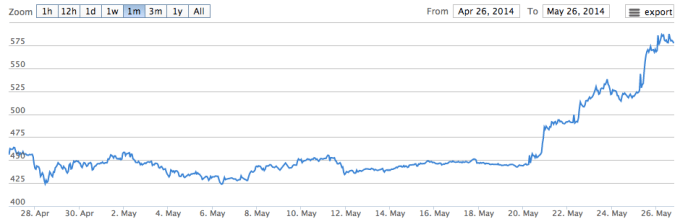

It’s been a torrid few days for bitcoin, the now globally known cryptocurrency. A price rally kicked off that has, over the past week, pushed the value of bitcoin up by around 25 percent.

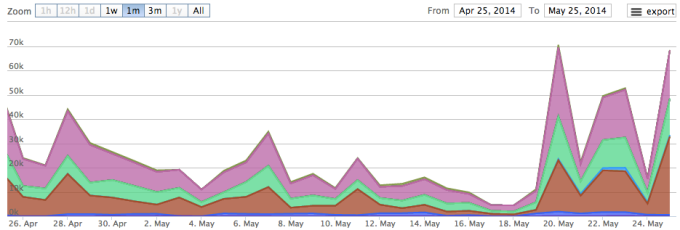

Trading near the $580 mark, bitcoin is still down around 50 percent from its record, late-2013 highs, but the life that it’s showing could once again bolster consumer interest in the stuff. Interestingly, bitcoin transaction trading volume isn’t up. In fact, daily bitcoin transactions have settled into a consistent range of between 50,000 and 75,000 per day, according to Coinbase.

While transaction volume is flat, total traded bitcoin is up sharply on major exchanges. So, we’re seeing about the same number of transactions, with each trading event involving more bitcoin.

Here’s the one-month chart (Via BitcoinAverage) of volume — bitcoins bought and sold, not the numerical tally of total transactions — from major exchanges (Coinbase is excluded):

And, from the same source, a one-month price chart. See if you can spot the line-up:

The rally itself comes at a soul-searching moment for the bitcoin. A recently published investigation called the ‘Willy Report’ alleges that bot accounts on the Mt.Gox exchange led to massive price inflation last November, the month that saw bitcoin reach its all-time record highs.

Here’s he key excerpt from the report, detailing how the supposed bot ‘Willy’ executed massive transactions:

So basically, each time, (1) an account was created, (2) the account spent some very exact amount of USD to market-buy coins ($2,500,000 was most common), (3) a new account was created very shortly after. Repeat. In total, a staggering ~$112 million was spent to buy close to 270,000 BTC – the bulk of which was bought in November. So if you were wondering how Bitcoin suddenly appreciated in value by a factor of 10 within the span of one month, well, this may be why. Not Chinese investors, not the Silkroad bust – these events may have contributed, but they may not have been main reason. But more on that later.

There has been pushback since, with some arguing that Chinese bitcoin markets were in fact the leading driver of the past price spike. Other criticism has centered on the idea that one or two trading accounts could not have influenced so large a global market.

As bitcoin’s price has yo-yoed, I’ve kept a closer eye on bitcoin transaction volume than its current dollar conversion price. If the bitcoin network is growing — the key metric of expanding adoption, in my view — transaction volume should rise. That would imply greater implied potential utility per coin, thus increasing their value.

Which usage metric do we care more about? Transaction volume, or total bitcoin traded? Both, really, but I think that rising raw transaction volume itself would point to more pedestrian usage of bitcoin — not everyone is going to buy or sell several bitcoin at once, and, as bitcoin fans are trying to tie the cryptocurrency into normal life, we should expect to see rising numbers of small purchases if they are succeeding.

Whatever the case, rising bitcoin sales and a rally mean that big dollars are buying into the cyrptocurrency.

IMAGE BY FLICKR USER HAMED AL-RAISI UNDER CC BY 2.0 LICENSE (IMAGE HAS BEEN CROPPED)