As more Americans become aware of the need to conserve water for environmental reasons, or due to drought-related water use restrictions, the water utilities have found themselves struggling to stay financially sound as they begin to sell less water to their customers. Valor Water Analytics is a company moving into this largely ignored sector in order to provide utilities with software that can help them better understand how customers’ changing water usage patterns will affect their bottom lines, and what they can do about it beyond just rushing to raise rates.

The company was founded by Christine Boyle, who holds a doctorate in water resource planning from the University of North Carolina at Chapel Hill. The idea for the software program actually came out of a grad school project, she says, where she had developed a set of analytical tools to help utilities who were struggling financially as customers conserved during a drought.

Though she first began working on the tools back in 2007, it took some time for her to license the technology from her university. But now Valor has a worldwide, exclusive, transferable license for the technology, and the software is currently being used by four utilities in N.C., including those in Cary, Fayetteville, Greensboro, and Chapel Hill area. These utility customers are pilot testing the program, but they’re not the first to have done so.

Though she first began working on the tools back in 2007, it took some time for her to license the technology from her university. But now Valor has a worldwide, exclusive, transferable license for the technology, and the software is currently being used by four utilities in N.C., including those in Cary, Fayetteville, Greensboro, and Chapel Hill area. These utility customers are pilot testing the program, but they’re not the first to have done so.

Valor is working with the Urban Water Consortium, explains Boyle, which directs which utilities will trial the program at what time. Over the years, Valor has worked with 15 utilities in total, she notes.

Officially incorporated as of last November, Boyle is now preparing to take Valor Water Analytics from being more of a research effort into a software-as-a-service business.

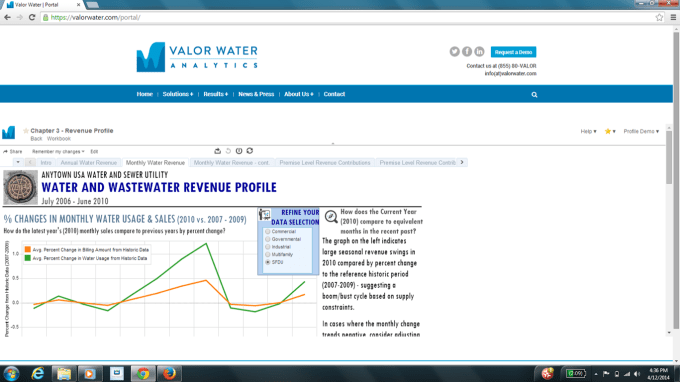

Using an online portal now being re-coded with more modern programming languages, utilities can log in and view how water use changes impact revenue. A variety of product lines help them address concerns around conservation and drought, allowing the businesses to increase charges more appropriately.

For example, it may target rate hikes at those who are wasting water, rather than an across-the-board rate hike which effectively punishes those who are conserving water appropriately.

Utilities can also structure pricing with things like “water budgets” which are like guidelines for customers’ water usage. If you exceed your water budget, you might pay more, for instance.

Boyle says that the software isn’t just about putting this business intelligence data into an online dashboard, but also guiding the utilities to make better financial decisions. “We run the analytics but we also deliver advising and insight…we layer it with suggestions,” she explains. “Utilities were so hungry for this information.”

Prior to her company’s software, most utilities didn’t have programs that could do this sort of number-crunching, says Boyle. Instead, they’d sometimes have data analysts creating fancy Excel spreadsheets, or would bring in outside consultants every few years. “It sounds weird that they haven’t been looking at this stuff…but they’re really not. That’s why this is exciting for us,” she says.

Valor Water Analytics, now based in the Bay Area, has just landed its first California utility customer, and is working to sell to others across the state and the U.S.

The company generates revenue at a rate of about 38 cents per customer during year one (which tends to involve the integration work with backend systems), and then at 18 cents per customer afterwards.

At Disrupt, Valor launched its “Drought Conversation Toolkit” for utilities, which is a product that’s specifically designed to help a utility manager measure the revenue impacts of drought-related conservation. Also at Disrupt, Valor announced a partnership with ESRI and a deal with Sonoma County’s (CA) water utility.

The startup, which has a small amount of angel funding, is looking to raise an additional round of $500,000 in order to get to scale faster.

[gallery ids="1053556,1053557,1053558,1053559,1053560,1053561"]

Judges’ Q&A

Judges this round included: Cyan Banister, Partner, Banister Capital; Cyril Ebersweiler, Founder, HAXLR8R accelerator; Ryan Sweeney, Partner, Accel Partners; David Tisch, Managing Partner, BoxGroup; Q&A paraphrased for brevity.

CB: How long is the sales cycle?

A: We went to market in June, and the first sale quick. We have 10-15 in the pipeline, we don’t know how long it will take close them. I know it’s government, so it could be slow. I’m going to say 6 months as a guesstimate.

CE: Market size? How many utilities and what kind you charge them?

Is it a problem getting all their data into your software?

A: U.S. has over 50K water utilities. But we’re going after middle and large sized utilities.

Extracting data – we work closely with the utilities I.T. dept, and extract data from billing system. So far, it has worked. To scale, we have some other choices to make, in terms of working with third parties.

CE: Is there a reason for a utility to not work with you?

A: [Some] don’t know why they need to change from the way they’ve done things for year. We need to push them to adopt new solutions because yesterday’s solutions aren’t working today. We’re working with a ‘coalition of the willing’ first, then will fight the harder battles after we have a reputation established.

DT: What benefit have utilities extracted?

A: We help find hidden revenue. We are able to locate cost and efficiencies. Utilities are concerned with affordability and community issues, and we help with that, too.