Last Friday, Microsoft finally took control as the new owner of Nokia’s devices business, but it’s coming into its new position as a mobile hardware maker with no less a challenge than Nokia has had for the last couple of years.

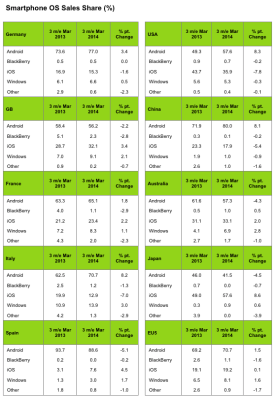

According to the latest 12-week figures from Kantar Worldpanel ComTech — a market research division of WPP — Windows Phone accounted for 8.1% of smartphone sales in the 12 weeks to the end of March across the top five markets in Europe (the UK, France, Spain, Italy and Germany), with Android taking 70.7% of sales and iOS 19.2%.

And Europe seems to be Windows Phone’s best market at the moment. In the U.S. Windows Phone took 5.3% of sales, while in Australia it took just under 6%; in China it was 1%; and in Japan, just under 1%.

What’s going on? Put simply, the Windows Phone operating system running Nokia’s and other devices remains a distant third when it comes to smartphone sales in key markets across Europe, the U.S. and Asia.

And that has a double effect. First, in the game of economies of scale, Microsoft will find it more challenging. Second, in the game of mindshare among consumers and developers, it means that Windows Phone devices are for many still not appearing as must-haves either in terms of device ownership, nor in terms of platforms for building new apps and other services.

At issue for Windows Phone is the double pressure of price and volume of Android handsets, with both playing a big role in keeping Windows Phone largely locked out of the smartphone boom. That boom has seen markets like the UK reach smartphone penetration of 71%, with smartphones accounting for 88% of mobile sales. That’s opportunity for those who are clicking with consumers and carriers.

Dominic Sunnebo, a director at Kantar, writes that the main challenge for Windows is that Nokia, very much the main and dominant Windows Phone OEM, has based a lot of its fightback strategy on wooing new smartphone users with entry-level phones. The problem is that these devices have not managed to compete well enough with the Android camp.

“Windows had a tough start to the year as a result of its entry-level Nokia models facing fierce competition from low-end Motorola, LG and Samsung Android smartphones,” he writes.

Even before being taken over by Microsoft, Nokia’s device fate had become inextricably connected to that of Redmond.

“Nokia really is the vast majority of Windows now, so any trend you see for Windows is being driven by Nokia,” Sunnebo told me in an interview. “Essentially Nokia was starting to make some real headway with its entry level Lumia 520, particularly in capturing first time Smartphone buyers and those transitioning across from Symbian….it arguably had the best entry level device.

“Now, we’re starting to see some really compelling competition at this end of the market from the likes of Motorola (with Moto G) and Samsung (heavily discounted S3 & mini models) eating into prime Nokia territory.”

He also points out that moves from up-and-coming Chinese brands to expand outside of their home market — think Xiaomi, Oppo, OnePlus here — are now also going to make the breakthrough challenge even harder.

“There is an increasing realization amongst consumers that the difference between the high-end and low-end is becoming very fine,” he says. “This could play to Nokia’s advantage (it makes great entry level devices), but it certainly won’t be alone in pushing great spec devices at low/mid prices.”

Interestingly, Apple continues to fight the Android juggernaut in its own, high-end way. Sunnebo says that its sales saw a bounce back in Europe, Japan and Australia largely on the “strong performance” of the 5S model at the top of its range.

But “bounce back” and “strong performance” are relative terms: the margin between Android and iOS continues to widen, with Android at over 70% of sales in five of the markets surveyed by Kantar.

Nevertheless, in specific markets Apple continues to trounce Android. In Japan, Apple is still the dominant smartphone brand, with nearly 57% of sales. Specifically, it’s taking 42% of smartphone sales on NTT DoCoMo, 59% on KDDI AU and 81% on Softbank, Kantar notes.

Why? Apple has found the right mix of design, 4G access and device reliability that resonates with Japanese consumers. “Japan’s love affair with Apple shows no sign of fading,” Sunnebo notes. He also points out that this has a knock-on effect for the iPad, with nearly a quarter of Japanese iPhone owners also owning an Apple tablet.

But while Apple has kept a fairly big space between the sizes for an iPad and iPhone, in fact in Asia the real story is about the effect of devices that are increasingly appearing in between the two. In China, it notes that devices with a screen larger than 5” made up 40% of smartphone sales in March.

“It’s clear that phablets really are changing the way Chinese consumers use smartphones,” Sunnebo writes. “More than one in five phablet owners now watch mobile TV on a daily basis, half do so at least once a month, and this is without the widespread availability of 4G. As 4G infrastructure expands in China, the demand for data is going to be unprecedented, paving the way for carriers to boost revenues significantly through larger data packages.”

While Apple has effectively taken a trickle-down approach with older models and those with less storage to court new smartphone buyers, the question remains whether it will choose to sidestep this other trend as well, or jump into it with its own take on the iPhablet.