Across East Africa more than 300,000 households previously without electricity are powering homes and devices with solar panels and using mobile money to pay for it.

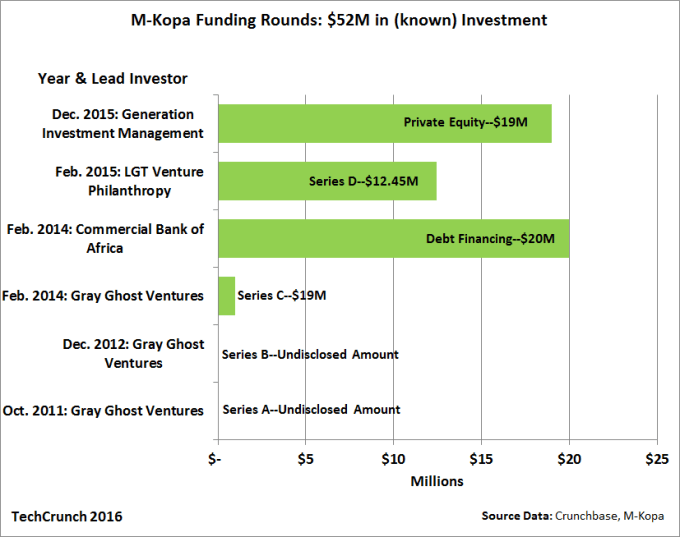

Their power provider is M-KOPA, an energy startup with IPO ambitions already backed by $52 million in VC.

Co-founded by Canadian Jesse Moore, the company offers solar-power home systems targeted at lower-income and rural customers without electricity. M-KOPA’s baseline box-kit comes stocked with a solar panel, multi-device charger, lights, radio and a pay-as-you-go SIM card.

After a $35 deposit, those looking to illuminate their homes have one year to pay for the package through mobile money transfers as low as .50 cents.

The company traces its origins to the work of co-founders Jesse Moore and Nick Hughes at Vodafone. The European telecommunications giant is the parent of the Kenyan telecom Safaricom — which provides the M-Pesa digital finance product.

“M-KOPA’s germination goes back to those early days of M-Pesa. We began to see that …mobile money would set up the rails upon which other businesses like ours could develop,” said Moore, M-KOPA’s chief executive.

After its first funding round, M-KOPA launched in 2012, forming a U.S. LLC for investment purposes while opening subsidiaries in Kenya, Uganda and Tanzania. In East Africa, the company has its own distribution network, including a 1,500-agent sales force and 100 service centers.

To date, M-KOPA has sold more than 300,000 household kits: roughly 260,000 in Kenya, 40,000 in Uganda and 20,000 in Tanzania. Safaricom and M-Pesa remain finance partners in Kenya and Tanzania, while M-KOPA’s Uganda customers can pay their kits off through either MTN Money or Airtel Money.

Moore sees M-KOPA as more than just a utility company. “We don’t fit into a conventional box. We are a mix of a micro-finance, technology, and energy company wrapped up in one,” he said, underscoring the venture’s leasing function and that “kopa” actually means “borrow” in Swahili.

M-KOPA plans to expand its country, client and product base over the coming years. One unique opportunity is building additional leasing offerings around new lending profiles.

“We are creating credit histories for a large number of customers…[who] didn’t have access to formal financial services before M-KOPA,” said Moore. He noted the company has partnered with Kenya’s Credit Reference Bureau, “creating 75,000 positive credit ratings” from which M-KOPA itself can draw upon.

Moving forward, M-KOPA looks to pair new financing options to more powerful solar charging capacity and additional product packages. In February the company offered its first flat screen TVs.

Moore said to expect solar-powered leasing options geared toward Internet access, smartphones, and tablets. As solar technology improves, this could extend to refrigerators and other household appliances.

M-KOPA projects it will reach one million clients on the continent by 2018. It recently started selling in Ghana through its first licensing arrangement and a local mobile partner.

“This is a different approach for us than having our own offices and staff, but it’s what we are testing toward further expansion,” said Moore.

As for Nigeria — Africa’s largest economy and most populous nation — M-KOPA’s CEO noted the “tremendous potential” but listed a couple of constraints to entry. “It’s a combination of the country’s kerosene subsidies, which make our price point less competitive, and we haven’t seen the same uptake of mobile money, which isn’t a showstopper for our model but definitely something we’d prefer to have,” he said.

M-KOPA’s Moore believes the company will attract more investment toward a billion-dollar valuation and a future IPO.

“We’re moving beyond startup stage, have significant revenue, and we definitely use the possibility of going public as motivation toward building our business.” M-KOPA backers already include Al Gore’s London-based Generation Investment Management ($19 million) and individuals Sir Richard Branson and Steve Case.

Its first three rounds came from Gray Ghost Ventures (GGV), a $60 million impact venture fund headquartered in Atlanta, Georgia.

“We saw early on M-KOPA’s model could be a game changer for low income people. It takes care of their lighting needs, solves the financing problem, and frees up household resources to invest in other things like small businesses or education,” said GGV investor relations manager Jennifer McReynolds.

Many M-KOPA customers were previously paying more per month to light their homes through kerosene. GGV has an active relationship with the company, according to McReynolds, maintaining a board seat as M-KOPA’s first institutional investors.

Moore views Sub-Saharan Africa’s infrastructure gap as an opportunity — only 24 percent of the region’s 800 million have electricity — and believes solar power presents more than a substitute to traditional energy. “We should look at electrifying Africa differently than we did for places like North American 100 years ago.”

M-KOPA’s potential to scale up, Moore believes, is significant because the growth of Africa’s off-grid population will continue to exceed expansion of its conventional power infrastructure.

“From a capital and environmental perspective, solar energy is a more cost-effective and competitive option with the potential to leapfrog grid power on the continent,” he said.