Netflix’s shares popped nearly four percent today to an all-time high of $707.61. The new record comes a day before the company splits its shares on a seven-for-one basis, and two days before it will report earnings.

Shares in the online video streaming and content shop have been on a tear, roughly doubling so far this year. Netflix is now worth north of $40 billion.

Driving the bull run in Netflix has been its share split, which has proved quite popular with investors, and recent strong analyst sentiment on the company. New price targets can sometimes move prices closer to targets, of course.

At risk for Netflix is the heavy weight of high expectations. On the heels of its split, if Netflix borks its earnings, investors will be merciless. Also in the cards for Netflix is simply how richly it is valued. The company has, according to Yahoo Finance, a forward price-earnings ratio of more than 200. That implies that investors are quite willing to pay for tomorrow’s profits today when it comes to Big Red.

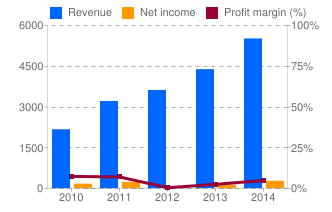

Netflix’s profits were slim in its last quarter, generating $23.70 million in net income off $1.57 billion in revenue. Netflix is, and has invested heavily in original content, and international expansion. Investors have thus far been more than content to watch the company do this

than worry about short-term profits. It’s a similar situation to Amazon, if you will.

So, it’s a big week for Netflix, and one that the investing public seems to think will go well. We’ll TechCrunch will cover Netflix’s earnings on Wednesday live, so stick around.