Editor’s note: Eric Kim and Chi-Hua Chien are co-founders of Goodwater Capital, an early-stage venture capital firm that empowers entrepreneurs who are changing the world through consumer technology.

Consumer Internet startups have experienced a long-running boom in funding and valuations, but a recent trend toward strategic investments and acquisitions by Internet giants is raising eyebrows.

Investments such as the Google-led $542 million round for Magic Leap, Tencent’s $350 million investment into Koudai, and Alibaba’s $215 million investment in Tango have changed the way that later-stage consumer Internet startups should think about their funding options. What’s driving the spate of strategic-led investments? It’s simple, really; it’s all about cash.

The Billion-Dollar Cash Club

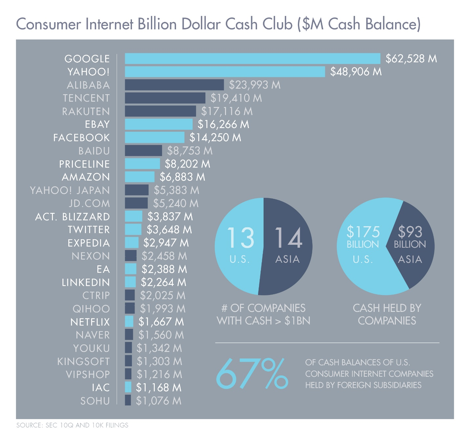

We analyzed all consumer Internet companies with cash balances (cash + short-term + long-term investments) greater than $1 billion and found surprising results.

- 27 companies in the billion-dollar cash club combine to hold ~$268 billion of cash on their balance sheets.

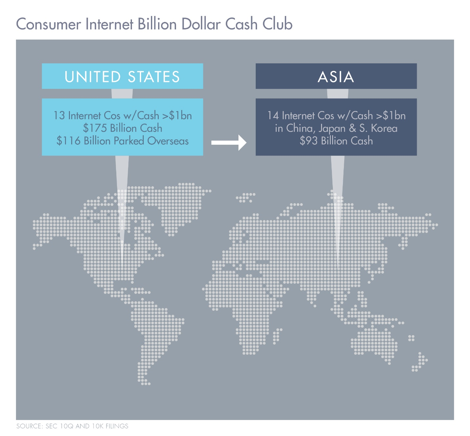

- More than half (14) of the companies in the club are based in Asia, and they hold about one-third of the cash ($93 billion) while 13 U.S. companies have ~$175 billion.

- Adding Apple, Microsoft and Samsung (increasingly active in consumer startups) provides an additional $337 billion in cash.

Between the 27 consumer Internet giants plus OS/device makers Apple, Microsoft and Samsung, there is nearly $605 billion of firepower sitting on the sidelines looking for new opportunity. We believe these enormous balance sheets will yield a very active and hyper-competitive consumer Internet funding and M&A market in 2015 and 2016.

However, an often overlooked insight is where the cash actually sits geographically. Sixty-seven percent of the cash balances of U.S. consumer Internet companies is held by foreign subsidiaries. Adding Apple and Microsoft actually increases that to 72 percent. The implications are critical — more than $300 billion of cash can’t be easily deployed by these U.S. companies into U.S. investments and acquisitions.

Your Next Offer May Come From Asia

Meanwhile, from across the Pacific, Asian tech companies are partaking in high-flying growth rounds, such as Alibaba’s investment in Lyft’s $250 million round and Tencent’s $60 million backing of Snapchat.

Recent early-stage deals such as Rakuten/PocketMath and Tencent/AltspaceVR show the willingness of Asian strategic players to make even riskier bets in the U.S. This is just the tip of the iceberg of what could become a major geographical power shift between global tech companies, and a deeper analysis of cash balances shows us why: Asia-based Internet companies have $173 billion available for strategic transactions in the U.S., compared to $122 billion for their U.S. counterparts.

It’s worth noting that some U.S. companies have utilized creative debt issuances to effectively “access” their foreign cash (just compare Apple and eBay’s tax strategies) while Asia-based companies face their own restrictions for investing on U.S. soil. That said, U.S.-based startups would be well advised to start to get to know the strategics from Asia, several of whom have already set up offices in the Valley. (Analysis includes Apple, Microsoft and Samsung.)

While most of the 30 companies we analyzed are highly innovative, they also have a history of aggressively acquiring companies that are potentially disruptive (Google + Nest, Facebook + WhatsApp, Apple + Beats, Rakuten + Viber, Yahoo + Tumblr, Tencent + Riot Games, Baidu + 91 Wireless).

Entrepreneurs running fast-growing consumer web and mobile companies will have to balance their desire for independence with the reality that the market is perhaps more ready than ever to pay for their at-scale customer adoption. So don’t be surprised if your next big investment or strategic acquisition opportunity comes from Asia.