Apple suffered a 5 percent drop in its share price Tuesday as Wall Street reacted strongly to news from China that the government is further devaluing the yuan. The currency devaluation is likely to increase import costs of devices for Apple.

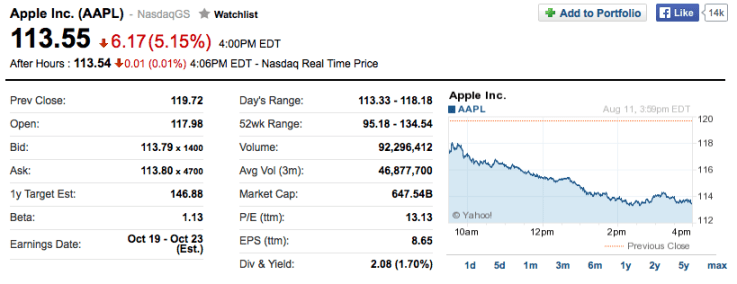

The announcement from China’s central bank that official guidance for the yuan would be reduced 2 percent to 6.2298 yuan per dollar, its lowest point in three years, sent the $700 billion tech giant’s shares tumbling. A drop worth tens of billions in market cap value.

source: Yahoo Finance

The yuan news prompted concerns that the currency devaluation can only harm Apple and will likely aid its main electronics competitors in the region, including Huawei, Xiaomi and Lenovo, who will benefit from the impact of a stronger dollar on their global sales. The price target for the company was cut today to $130 from $135 at Jefferies, which cited uncertainty surrounding iPhone demand in China.

During last month’s earnings call, Apple CEO Tim Cook went out of his way to note that China was likely headed to become Apple’s largest market, with business there making up 27 percent of Apple’s global sales.

Stocks closed Tuesday with AAPL trading at $113.55, 5.15 percent lower than the previous day’s close.