Uber may be on the wrong end of a 95 percent-plus marketshare that its chief rival Didi Kuaidi enjoys in China, but the country is on track to overtake the U.S. and become the U.S. firm’s largest market before the end of 2015. That’s according to communications leaked to the Financial Times (pay wall).

In a letter reportedly send to investors ahead of a planned funding raise of $1 billion for China — to help Uber expand into 50 new cities there; it currently operates in 11 — Uber CEO Travis Kalanick provided surprising nuggets of how the U.S. firm is performing in China. Kalanick’s information is at odds with how Uber is perceived in the country, where it is seen as an outsider struggling for marketshare.

Kalanick claimed that Uber is logging nearly one million trips per day across China. If true — there have been suggestions that its generous subsidies are being abused by drivers who log fake rides — that’s quite astonishing since Uber hit one million daily rides worldwide as recently as December 2014. (In addition: a New York Times story earlier this week pegged its rides in China at 100,000 per day — Didi Dache was logging five million per day a year before its merger.)

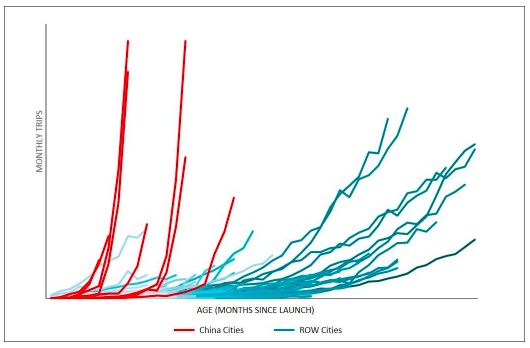

The Uber CEO also said that four of the company’s largest cities worldwide, based on rides per day, are in China. That’s despite Uber China — the company’s business in the country — being far younger than its U.S.-based operations.

Guangzhou, Hangzhou and Chengdu have all surpassed New York as our three largest cities on a trips basis. Impressively, Hangzhou and Chengdu have accomplished this feat in just 9 months, compared to New York which is 4 years old.

Hangzhou is now over 400x the size that New York was at its same age. 200,000 Hangzhou residents are becoming new UberChina riders every week!

That staggering growth is shown in the chart below:

Other tidbits Kalanick revealed included:

- Uber trips in China have grown at a 100% monthly compound rate since the beginning of the year

- Uber is apparently creating over 100,000 new jobs per month across China

Kalanick, who revealed in the letter that he is personally overseeing the business in China, said he believes that Uber can buck the trend of Western companies struggling in China.

“Simply stated, China is the #1 priority for Uber’s global team,” he wrote. “[The] combination of operational excellence and a superior product is allowing us to grow significantly faster than our competition.”

On that note, Kalanick had some choice words for “one competitor” — presumably Didi Kuaidi — which he said “cloned our core product line and is attempting to transition from its legacy taxi business to a similar P2P model.”

Didi Kuaidi did indeed launch a peer-to-peer service this month, but Uber claims that it leads the P2P taxi market in China with a near 50 percent share and a presence that is “substantially larger in many of our key cities.”

Kalanick also blasted Didi Kuaidi’s backers which he claimed had made unfair moves to shut Uber out. Tencent blocked Uber’s official accounts from its WeChat service — China’s largest messaging app service — while the Uber supremo said drivers had been paid to protest against Uber, and “forged” messages were sent to existing Uber drivers in some cities.

The letter from Kalanick is, of course, written by a CEO to a list of potential investors and therefore is always going to be bullish. But it provides a very different take on Uber’s situation in China. The U.S. firm’s big window of opportunity appears to be a shift from traditional taxis on-demand to a peer-to-peer model across China.

That change hasn’t sat well with many regulators in the country, Asia and other parts of the world to date. Though Kalanick said he has “spent time with high level government officials throughout China,” regulators in some Chinese cities have raided Uber offices and cracked down on its competitors for offering P2P services. Yet, if that model can achieve legitimacy among Chinese authorities, then Uber’s prospects of success in the country will be a lot rosier.

An extra $1 billion in the coffers will help the cause too.

Uber has raised some $5 billion from investors to date. One existing shareholder is Chinese search giant Baidu, which made a strategic investment in the company in December, and is using its payment wallet and popular maps service to help raise Uber’s visibility in China. Uber was said to be raising $1.5 billion back in May, it isn’t clear whether this China raise represents a chunk of that figure or whether it is altogether separate.