You’d think investors would be happy. Twitter just released its first quarterly earnings report as a public company, with revenue and earnings coming in significantly ahead of analyst estimates.

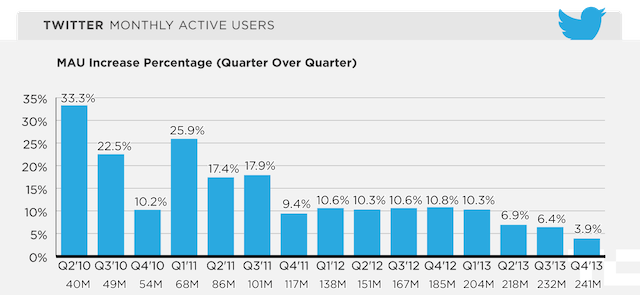

And yet, as of 6:02pm Eastern time, Twitter’s stock had fallen 18 percent in after-hours trading. What happened? Well, the company also said that it now has 241 million monthly actively users — up 30 percent year-over-year, as the release says, but only up about 4 percent from last quarter. In other words, it looks like user growth continues to slow.

In addition, Timeline Views, which are another indication of user engagement, actually fell 7 percent to 148 billion.

The concerns make sense, but at the same time, the discussion feels like a big reversal. As others have pointed out, a couple of years ago, the big concern around consumer social networks (well, mainly Facebook and Twitter) was whether they could actually make money from their rapidly growing user bases. By the time Twitter’s S-1 was revealed to the public last fall, there were questions about whether it had a growth problem, and now it seems those concerns are having a real effect on stock price.

(Note: I’ll be updating this post until about 6pm Eastern just to make sure the numbers are still accurate, but they don’t appear to be changing hugely.)

Update: CEO Dick Costolo offered some thoughts on user growth during the earnings conference call.