ChatWork, a Japanese company that provides a business messaging service aimed at eliminating email and helping teams to work more efficiently, has raised $12.5 million in fresh funding to grow its presence in the U.S. and other markets.

Wait a second. A messaging service? Aiming to beat email? Helping businesses work better? Isn’t that Slack, I hear you say.

Yes, Slack — the U.S. company valued at $2.8 billion — has become the tech industry’s startup darling, but it is far from the only company in this space. And, there’s a world outside of the tech and startup bubble, you know(!). Last year we wrote about Pie (Singapore) and Eko (U.S./Thailand) which raised money — $1.2 million and $5.7 million, respectively — to go after business audiences outside of the tech spectrum with messaging products. ChatWork is much the same, except that the company and its service have existed for five years. (ChatWork actually began as a business consultancy way back in 2000, for that matter.)

ChatWork got a very early start in its native Japan, where CEO and founder Toshi Yamamoto tells TechCrunch it owns 70 percent of the business messaging market according to third-party analysis. This new Series B financing — which was led by Jafco and included participation from fellow Japanese investors Shinsei, SMBC and GMO — is aimed at developing its user base in the U.S. and other Western markets.

Yamamoto said the company has 86,000 companies from 204 countries using its service. It monetizes using a freemium model (starting at $4 per month) so all of those aren’t paying customers, however Yamamoto declined to say exactly how many are paying.

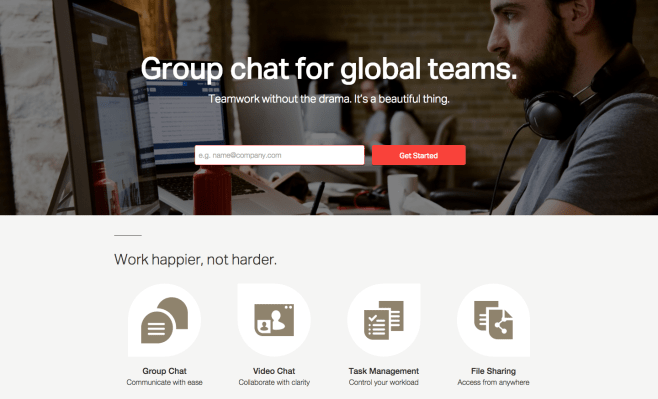

Yamamoto moved to the U.S. to open ChatWork’s San Francisco office three years ago and while he said that competition is fierce in the country, he believes that the company’s product stands above the others. (Even Slack.) Beyond group and one-on-one messaging, the ChatWork service offers file-sharing, video calling and task management in a single place.

Slack has been a breakout success among tech companies, but it hasn’t (yet) moved into other verticals. That’s where services like ChatWork see a real opportunity in the U.S., among less tech-savvy business professionals who will appreciate a simpler user interface and feature set.

There’s also a notable feature that allows non-company representatives to participate in some chat rooms, too. So, for example, a lawyer could invite clients or customers into part of their company’s ChatWork setup without granting access to everything. That’s not possible in Slack, for now. Most chat services end up gaining feature parity fairly quickly, the larger point — which ChatWork hopes to prove — is that there is no one solution for all types of businesses.

“There are so many competitors [in the U.S.],” Yamamoto told TechCrunch in an interview. “But our major challenge is people working in very traditional ways. We have to show them that competing on a global level in the way that they work is holding them and their teams back. There’s still a large market out there.”

ChatWork plans to spend its money honing its tech and product, and increasing its team of 63 — which is predominantly in Osaka, Japan, with five people in San Francisco — with 30 new hires, predominantly in the marketing area.

This is a very different approach for ChatWork, which had been a profitable company up until it raised $2.5 million last April in order to shoot for growth and scale in the traditional startup sense.

“Initially, I didn’t want to get funding but after a couple of years in the U.S. I began to understand how our competitors and other companies grow. Japanese startup companies are very conservative, but coming to San Francisco made me change my mind,” Yamamoto said, adding that the firm will also zone in on Southeast Asia and India where it sees promising organic growth.

In the case of Southeast Asia, though, the ChatWork CEO said that the company may reevaluate its business model in light of a reticence to pay for digital goods. The decision has yet to be made, but Yamamoto said that an advertising-based revenue model might be better suited to places like Vietnam, Thailand and Indonesia which the company is eying up.