King’s long anticipated IPO filing dropped some staggering figures this week.

The $1.8 billion in annual revenue that the Candy Crush Saga-maker earned last year was about $600 million or $700 million more than the whisper numbers I had been hearing at the end of 2013. It signals just how large free-to-play mobile gaming has become compared to older parts of the gaming industry, which deliver titles as finalized, packaged goods at $60 a pop.

Just to put some of those figures in perspective (with help from some longtime industry observers):

King’s ‘gross bookings’ last year were about 85 percent of Nintendo’s last reported annual gross sales from software, pointed out long-time game developer Ben Cousins, who is behind iOS first-person shooter “The Drowning.”

The company had 93 million daily active players, or about 17.5 times as many PlayStation 4s as Sony as sold to date, pointed out Kristian Segerstrale, who used to head up EA’s digital strategy and sat on the board of the other European mobile gaming phenom Supercell.

So there we have it. Traditional console players like Sony and Nintendo continue to be disrupted by the new platforms of Android and iOS, which are simultaneously cannibalizing audiences for older hardware platforms and expanding the market to a new generation of casual gamers.

King is now one of two game developers that have produced a $1 billion free-to-play mobile title after Japan’s Gung-Ho with Puzzle & Dragons.

But is it all so rosy?

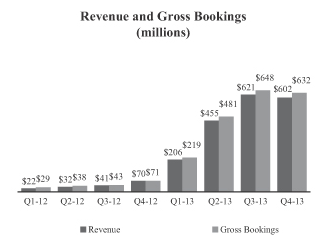

It looks like top-line revenue growth is stagnant or slowing not only for King, but also other top-grossing game makers.

King’s overall revenue declined to $602 million in the last quarter of the year from $621 million the previous quarter. This is also extra notable because the holiday season is usually a strong one for mobile game makers. App download numbers usually peak around Christmas time, as consumers are gifted new iPhones, iPads or Android devices. So King’s top-line revenues declined quarter-over-quarter in what is usually a stronger season for game developers.

And they’re not the only ones.

Supercell, the Finnish gaming company behind two other top-charting hits Clash of Clans and Hay Day, also reported earnings this month.

They posted $892 million in annual earnings for 2013, which is also extraordinarily impressive considering that they finished 2012 at $101 million in annual revenue. But that number isn’t that much larger than the annualized $716 million run rate that the company was at in the first quarter of last year, when it said it made $179 million. And this is before Supercell added Android titles, which should have more than doubled their potential user base in the fourth quarter.

It just makes it obvious that revenue for the very top-grossing games is not growing as fast as it used to in previous years. Overall, Apple’s app store sales reached $10 billion in 2013, around double the $4-5 billion runrate it was estimated to be on in 2012.

Where does that leave King’s potential investors? The business is certainly cash rich. The company made $568 million on $1.89 billion in revenue last year. But 78 percent of King’s gross bookings came from mega-hit Candy Crush Saga.

Like every other gaming company in the business, King will argue that it has a good strategy for hit-proofing itself from the volatile nature of the gaming industry. The company has developed about 180 different games or so over the last decade. It tests these titles on a cohort of “hardcore casual” players that frequent its web-based portal.

King originally started with a destination site, but mined its historical library of titles to make a rather late, but successful transition to the Facebook platform and mobile devices. The company almost died many, many times, so their astounding revival last year is quite a story. In the early days of the Facebook platform, Zynga and other social-gaming titans were running off, making hundreds of millions of dollars a year while King was supporting a small casual gaming portal. In the end, this Achilles’ heel of an independent gaming site turned out to be an advantage as Zynga’s almost monopolistic power over distribution on the Facebook platform eroded. That web destination is like King’s private, little lab or petri dish for new IP.

But just as investors will be making a bet on the company, King is making a risky wager itself. It is choosing public markets at a time when other leading mobile gaming companies like Supercell and NaturalMotion have chosen the M&A route. Supercell chose to insulate itself from the fickleness of the public markets by selling slightly more than half of itself to Japan’s Gung-Ho for $1.53 billion last year. Meanwhile, NaturalMotion decided to sell to Zynga earlier this year for about a half-billion dollars.

Will public investors be patient enough to see King through its inevitable high highs and low lows? Only time will tell.