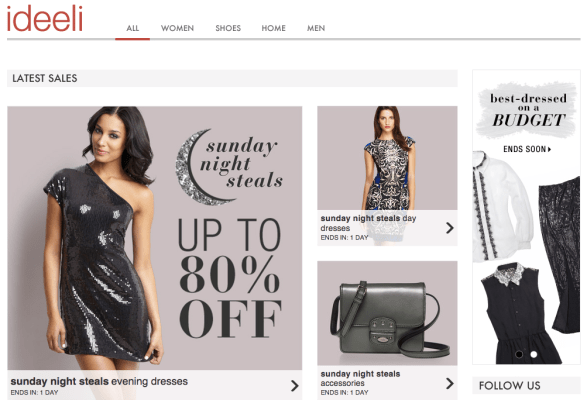

More acquisitions for Groupon to widen the net of consumers using its platform for more than daily deals. Today it is announcing the acquisition of ideeli, a flash fashion retailer, for $43 million in cash. A potentially strategic gain for Groupon, however, is a big loss for ideeli’s investors: the New York-based company had raised $107 million in funding from investors like StarVest, Kodiak and Credit Suisse since being founded in 2007.

According to a Q&A Groupon filed with its 8-K report detailing the acquisition, Groupon says ideeli made $115 million in revenue for the fiscal year ended February 2, 2013, and a $30 million operating loss. The market so far is not hugely enthusiastic about the news with Groupon trading down by around 2 percent to $11.34.

The acquisition underscores Groupon’s current acquisition mode and push to expand into new product categories. It comes on the heels of the company completing its $260 million acquisition of LivingSocial’s Ticket Monster business in Korea.

In the case of ideeli, it is the company’s first major move into the fashion category by acquisition, the company notes. It is both a product/customer and technology play, with Groupon continuing to run ideeli’s business and also using its mobile expertise, possibly to expand into other flash sales categories.

“We are thrilled to add ideeli and their team to our company,” said Groupon CEO Eric Lefkofsky in a statement. “Ideeli extends our fashion presence and brings great relationships with many of the top brands in apparel. Our customers have a demonstrated appetite for these offers, and by broadening our reach in this space Groupon is even better positioned as the place you start when you want to do or buy just about anything, anytime, anywhere.”

The company points to research that estimates the value of the off-price fashion market at around $40 billion annually (including both online and offline retailers).

“Groupon’s brand, reach and vision as an ecommerce destination make it a tremendous place to continue to grow our company,” said ideeli CEO Stefan Pepe in a statement. “We look forward to bringing the great deals we offer to Groupon customers.”

Although Groupon is getting the company at a relative steal, the big question is whether it will be able to captalise on the assets in ways that ideeli as a standalone company has not.

When ideeli was first founded seven years ago, flash sales were all the rage and consumers were flocking to sign up to sites where they would be members and receive information on exclusive discounts — part of the reason why ideeli’s founder (and eventual chairman) Paul Hurley was able to attract so much investment.

More recently, however, companies like Gilt Groupe — a competitor of ideeli’s — which built early reputations around the business model have found themselves on the defensive trying to prove that the concept is not just a fad, but something sustainable.

Up to now, Groupon has not broken out sales of fashion items on its platform compared to other categories — they sell products but as part of a bigger mix of goods — but a spokesperson notes that fashion discounts “have been very popular with Groupon customers.” He also points out that ideeli will help it develop further inroads into the sector as a whole: “ideeli brings a significant presence within the industry as well as great relationships with top brands,” he says.

In Groupon’s last quarterly results reported in November 2013, it reported sales of $595.1 million, missing analysts’ estimates but beating on EPS of $0.02. That points also to how the company needs to continue to develop more products that are diversified from each other and “beyond the daily deal” (as co-founder and ex-CEO Andrew Mason once said) to build up its business.