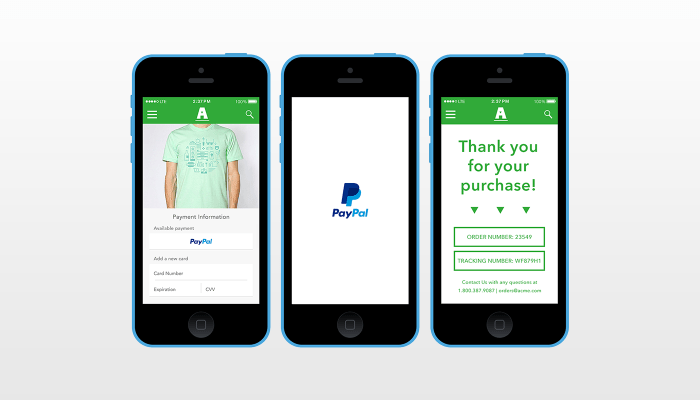

Mobile commerce today is still challenging with complicated checkout flows that see users bouncing between screens, and having to tap out their personal information on tiny screens and keyboards. PayPal today is hoping to change that with the release of a new product called One Touch for merchants and app developers.

The feature was built in collaboration with PayPal acquisition Braintree, and is basically like a PayPal version of Braintree’s Venmo Touch product.

For those unfamiliar with Venmo, it was an early-stage mobile payments startup Braintree acquired in 2012, before being bought itself by PayPal last year. Venmo offers a social app that makes it easy for users to quickly send money to each other, then cash out to a bank overnight. Venmo Touch, meanwhile, was introduced as a way for mobile app users to access their stored payment information across a network of Braintree-supported apps, like HotelTonight, Airbnb and Uber, for example.

The idea is that you would no longer have to re-enter your credit card information at checkout or time of payment within these apps – it would be stored via the Venmo Touch service and recalled when needed.

While useful, Venmo’s footprint is arguably smaller than that of PayPal’s, which is why today’s news matters. This launch means that a wide number of PayPal merchants will now have an easier way to accept mobile payments in their native applications. And consumers, who are more likely to be a PayPal customer than a Venmo customer, will now have easier ways to shop and pay on mobile, given broad enough merchant adoption.

In addition, One Touch will have the benefit of the larger company’s security practices and fraud protection capabilities. Besides having a wider data set in general to draw upon, being a mobile service means that PayPal will be able to detect in real-time and confirm with the user when unusual activity occurs.

PayPal’s One Touch & Venmo Touch To Live Side-By-Side

While PayPal’s One Touch makes sense as the next big product launch for the payments giant, the arrival of the service doesn’t mean that Venmo Touch is going away, says Braintree’s CEO Bill Ready. Instead, he explains, consumers will have a choice, depending on which payment apps they have installed on their phone.

“It’s starting to bring together the two networks of PayPal and Venmo,” says Ready, “but letting consumers still choose what product experience they want – the more social experience that Venmo, offers, or PayPal, if they’ve been a user for years.”

Ready also notes the importance of making checkout work better on mobile, adding that more than half of e-commerce shopping sessions come from mobile these days, but only 10 percent to 15 percent of mobile purchases actually come from mobile devices due to the pains involved with the mobile buying experience as it stands now.

One Touch is being launched now into beta with select merchant partners as part of the recently released Braintree v.zero SDK, and will be rolled out more publicly in September. Developers who already have the SDK installed will be able to log in to their dashboard and enable the new option, as the SDK was designed to be “future-proofed” as new services, like this, become available.