Smart remote software maker Peel has closed an additional $50 million in funding, supplied by Alibaba, the e-commerce giant which recently made its public market debut in the U.S. The company’s new funding is a strategic investment separate from its existing $45 million raised across four rounds, with the most recent announced in June, and brings its total rase since its founding in 2009 to $95 million. The new money will help Peel continue to expand its product lineup, which initially focused on hardware, but has since moved on to both its software app, and a development platform for broadcasters.

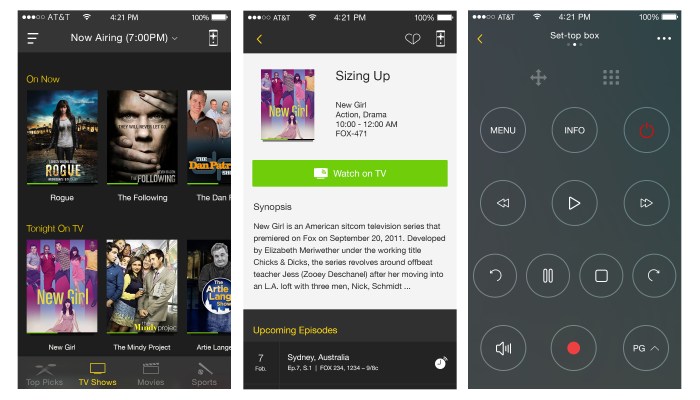

Peel’s app is available on both Android and iOS, and now counts 90 million users as its install base, with 5 billion smart remote commands issued via its software every month by way of engagement stats. The app originally essentially mimicked a hardware universal smart remote, and focused on providing that kind of experience to smartphone devices via an IR blaster, but the company has since shifted its focus to providing an intelligent remote companion that can generate custom content viewing suggestions based on viewer habits.

Its new Peel.in Platform is a B2B play, providing networks and broadcasters with software tools to help bring in more viewership from digital and social media sources. Using Peel.in, networks can send out special links via Twitter or Facebook, which, when clicked on a device that has the Peel app, will automatically tune to the correct channel on the user’s TV.

Peel’s new funding from Alibaba actually closed prior to the Chinese company’s IPO, which broke U.S. records. Alibaba has designs on both the entertainment, and the home smart control spaces, and Peel addresses both – its app can control not only most TVs and set-top boxes out there, but also air conditioners and smart appliances. Alibaba launched a smart TV and set-top box platform in 2013, and a smart home IoT platform in 2014, so it definitely has expressed interest in Peel’s specific market of opportunity. Considering this investment is larger than all of Peel’s existing funding combined, I’d say we wee a close working relationship between these two going forward.