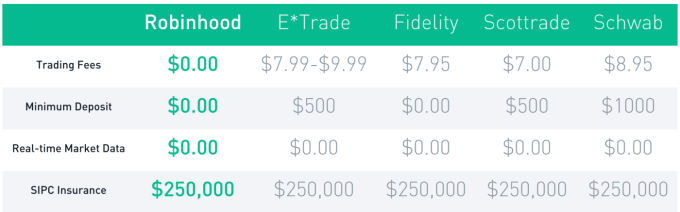

Why pay E*Trade $8 to buy or sell a stock when you can trade for free on Robinhood? After two years of development, $16 million in funding, and 500,000 waitlist signups, Robinhood finally hits the iOS App Store today. Robinhood lets you track the performance of stocks, and buy or sell them with just a few taps at no cost.

The app could attract a younger, less wealthy demographic to the stock market because people can trade smaller amounts without having their potential earnings eaten up by the fees most brokerages charge. Instead, Robinhood makes money through interest on funds you hold with it or when you trade on margin, plus selling trade volume to stock exchanges.

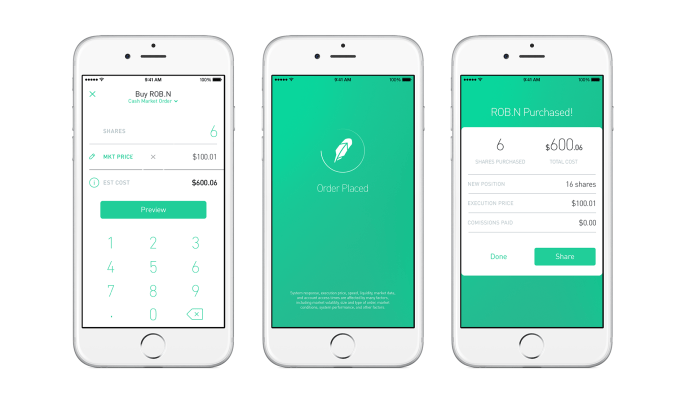

During my demo, I found Robinhood to be stylish, and easy to use — uncommon traits for financial apps. Robinhood hopes to onboard the waitlist within two months and then start adding those who signup today. But until then, anyone can use the app to just monitor stocks.

Here’s my quick demo video of the app:

Financial tech serial entrepreneurs Vlad Tenev and Baiju Bhatt hope the third time’s the charm with Robinhood. The two met at Stanford [Disclosure: I was friends with them there and was in a fraternity with Tenev], before both going on to prestigious grad programs in math. They started an algorithmic trading tech startup called Celeris, and then took another swing building software for big investment banks. Neither worked out, but in the meantime they noticed there wasn’t a good mobile app for stock trading.

What surprised them, though, was that there was no excuse for the exorbitant fees the E*Trade and Scottrade charge other than own gross inefficiency. By replacing brick and mortar branches and TV marketing budgets with a handful of engineers and mobile virality, Robinhood was able to ditch the commission fee.

But that was a year ago. Why’s it taken so long to launch? Because Tenev and Bhatt knew that if they messed up on security or reliability, screwing with people’s money, no one would trust Robinhood to hold their funds.

So the startup got serious and raised $16 million from top investors like Google Ventures, Andreessen Horowitz, Index Ventures as well as savvy upstarts like Rothenberg Ventures and Slow Ventures. That money afforded it top security and infrastructure experts from Stanford, MIT, and CalTech that worked at Google, Facebook, and Palantir. “Security is basically a computer science problem. Our solution has been hiring the brightest minds” Tenev tells me.

The two founders have spent the time since scoring the capital to close every security hole they could and test the app with a few thousand users. Metrics showed people who made at least one trade on average checked the app 20X per week, made four trades their first month, and 90% were likely to recommend Robinhood to a friend. Those metrics told the team the app was finally ready for the public.

When you sign up, you’ll set an in-app password or Touch ID to make sure no stocks are traded without your consent. To make adding funds easy, you can sign in with your name and password for any of nine top banks rather than having to fiddle with checking account numbers and a multi-day verification process. For added assurance, your assets worth up to $500,000 are protected by the Securities And Exchange Commission. And there’s no minimum amount of money you have to add. Go ahead and trade $2 of battered Zynga stock if you want.

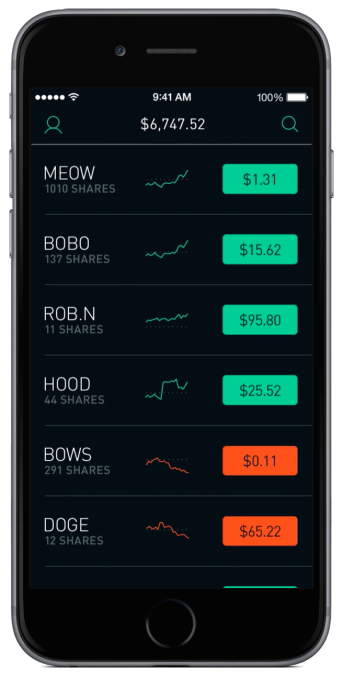

Once in Robinhood, you can add stocks to your homepage watch list. A quick glance will tell you if they’re up or down and by how much, while tapping in shows detailed stats and a price timeline you can scrub across.

If you want to buy one, just tap ‘buy’, then slide up to confirm. Selling and cashing out is that simple too. The whole app uses colors to quickly convey concepts like a white background for when the markets are open for trading and a black background when they’re closed, or green stock names for winners and red names for losers on the day.

When I asked for specifics on how Robinhood will make money, the founders laughed, saying when you move money around, it never seems to tough to earn some for yourself. Just ask Wall Street. But the answer is first and foremost that Robinhood will earn standard interest on funds you add to your account. It will also charge its own interest rate if you buy on margin while waiting for cash from stocks you’ve sold to clear into your account, or buy on credit from Robinhood.

Down the line, the startup could sell API access to its system. And if it can aggregate enough transactions, stock exchanges will pay it for its trade volume to increase the liquidity of their marketplaces. For now, though, Bhatt says the company’s biggest worry is getting people who’ve waitlisted for a year onboarded as quickly as possible without any snafus that could hurt its credibility.

Down the line, the startup could sell API access to its system. And if it can aggregate enough transactions, stock exchanges will pay it for its trade volume to increase the liquidity of their marketplaces. For now, though, Bhatt says the company’s biggest worry is getting people who’ve waitlisted for a year onboarded as quickly as possible without any snafus that could hurt its credibility.

Yahoo’s Finance app, Scutify, StockTouch, and websites like Google Finance are Robinhood’s biggest competitors on the monitoring side. But as for mobile-first stock trading, Bhatt and Tenev are the only ones who’ve successfully jumped through the regulatory hoops and weathered the engineering challenges to get to market.

If Robinhood catches on, it could not only get a younger generation playing the market, it could start them on the road to financial expertise that will serve them the rest of their lives. When it comes to learning about money, Tenev says “the earlier someone gets started the better.” It helps that Robinhood’s average user age is 27, compared to E*Trade’s 55. The idea that its customers won’t die off anytime soon must be reassuring for the startup.

Bhatt also thinks that “Participation in the economy through stock ownership is a pretty important way of keeping the divide between the haves and have-nots from growing.”

Technology has already democratized publishing, funding, and so many more industries. Now Robinhood wants to steal stock trading from the rich and give it to the poor.

Comment