Brexit. Trump. The Federal Reserve. The world threw nearly everything at Twilio for its untimely IPO. Despite market volatility, the company continues to impress.

The week the world met Twilio can only be defined as positive. Unfortunately, the greatest challenges for the company lie ahead.

Short Term

Herd behavior fuels IPOs. Casual investors often jump in immediately because of the media hype. This pushes the stock price up. In recent years, the following days have been brutal for investors.

This pushes the stock price up. In recent years, the following days have been brutal for investors.

If you manage to get your hands on coveted shares prior to the moment trading goes live on an exchange, you can basically celebrate before the market even opens. For the rest of us, it’s not always as fun.

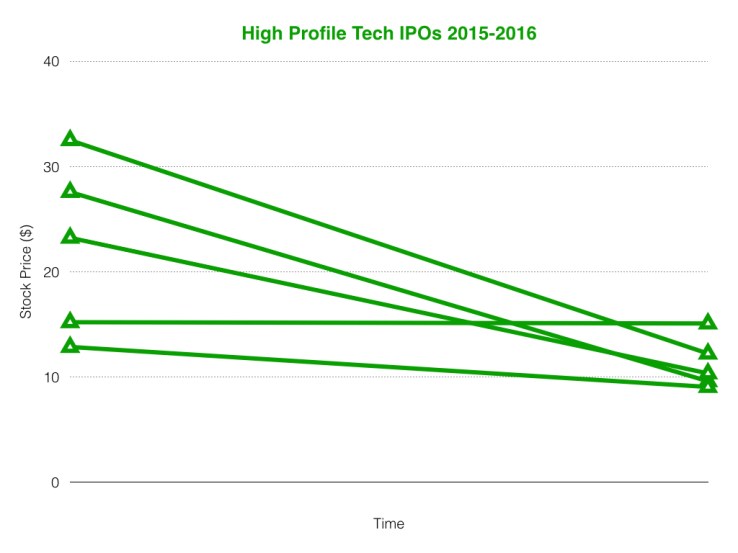

The following two graphics only take into account exchange traded value. This is the change that an everyday investor is going to see.

In five of the last high-profile tech IPOs, three increased in value on their first day of trading. Over the following week, four lost value from their first-day high. Twilio closed up 20 percent from the time it hit the markets. A week later, the company’s share price had increased over 52 percent.

Twilio’s current market cap is fluctuating around $2.9 billion. While revenues were up 78 percent in 2014, the company still operates at a loss.

The company fits squarely in the middle of the road with regards to market cap and doesn’t stand out in its lack of profitability.

Long Term

The companies in the following chart are deliberately not labeled. We are looking at general market trends, not comparing companies.

Every single one of these companies has lost value on the public markets since they began openly trading. If the first few weeks after an IPO are fueled by emotion, the first few months are fueled by numbers. Somewhere between the two, lockout periods end for early investors and the market gets a more toned idea for the value of a new company.

Day-one trading value is utterly disconnected from long term success in the public markets. Despite a slow start, Fitbit had a very successful early run. While the share price was up over 30 percent in the first three months, the company has gone on to lose 62 percent of its day one trading value.

In a few months time, Twilio will have generated enough data to be evaluated as a longer term investment. History tells us the company will lose value but it has already bucked expectations in the first week so much is left to be seen.

So, we’re going to see more tech IPOs right?

Sorry, Silicon Valley. Contrary to popular opinion, the entire economy is not tech wrapped in tech topped with extra tech. Twilio is a single data point that is easily lost in a sea of financial data.

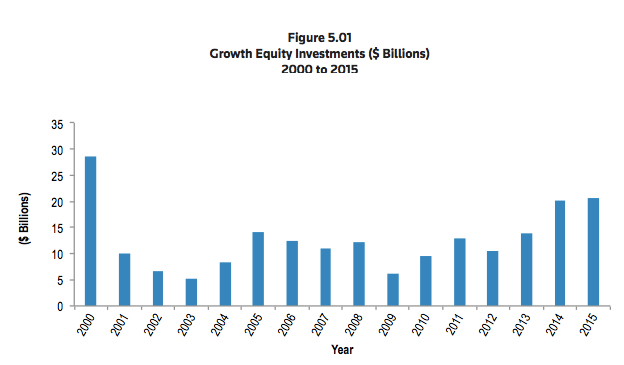

If the stock market stays healthy, money will continue to be allocated to higher-risk asset-classes like venture capital and private equity. With sufficient of money to sustain unicorn growth, companies have little reason to run to the unpredictable and bureaucratic public markets.

The paradox with this line of logic is that companies only want to hold their IPOs in healthy markets.

With Microsoft’s purchase of LinkedIn and elevated private equity activity in tech, there is a confidence void around the value of unicorn companies in the long-run. David Cohen, Co-Founder of TechStars, argues that companies have always been consolidated off public markets. The economy is cyclical and right now large companies have enough cash on hand to acquire smaller public companies.

“Going public is one step in life cycle of company, it’s not the last step,” added Cohen.

But is Twilio still changing the tech industry?

It’s becoming popular to speculate what effect Twilio will have on the tech world. Public markets aside, Twilio has already “made an impact” on tech.

One of Twilio’s greatest strengths was its market strategy. Twilio was largely developer-first. Other companies following this path have their eyes keenly focused on the enterprise communication company.

Cohen noted that his own investment strategy has been influenced by the early success of his Twilio investment.

“In 2010 I had a meeting with SendGrid and my first thought was this is Twilio for email,” said Cohen. “We likely wouldn’t have funded SendGrid without Twilio.”

SendGrid provides a backend API for transactional email like receipts, password reminders, and sign-up verification.

Companies tend to not make bold financial decisions during periods of uncertainty. The US great-recession officially ended in 2009. The period of growth after it brought some of the most successful tech IPOs in history. Facebook, Twitter, and Zynga capitalized on a period of intense growth. Private capital had been hard to come by in the recessionary years. Public markets were not performing fantastically either but by June 2009, when the recession was lifted, the Nasdaq was already up 33 percent from its low point in February. The boxes were rapidly being checked for healthy markets on the horizon.

The CBOE Volatility Index (VIX) is one of the commonly used metrics for uncertainty. This chart shows market volatility as captured by the VIX between. Values this year are markedly higher than in 2015. Few have wanted to IPO their precious unicorn baby into what could become Dante’s Inferno.

[graphiq id=”iLb9mQcfsc5″ title=”CBOE S&P 500 VIX Futures (CFE:VI)” width=”600″ height=”519″ url=”https://w.graphiq.com/w/iLb9mQcfsc5″ link=”http://mutual-funds.credio.com” link_text=”CBOE S&P 500 VIX Futures (CFE:VI) | FindTheData”]

The bottom line is that Twilio will not bring back tech IPOs on its own. CEO Jeff Lawson has all tools at his discretion to make the company great for the long hall. We can expect a trickle of mature unicorns coming to pasture. The rest of the tech IPOs will come when market confidence meets a fall in private capital.

Source: NVCA Yearbook 2016