Following the bell today, Qualcomm announced its fiscal third-quarter financial performance, including revenue of $5.83 billion and adjusted earnings per share (EPS) of $0.99. Using normal accounting methods, the firm earned a slimmer $0.73 per share.

The street had expected Qualcomm to earn an adjusted $0.95 per share on revenue of $5.85 billion. Following its mixed earnings report, shares of Qualcomm are essentially flat in after-hours trading after initially rising modestly. The company lost more than one percent loss during regular trading.

The chip shop was widely expected to detail thousands of layoffs today. Qualcomm announced a $1.4 billion cost reduction plan, including a $300 million decline in share-based compensation, along with $1.1 billion in cuts to personnel costs. According to CNBC, the firings will total around 15 percent of the firm’s workforce.

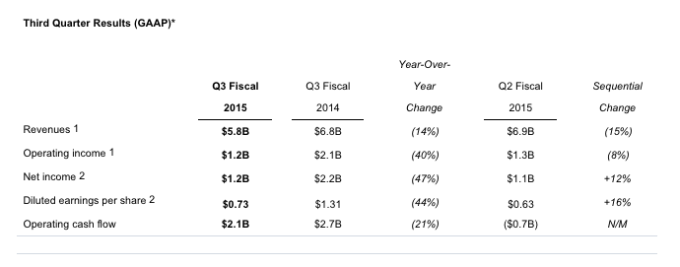

The company’s revenue is down 14 percent from the year-ago quarter. Qualcomm’s profit fell 44 percent from the same quarter, a year past, to $1.2 billion. The firm ended the financial period with $35.2 billion in cash and equivalents.

The firm had guided for a 9 to 21 percent revenue decline in its sequentially preceding quarterly report. Qualcomm also forecasted that its profit, using non-GAAP methods, would decline between 31 and 41 percent.

Not that great.

Qualcomm has struggled in recent quarters. Its share price ended regular trading, heading into earnings, at around the $64 mark, down sharply from its 52-week high of nearly $82 per share. Competition from rival Chinese chip makers, and a recent choice by Samsung to use silicon it developed in some of its flagship phones.

Also key to its quarter, Qualcomm is bowing in a way to external investors JANA Partners, of which two individuals will be added to its board. The company, in a release, promised that “a third director to be selected by the Company and consented to by JANA will be added promptly.” That should assuage the outside community at least some.

Looking forward, Qualcomm expects fiscal fourth-quarter revenue of between $4.7 billion and $5.7 billion, a large band, and adjusted earnings per share of $0.75 to $0.95. Those figures represent year-over-year declines of 15 to 30 percent, and 25 to 40 percent, respectively.

The market had expected $1.08 in adjusted profit per share and revenue of $6.13 billion. Those sets of figures are painfully far apart.

So Qualcomm essentially met on revenue, beat on profit, promised to cut costs and bring in external help, but managed to project forward quite weakly compared to expectations. It’s up to investors to handicap that particular mix.