Private equity firms have certainly been flexing their muscles this year, whether Thoma Bravo snagging Qlik for $3 billion or Vista Equity Partners grabbing Marketo for $1.9 billion and Ping Identity for another $600 million. Apparently Providence Strategic Growth, the growth investment arm of Providence Equity didn’t want to be left out and today they announced a $130 million investment in LogicMonitor, a cloud infrastructure monitoring service.

The $130 million gives the company that launched in 2008 plenty of room to maneuver as it plans to scale its operations in a big way in the next couple of years, according to CEO Kevin McGibben.

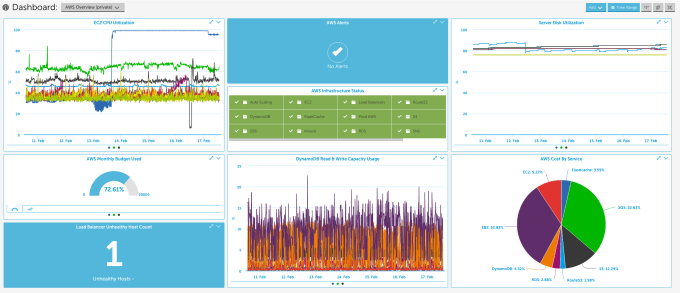

The company helps monitor on prem or cloud infrastructure from a single interface, according to McGibben. While there are application performance monitoring companies like New Relic and App Dynamics and log analysis tools like Splunk, McGibben claims these are adjacent kinds of monitoring and his company is unique (in the true sense of the word) in offering an Infrastructure Monitoring as a Service.

“Really what we are doing is transforming the infrastructure performance monitoring market. We want to be leader for complex and agile environments. We are transforming to a new defined space and changing the way the market solves the problem.”

LogicMonitor AWS dashboard. Photo Credit: LogicMonitor.

He says the chief competition isn’t these previously mentioned companies, but traditional vendors like IBM, HP, BMC and CA, but he’s probably also competing at least to some extent with ScienceLogic, DataDog and SolarWinds (even if he claims they aren’t as complete as his company’s solution).

He says he went the private equity route for a couple of reasons. First of all he gave the standard shared vision response. He says he found a funding partner that understood the market dynamics and what they do.

“There is a lot of noise in the market and it’s hard to find the right VC partner at our growth stage,” he said. “VCs [typically] have a short time horizon relative to expected return or exit event. Having a long-term view is incredibly valuable. It allows me a bit more of a mid-to-long term view of building the business [without] the pressures that come from a traditional VC.”

He said that going the traditional VC route with this kind of money would have meant syndicating the round (taking money from multiple investors) and that would have been a further complicating factor.

As for what Providence might have seen from them, McGibben says it’s a company being built the right way. “One reason they were interested is that we are building a valuable business model. We are not having a massive burn rate. We are a fast growth and valuable company. That’s fairly unique in this business,” he said.

The company intends to take that big pile of cash and plow some into R&D and add new products. McGibben indicated that some new products are already in the pipeline and will be announced in July, but there are plans on the drawing board to expand further, and if the right opportunity comes along possibly do some acquisitions.

It also has global expansion plans including building up markets in North America and the EU this year and into Asia and the Pacific Rim by 2017.