As expected, Square has filed to go public. The financial transactions shop reported in its S-1 document that during the first half of 2015, it had revenue of $560.6 million, and a loss of $77.6 million. Those numbers compare favorably to the year-ago six-month period during which Square reported $371.9 million in revenue, and a slightly steeper $79.4 million in losses.

In short, Square grew at a decent clip while managing a minor reduction in losses. That’s a good thing. The company is going to list on the NYSE. The company’s reported half-year gross profit of $164.6 million, compared to its total revenue underscores how competitive, and expensive the payments business is.

Notably, the company’s net loss fell in its second quarter to $29.6 million, down from a far steeper $47.9 million in its first quarter. To be clear, however, Square has a history of losses, and it doesn’t appear to be in close reach of profitability at its current rate of growth.

The company also specifically broke out its transaction revenue from its deal with Starbucks. It said that it brought in $62.9 million in revenue from that deal in the first half of 2015, up from $56.6 million in the first half of 2014.

Square, as of the end of its second quarter in 2015, had cash and equivalents of $197.9 million, implying that it is not out of runway in any material sense. Though, if the company has strong investment plans ahead of it, an IPO would provide welcome capitalization.

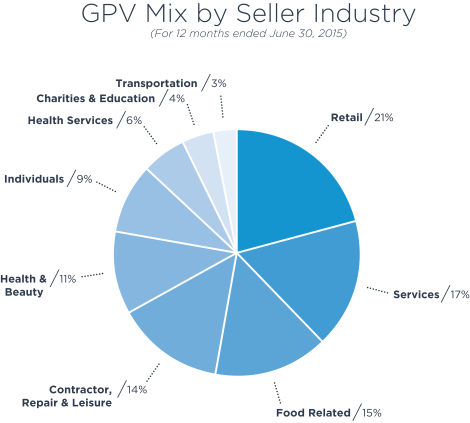

The company’s gross payment volume — the total dollar amount of all card payments processed by sellers — hit $15.9 billion in the first half of 2015. That’s up from $10.4 billion in the first half of 2014 and $23.8 billion in total for 2014. The company said it had $14.8 billion in GPV for 2013 and $6.5 billion for 2012.

There’s plenty of boilerplate in the company’s risk factors — like whether it will be able to hit profitability given its continuous investment into the business. But the most interesting risk factor listed in the report is that of the nature of Jack Dorsey’s relationship with Square and Twitter.

Dorsey is the CEO of Square, but also was recently named the CEO of Twitter, and will essentially have to split his time between the two companies. “This may at times adversely affect his ability to devote time, attention, and effort to Square,” the filing notes.

Another risk factor listed in the S-1 is the potential breach of its customer data. This isn’t necessarily surprising — most-recently, Target and Home Depot were targeted as part of a massive security breach that exposed sensitive customer data. It ended up as one of the biggest customer data breaches in recent memory — and it’s something that Square is going to have to avoid.

Dorsey is Square’s largest shareholder with 24.4 percent. Khosla Ventures has a 17.3 percent stake and co-founder James McKelvey has a 9.4 percent share. Other top shareholders include JPMC Strategic Investments at 5.5 percent, and Sequoia Capital and Rizvi Traverse, each with 5.4 percent equity.

Square has access to a $225 million credit facility, of which it has drawn down $30 million. That open debt pool, combined with the company’s current cash supply, and presumed IPO proceeds should leave the company well capitalized.

The raw figures are better than what many at TechCrunch expected. That said, the company is attempting to enter the public markets at an interesting time. Recent IPOs, including the tectonic Alibaba and the popular Box, have seen their share prices struggle. The larger public equity markets have been marked by uncertainty and swings. Square is not attempting its flotation at a time when things are placid.