Facebook is launching a new way for brick-and-mortar business owners to measure if their Facebook ads drove in-store sales, even if customers never clicked. Businesses can buy ads, then send Facebook privacy-safe data on who bought what, and Facebook will tell them how much people who saw the ads bought compared to those who didn’t.

By providing confidence in return on investment from ad impressions, Facebook could get advertisers spending more, especially on mobile where ad clicks disrupt the user experience. Plus, the info could help marketers learn what ads actually resonate with people, which in turn helps users and Facebook by making ads in the feed more relevant and less annoying.

Ad measurement might not sound super sexy, but the marketing industry is experiencing a massive leap forward in how it tracks ROI right now.

Once upon a time, marketers had little idea if their ads worked. They’d buy TV or print campaigns in specific markets, and then hope to see sales lift there too. The problem was there were tons of confounding factors, and it was tough to tell if a buyer had actually seen the ad. Online advertising changed everything. Suddenly marketers could track that a user clicked an ad that sent them to their site where they made a purchase, indicating the ad worked.

Unfortunately, there were a ton of limitations. If the ad wasn’t the last click before the purchase, they were hard to tie together. That led marketers to put a premium on “demand fulfillment” campaigns like search keyword ads that could be easily tracked, but this shortchanged any “demand generation” ads the user saw before that might have contributed to their purchase decision. If users only saw an ad but didn’t click, then bought something later, the advertiser may not have known that impression had an impact.

Google, Facebook, and others eventually began developing ways to tell if someone who simply saw an ad later made a purchase online. But that still left the connection between online ads and offline sales in brick-and-mortar stores as a big mystery.

[Update: But last year Facebook began working with offline purchase data provider Datalogix to track offline purchase data about how online ads influenced brick-and-mortar buying habits. Datalogix can figure out what someone bought by using data from grocery store loyalty cards and other methods. It then sells this data to Facebook, Google, and other companies so they can track to see if spend on the advertised products increased and tell advertisers if their ads are driving return on spend.

Facebook later paternered with other purchase data providers including Epsilon, Acxiom, and BlueKai as well as Datalogix to let brick-and-mortar businesses upload hashed, privacy-protected lists of their customers to Facebook so they can target them with ads to keep buying.]

And now, Facebook’s new Custom Audiences measurement could make it clear that someone didn’t just stumble into a physical store’s big Sunday sale, but instead saw an ad for it that inspired their visit.

Facebook’s Vice President Of Ads Product Marketing Brian Boland tells me “This has never been done at this scale, to link digital exposure to in-store sales for anyone with a CRM system.” Previously, Facebook had been privately testing the measurement tool with a select few advertisers, but now it’s available to any advertiser that buys directly from Facebook’s managed sales team.

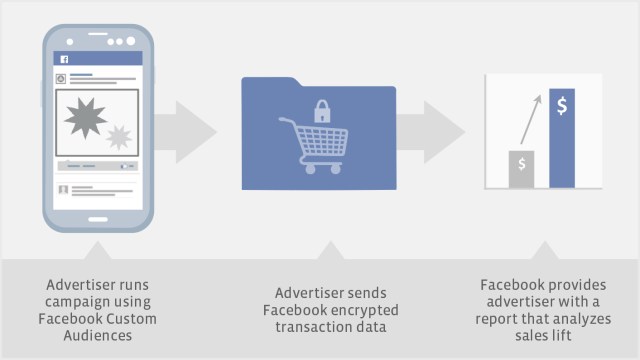

Here’s how it works. A business collects email addresses of their customers or potential customers through online forms, requests at the register, signups for newsletters, loyalty programs, or surveys. The business then uses Facebook’s Custom Audiences targeting tool to submit the email list from their customer relationship management system in a hashed, privacy-protected way, and advertise to these people on Facebook.

When a customer subsequently makes a purchase at the advertiser’s physical location and swipes a credit card or loyalty card, or provides their email address again , the business can match the purchases to their email address. The business then submits an encrypted version of this sales data to Facebook. Facebook compares how much people who saw the ad bought versus a control group of people in the Custom Audience that it didn’t show ads to, and reports the findings to the business.

The impact of being able to measure online ads’ impact on offline sales like this is massive. “I’m beyond excited” Boland tells me in complete monotone, Ad measurement guys aren’t always the most dynamic, though, so I still believe him.

How will this change marketing? For example, an advertiser could learn that people who saw the ad spent 60% more than those who didn’t. That means it’s probably cost-effective to keep buying those ads. If the business runs multiple A/B tests, they could figure out which ad variant drove the most sales lift, cancel their other versions of the ad, and run more like the successful one in the future.

The ability to measure ROI of impressions, not just clicks, is especially critical for mobile advertising. On the small screen, you do one thing at a time, opposed to running multiple apps and browser tabs on the same screen on the web. That means clicking on an ad on mobile is very disruptive to whatever you’re doing. You can’t just pop a tab and keep browsing. That likely discourages mobile ad clicks.

But just because someone didn’t click doesn’t mean the ad didn’t affect their buying decisions. On mobile, ads like those on Facebook often take up the entire screen. They’re essentially a screen takeover. Even if you only read for a second and then scroll by, that brand name, store location, or promoted discount could stay in your brain and later get you into a store to buy something. Facebook’s new measurement technology could reveal that connection.

The tool could bring in a bunch more ad revenue for Facebook. Boland tells me “We fundamentally believe that measurement drives confidence. We’re moving away from proxy metrics [like clicks] to sales outcomes. As we build real measurement solutions, they’ll spend more money digitally and specifically on mobile.”

Of course, some users might find the idea that Facebook “knows” what they buy offline to be a bit creepy. But the sales data is all encrypted so Facebook doesn’t actually know who is who, and it deletes all the sales data once it’s made its reports to the advertisers.

But what most people hate more is being shown crappy, irrelevant ads. Along with more money, Custom Audiences measurement could even make Facebook’s users happier. Better data on what ads work lead to more relevant ads, and more satisfied users who spend more time on Facebook. Soon, you might see fewer ads for things you never buy, and more for your favorite local stores.

Advertising is easy to hate on, but it’s what lets companies like Facebook, Google, and Twitter offer their services for free to everyone. And there’s a big world out there full of things you might want to buy or learn, but you’d never discover. At their worst, ads fracture our attention and clutter our vision. But when well-targeted and measured, ads can help curate the world for us.