Amazon reported lower than expected revenue in its third quarter, and a larger than expected loss. Analysts expected the company to lose $0.74 on revenue of $20.84 billion. Instead, Amazon lost $0.95 per share on revenue of $20.58 billion.

That per-share loss works out to a net loss for the firm of $437 million.

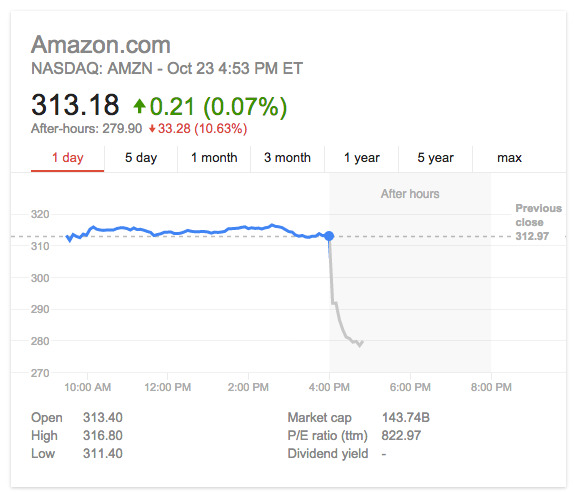

Shares in the firm took it poorly, as investors headed for the exits:

That’s a pretty damn rough chart. However, it’s not the first time that Amazon has taken a whacking after its earnings. In January of this year, the company shed a quick 8 percent after it reported revenue and earnings per share that were both under expectations.

Amid all the doom and gloom, it’s worth noting that net sales did rise 20 percent to $20.58 in the third quarter, up from $17.09 billion in the third quarter of 2013. On the whole, Amazon as a company remains healthy, well capitalized and innovative. However, investors had long valued it on its revenue growth, and not its short-term profitability. To see the firm miss on top-line expectations and profits is therefore doubly damning.

The company’s recent Fire Phone launch was not a success. And Amazon’s prime, respected cloud business is locked in a price war with Microsoft and Google, two companies that are both profitably, and more cash rich. Perhaps aggressive cloud pricing will cause continued, near-term pressure on Amazon’s margins.