Captain401, a service that helps small businesses set up a 401k, is launching out of Y Combinator today. The goal of Captain401 is to make managing 401ks as simple as other services are for other functions within companies — and in a more digitally focused manner like Zenefits or Zenpayroll.

Captain401 seeks to create a process that avoids funds that have higher fees and fail to beat the market, CEO Roger Lee said. The investing service is automated, helping employees make better decisions about their investments and become more educated about the best choices, he said.

“Incumbents like ADP, John Hancock, they require tons of paperwork, snail mailing, filling out and signing,” he said. “Some companies like Fidelity don’t work with small businesses. We think we can do a lot better there, our solution is online and paperless. “It takes companies 10 minutes to set up their plan, we automate the ongoing administration. For the employees it’s that education and investment experience where the existing 401k companies leave employees to figure out what to do on their own.”

401ks are important to set up early for a number of reasons, if only is to show that employers care about the future of their employees. Lee had previously run a startup where his employees were asking about a 401k. Lee wanted to set one up, but the whole process was slow and outdated. Institutions, for example, still required stacks of paperwork that required signatures and had to be mailed and faxed in.

“It seemed like a hassle, it took way longer, and we thought we could do a lot better with more modern tech,” he said. “I personally over the years helped more than a 100 friends and family look at their 401ks and help with their investments, and realized without fail that each was sub-optimally allocated. They didn’t know how to choose their investments. We wanted to bring a Wealthfront into the 401k space.”

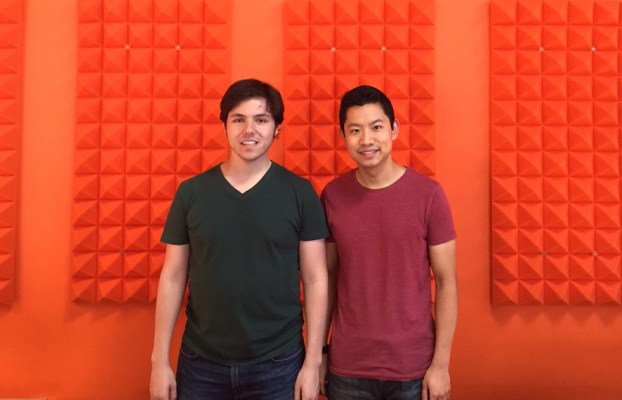

Meanwhile, his co-founder Paul Sawaya was a software developer at Mozilla. That company had a 401k instituted, but the whole process was difficult to manage and employees weren’t given education on how to best invest, he said. “I only logged in once when I was an employee there,” he said. The two met through a mutual friend — Tyler Bosmeny at Clever — and eventually came to the topic of 401ks, which they decided they could offer a better experience.

The 401k is tied to dozens of Vanguard index funds, which Lee says ultimately leads to higher performance than other funds. “That’s the approach that people like Warren Buffet, economists [consider], it’s the best approach for employees and get to the most returns.”

Captain401 came out of this year’s summer Y Combinator class. Interestingly enough, Y Combinator will be a customer of Captain401.

“Any step closer to a world where employees can get better investment options in their plan and they can diversify and get a suitable investment strategy that makes sense for them and their personal situation, that can just be so much better and help them so much more than the go it alone approach,” Lee said. “Obviously there’s a lot of work to do here.”