is going to come with a lot of costs pertaining to running the actual service and keeping it from crashing.

Snap’s biggest investment is its research and development arm, where it spent $184 million in 2016, up from $82 million. It spent $124 million in marketing last year, and $165 million in general and administrative costs. The total cost of revenue for the company ballooned from $182 million in 2015 to $452 million in 2016.

The net loss line is staggering, as are its accelerating losses, but it also puts the $1.8 billion it raised last year in perspective — it needs deep coffers to continue to grow. And going public is, at its heart, a way to build a big war chest in addition to giving shareholders some liquidity. Snapchat says it has around $1 billion in cash, cash equivalents, and marketable securities. Snap more than tripled its staff between the end of 2015 and the end of 2016, and now has 1,859 employees.

Engagement

For those 161 million daily active users, Snap makes about a dollar apiece. But as to be expected, Snap’s revenue per user is leagues ahead in North America compared to the rest of the world. That might not be all that surprising, given that it’s still an early advertising product and it hasn’t quite locked down monetization outside of the U.S. Here’s the quick breakdown:

Snap says its users visit Snapchat more than 18 times every day, and 60% of its DAUs use the the chat service. So again, while it’s not as massive as other platforms, Snap is making the case that it’s one of the stickiest apps out there. On average, over 25% of Snap’s DAUs post to their Snapchat story every day, and the company says over 2.5 billion Snaps are created every day.

Users

Snap has stressed its focus on daily active users (DAUs) as its pitch to investors and advertisers. That’s partly because it doesn’t have the same insane scale of Facebook — in terms of DAUs or MAUs. The company is trying to convince Wall Street that its engagement metrics make it a much more attractive platform. So, it might not have huge numbers, but with more than 150 million DAUs and stronger engagement than other platforms, it may turn out to be a more intriguing use of advertising budgets.

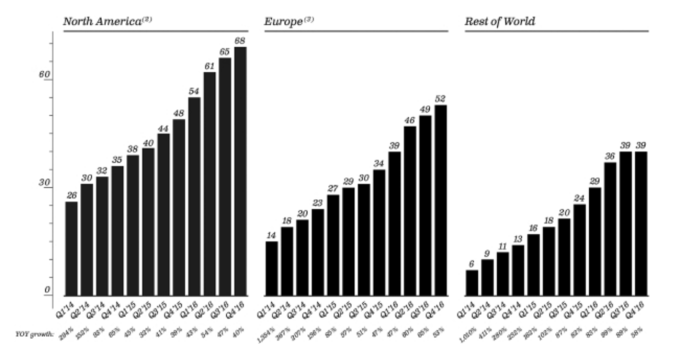

The company says it has 161 million daily active users as of the end of December last year, up from 110 million at the end of December in 2015. The majority of its use base is naturally in North America, with 69 million DAUs. Europe accounts for 53 million DAUs, there are 39 million DAUs in the rest of the world. Below is the chart the company gave in terms of average number of daily active users on a quarterly basis:

Diving deeper into international, it looks like the company’s growth across all three categories is pretty similar. While the U.S. is not growing as quickly year-over-year, all three categories that Snap has broken out are growing more than 40% year-over-year on a quarterly basis. We do, indeed, see slowing growth however across all categories if you look at a more quarter-over-quarter basis — especially beyond Europe and North America, where there was no change.

You can find a deeper dive on Snapchat’s users and growth here.

Hardware & Spectacles

Snap said it would be expanding Spectacles distribution this year, but didn’t offer a whole lot of insight beyond that.

You can find a deeper dive on Snapchat’s hardware and spectacles details here.

Risks and other existential threats

Snapchat’s risk factors included plenty of the boilerplate threats to its existence — keeping talent, managing burn and so on. But Snap in particular has acknowledged a lot of new issues that have become more and more prevalent in recent years. Snap lists the platform’s usage for terror-centric content in addition to other kinds of illicit content. And the United Kingdom’s decision to exit the European Union (or Brexit) also places a shadow over the company given its operations in the U.K.

Another interesting risk factor listed by the company is that given that the IPO is an offering for non-voting stock (founders Evan Spiegel and Bobby Murphy have essentially full control of the company), it may be unpredictable. Here’s the money quote: “We therefore cannot predict the impact our capital structure and the concentrated control by our founders may have on our stock price or our business.”

Snapchat’s growth also declined rapidly following the launch of Instagram Stories. While we can’t say for sure that Instagram Stories was the culprit, Snap’s quarter-over-quarter growth rate dropped off to low single-digit percentage points after Instagram Stories’ launch in August.

You can find a deeper dive on some of Snapchat’s biggest risks here.

Google Cloud

As part of the IPO, Snap laid out its huge dependency on Google Cloud and some of the potential problems it may face going forward by existing on Google’s infrastructure. While using Google Cloud may help keep costs low, it also means that it’s beholden to any major (though probably unlikely) changes the company might make. Snap said it would commit $2 billion over 5 years for Google Cloud infrastructure.

You can find a breakdown of Snap’s relationship with Google and use of Google Cloud here.

Acquisitions

Snap gave us some additional detail on some acquisitions it made over the course of the year, in which the company never gave a final price. Snap paid $150.6 million for Looksery and $64.2 million for Bitstrips. It also paid $114.5 million for Vurb.

You can find a list of some of the acquisitions identified by Snapchat here.

Diversity

Snap briefly touched on diversity within the company, which now has nearly 2,000 employees. It didn’t break out specifics, but said the company believed “diversity is about more than numbers.”

You can find a deeper dive on Snapchat’s notes on diversity here.

Co-founder Reggie Brown’s lawsuit

Snap settled its major lawsuit with ousted co-founder Reggie Brown over alleged IP theft in 2014, paying out $157.5 million. The amount was never disclosed, so we’re finally getting a glimpse at what happened in the checkbook there.

Comment