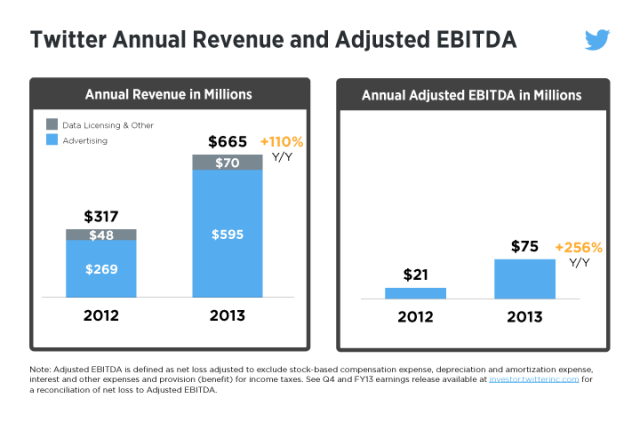

After the bell this afternoon, Twitter reported its maiden earnings as a public company, with fourth-quarter revenue of $242.7 million and earnings per share of $0.02 (non-GAAP). Analysts had expected Twitter to lose two cents per share on total revenue of $217.82 million.

In regular trading, Twitter eased just over a percent in a mixed session for the major indexes. In after-hours trading, following the release of its financial performance, Twitter is sharply lower.

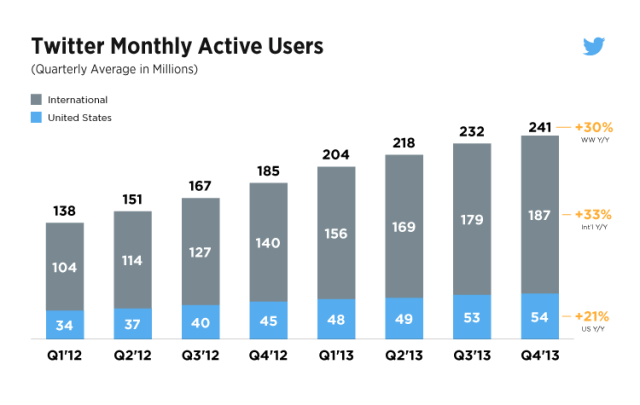

For the period, Twitter reported 241 million monthly active users. The service also reported monthly mobile active users of 184 million.

Critically for the company, mobile advertising revenues constituted 75 percent of its total advertising revenue. Twitter is essentially a completely mobile company from that perspective.

This was a very strong quarter for Twitter financially, showing profit in the face of expected loss, and strong revenue growth on both an expectation and quarter over quarter basis. However, user growth appears to be slower than expected. That appears to be dragging the stock down in after hours trading.

If Twitter’s core user growth cannot be sustained, its ability to drive future revenue growth — and therefore profits — is essentially under fire.

According to its pre-IPO S-1 filings, Twitter had revenue of $168.6 million in the sequentially preceding third quarter of 2013.

The importance of this report is hard to underestimate. Twitter priced its initial public offering — after much financial politicking — at $26 per share. Since that offering last November, Twitter has traded north of 70. Investors had priced the company for strong growth. Comparisons to Facebook’s offering have been inescapable. Twitter rose following its own offering, while Facebook fell.

Top Image Credit: Andreas Eldh under CC BY 2.0. Via Flickr. Image has been cropped.