Enterprise security and system management firm Tanium has announced another big tranche of funding, taking in $120 million, led by TPG and Institutional Venture Partners, with existing investor Andreessen Horowitz also participating.

Tanium took in $52 million from A16z back in March — saying it would be using that financing to scale faster. Andreessen Horowitz also got out its checkbook in June 2014, to the tune of $90 million, which was Tanium’s first VC investment since its founding back in 2007.

With its latest round locked in, Tanium’s total raised to date is now around $262 million. The new financing will be used to scale up to meet what it says is “global demand,” coming from “the largest enterprises and government organizations.” It adds its platform is now used in by more than half of the Fortune 100 companies.

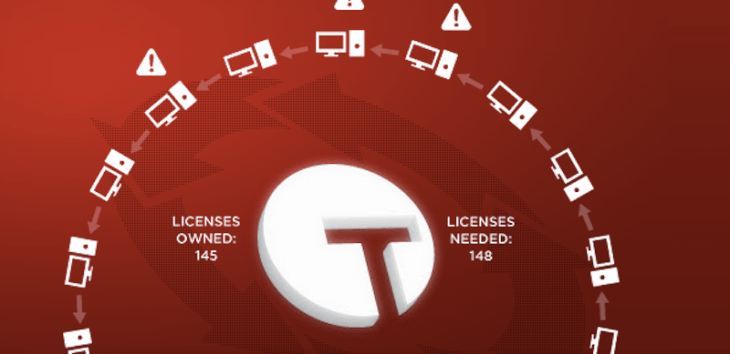

Its flagship product is a platform for IT departments to manage and control networks — even those comprising millions of machines and devices — with “15-second visibility” into network activity, rather than having to rely on days or even older data.

Writing in a Medium post, co-founder and CTO Orion Hindawi takes aim at the patchwork of security solutions Tanium is aiming to replace with its near real-time network scanning and management software, which consolidates multiple IT department functions onto a single platform.

He writes:

Our industry has failed its customers by telling them their problems will go away if they deploy lots of solutions and stitch them together themselves. Existing solutions are worthless, and anti-virus is a relic of a time long gone — attacks are coming 10x faster than anything AV solutions are creating. In fact, many of our clients have shared that they are getting rid of anti-virus in their new fiscal years. We applaud that decision. Consolidation is key to the future of IT management and security — at the company level and industry level.

Back in March the company said it had more than $100 million in total cash, so it clearly didn’t need to raise more funding at that point, but Hindawi said he wanted to be sure he had a warchest that could survive the chill of a downturn. Presumably he’s doubling down on that logic now.

“I saw the economic downturn in the early 2000’s and so did a lot of people on my team. I think there will be some right-sizing in the near future. I want to focus on growing the business and not raising before I run out. It’s prudent that we have enough cash before we need it,” he said in March.

So Tanium topping up its warchest with another multi-million dollar raise — the latest signifier of tougher times ahead?