New York City-based CommonBond launched in late 2012 on a mission to bring the power of person-to-person lending and crowdsourcing to the student debt crisis. With student debt in the U.S. having surpassed $1 trillion, college grads find themselves in an ugly situation today when it comes to subsidizing their education. Borrowing money from Uncle Sam means turning to federal loans and their high, fixed interest rates, while the big players in the private market appear content to maintain the status quo.

Companies like CommonBond have emerged in response to the student loan crisis, leveraging the popularity of peer-to-peer lending platforms like LendingClub and Prosper to give student borrowers a better shake. By connecting borrowers directly to alumni and a larger network looking to give back to graduates from their alma maters and see a steady return to boot, CommonBond is becoming an increasingly attractive alternative.

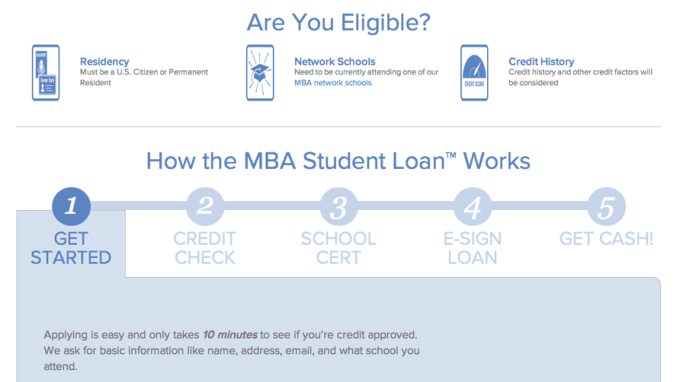

The startup raised more than $100 million in equity and debt financing last September from Tribeca Venture Partners, The Social + Capital Partnership, Vikram Pandit and more, adding to the $3.5 million it launched with back in 2012. Initially targeting MBA programs, CommonBond set out to enable graduates to consolidate their graduate school and undergraduate loans and refinance those loans at lower fixed rate than they would be able to find with Uncle Sam.

With its capital in the bank, CommonBond has since been looking to expand its coverage, which it did this week, bringing its consolidation and refinancing program to graduates of law, medical and engineering programs, as well MBA programs at Vanderbilt, Washington University in St. Louis and the University of Texas. According to co-founder and CEO David Klein, this expansion means that CommonBond now covers four times the number of degree programs — bringing its total from 25 to over 100 graduate degree programs in just 15 months.

With its new debt and equity capital and its expansion to include new graduate programs, the company plans to save borrowers over $10 million in 2014 and expects more than 1,000 new borrowers to join its ranks this year. Considering the average debt for law school grads has been hovering around $110K and the average for med school grads near $160K, there’s plenty of demand among those with graduate degrees, and the lending market for graduate students continues to swell alongside its undergraduate counterparts.

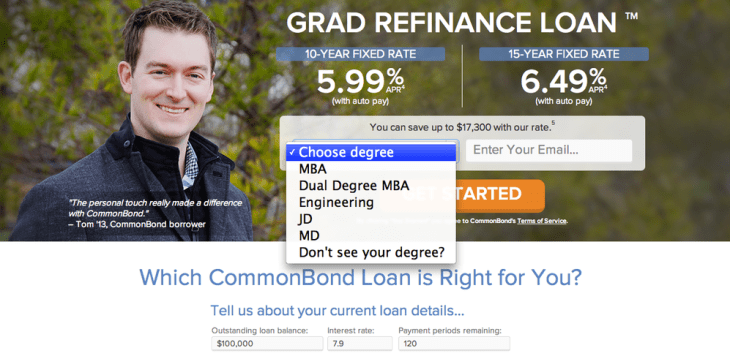

With this being the case, one can see the appeal of CommonBond’s lending formula, which now allows graduates carrying student loan debt to consolidate both undergrad and graduate loans into a single, 10-year fixed-rate loan and refinance at a rate of 5.99 percent with autopay. Under this formula, the company claims that it can save borrowers over $17,000 in repayment fees, thanks not only to lower rates, but the company’s effort to eschew the kind of additional fees one might find on other platforms, like application fees, origination fees or prepayment penalties, for example.

In addition, the company has also introduced a new 15-year, fixed-rate loan for borrowers who are looking to cut down on monthly payments, which it will be offering to borrowers at a refinance rate of 6.49 percent with autopay.

But beyond lower fixed loan and refinance rates, CommonBond also hopes to attract student borrowers and alumni alike by creating a community around the lending process. Through its community of students, graduates, alumni and professionals in dozens of cities around the country, the startup organizes networking and social events to help individuals from each side of the lending equation get to know each other live, in 3-D, along with potentially providing ancillary benefits, like helping students to find post-graduate employment, for example.

CommonBond also adheres to a social mission, which puts it into a growing class of startups that have built “social good” into their company philosophy, like Warby Parker and TOMS, for example, by funding the education of one student in need (for a full year) for every degree fully funded on its platform. Like TOMS, CommonBond wants to bring the “one-for-one” model to education and finance, allowing borrowers to power social good beyond their own educational horizons.

For more, find CommonBond at home here.