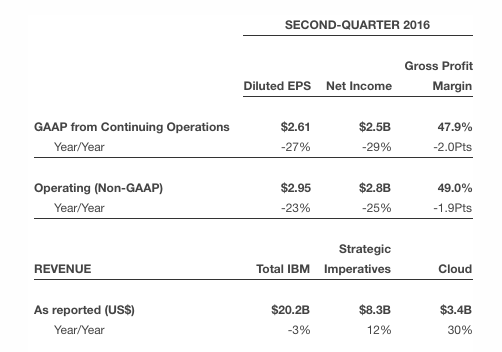

IT giant IBM has just posted its second quarter earnings, with revenues coming in at $20.24 billion and non-GAAP earnings per share at $2.95. The figures beat analysts’ estimates of $20.03 billion in revenue and non-GAAP EPS of $2.89 per share.

However, non-GAAP net income is $2.8 billion, down 25 percent from a year ago (GAAP net income was $2.5 billion, now 29 percent). And although results are showing profit and beating analysts’ estimates, they continue to be in decline. A year ago, IBM reported revenues of $20.81 billion and EPS of $3.84.

Investors seemed pleased with today’s earnings announcement. IBM stock is up almost 3.3 percent or $3.65 to $163.51 per share, in after-hours trading.

[graphiq id=”9snpGgcdB9b” title=”International Business Machines Corporation (IBM) Stock Price” width=”600″ height=”649″ url=”https://w.graphiq.com/w/9snpGgcdB9b” link=”http://listings.findthecompany.com/l/14803/International-Business-Machines-Corporation-in-Armonk-NY” link_text=”International Business Machines Corporation (IBM) Stock Price | FindTheCompany”]

While the company is one of the biggest and most iconic in the tech industry, IBM’s legacy business — namely areas like its server hardware and z Systems business — continues to shrink, and this quarter Systems was down more than 23 percent. This is one reason why the company, other big IT players and smaller startups are all putting so much effort and investment into new waves of business.

In the case of Big Blue, that covers just about all kinds of IT under the sun, including emerging areas like blockchain, artificial intelligence and machine learning by way of its Watson division, and a wide array of cloud services, both on its own (as with its video products or security) and in partnership with others like Cisco, which expanded its IBM relationship in recent weeks.

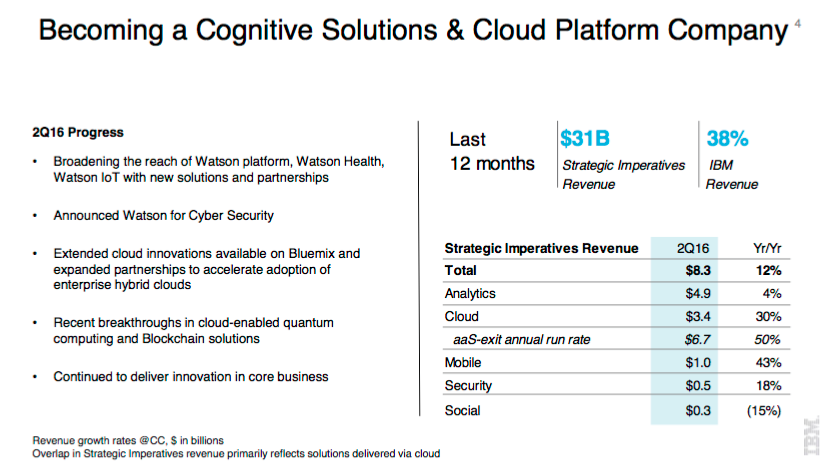

As you can see in the two tables below, the first from the investor presentation and the second from the financial release, while those new areas continue to grow, they are still not enough to offset the other declines:

In terms of Q2 bright spots, cloud services continue to grow and were up 30 percent this quarter and are now at $11.6 billion for the last 12 months running, and accounted for 17 percent of IBM’s revenues in the last quarter. Watson and analytics, security, and social and mobile technologies saw their revenues collectively rise 12 percent, and generated $8.3 billion in sales in the last quarter.

Among other divisions, IBM noted overall declines in several of them:

- Cognitive Solutions posted revenues of $4.7 billion, up 3.5 percent. Cloud revenue in the segment grew 54 percent.

- Global Business Services had revenues of $4.3 billion, down 2 percent.

- Technology Services & Cloud Platforms (this includes infrastructure services, technical support services, integration software) had sales of $8.9 billion, down 0.5 percent.

- Systems (includes systems hardware and operating systems software) had sales of $2 billion, down a whopping 23.2 percent.

- Global Financing (includes financing and used equipment sales) had sales of $424 million, down 11.3 percent.

IBM has been very active in M&A so far in 2016. The company has spent more in the last 12 months on acquisitions than ever before in the history of the company, according to IBM CFO Martin Schroeter. The majority of this quarter’s investments have supported IBM’s growing cognitive solutions business. Data from Truven Health will support Watson Health, while Bluewolf and EZ Source will help bridge cognitive solutions and cloud services with API-management products and consulting services.

During an earnings call, IBM reported that it is going to be enabling Watson for more security applications over the coming months. This is in line with other strategic acquisitions made by the company. IBM acquired Resilient Systems, a company that provides security incident response to a growing repertoire of cybersecurity services.

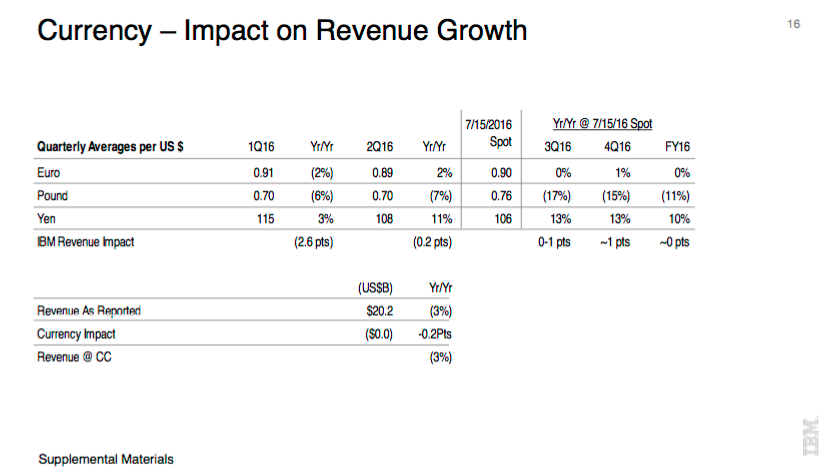

One interesting note to consider for future quarters is how the situation in Europe, and specifically in the U.K., may impact the company. Today, IBM reported currency impacts that were in the fractions of percentage points in different divisions, but the company counts the U.K. as one of its important international markets, and it’s forecasting that currency declines, for example in the U.K. pound, will impact them in quarters ahead. Other IT companies like HP and Dell have raised their pricing to make up for the currency drop, so it will be worth watching to see how and if IBM follows suit.