Those who signed up for the new Google Wallet debit card at the end of November are now receiving their cards in the mail, following the Thanksgiving holiday here in the U.S. This MasterCard-powered prepaid debit card allows you to link your online Google Wallet balance to a real, plastic card you can use at point-of-sale, at ATMs, or anywhere else a MasterCard is accepted, stateside.

To clarify, we’re saying “stateside” because the Google Wallet debit card has a magstripe on the back – not the EMV technology which would allow the card to work in other countries where magstripe cards have been largely replaced by the more secure, EMV chip-based payment cards instead. Additionally, Google specifies in black-and-white terms that the Card cannot be used outside the U.S.

Perhaps the more disappointing reveal, however, is in how the card works. A year ago, leaks revealed that Google was working on a universal payment card that could take the place of any plastic credit or debit cards you carried in your wallet with a single card where you could control the source of funding on the fly, from directly within the Wallet mobile app.

Those plans were sadly scrapped ahead of this year’s Google I/O, leaving this new Google Wallet card as a watered-down version of that earlier vision. (A vision which a startup called Coin has picked up and run with, we should point out.)

Today, the Google Wallet Card is funded with your Google Wallet balance, meaning you have to you have to first link a traditional funding source to your Google Wallet account, like a bank account, credit card or debit card you already have, then transfer money into Google Wallet itself.

Getting the Card Activated

If you haven’t already, you have to first request a Google Wallet Card by going through an identity verification process online. When the card arrives in the mail, it comes in a nondescript envelope with no name along with its return address (which almost saw it discarded as junk mail, I have to admit.)

The provided instruction sheet is overly simple, too, informing you to first activate your card online or within the mobile Google Wallet app. It’s not immediately obvious where in the mobile app (iPhone or Android) the Wallet card should be activated, since the app doesn’t allow the card to be entered in the same area where you add other debit or credit cards. That is, you can type in the card information there, including the number, expiration date, and security code, but the button to submit remains grayed out.

[Update: A commenter notes there is a call-out in the mobile app to activate your card. However, though I saw this notification online, a similar message did not show in either of my Google Wallet (iPhone or Android) apps, when tested. Your mileage may vary, as they say.]

Online, the activation process is more straightforward. After signing into Google Wallet, a big banner at the top of the screen informs you of your Wallet Card ship and delivery dates and lets you click a button to activate the card immediately. Here, it’s just a matter of entering in the last four digits of your Google Wallet Card, clicking “Next,” then “Done.”

Funding The Card

Though the Google Wallet Card FAQ doesn’t specify this, the resulting screen informs you that you can take out up to $300 per day at ATMs. Google itself doesn’t charge ATM fees, but some ATM providers do. Google doesn’t charge fees to order or activate the card either, nor does it charge monthly or annual fees. The only fee Google charges is a 2.9% fee to fund a Wallet account from a credit card. (Other fees are associated with Google Wallet, but not in terms of funding or using the Wallet Card itself).

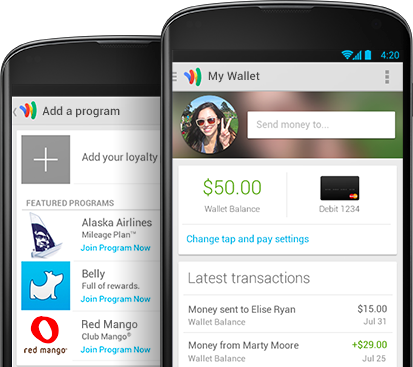

To fund the Google Wallet Card, you can click on your Wallet balance online or in the app, and choose “Add Money.” You can then pick from one of your other funding sources listed to add money to your Wallet account. This seems like an unnecessary additional step given that Wallet is already linked to your these sources. But if you try to pay for anything from an un-funded account, the card will be declined.

For some people, adding money via bank account and card transactions may be instant. If you’re in that group, then congratulations – your Google Wallet balance could be funded while on the go through a few taps in your mobile app, allowing you to leave your wallet at home, so to speak. But other banks may take up to a week for larger transfers, and some cards may take up to a few days before the money becomes available. In other words, the promise of a “universal” card, as was originally being tested, has not really come through yet.

Still, for those whose Google Wallet account is funded via Wallet’s Gmail integration, the Card could offer a handy way for users to spend or pull out cash sent by others. Of course, this would be far more useful if the Card worked overseas, allowing U.S. users to send cash to family back at home. Sadly, the current Wallet Card isn’t there yet. As Google notes in the FAQ, you can’t use the Card outside the U.S. “right now.” (Right now?)

Using The Card

As for the rest of it, the Google Wallet Card works the way any credit card does. You swipe it at a terminal, or you can hand it to a waiter or cashier to swipe on your behalf, no PIN required. One thing to note is that the card does not have your account number in raised numbers on the front. Instead, the numbers are printed on the back of the card. For those tough on their plastic, that means the numbers could wear off more quickly as the card gets used and abused.

In addition, it means it won’t work in those old-school “knuckle-busters” which are sometimes (well, rarely…but it happens!) still used here and there when paying a vendor who’s away from a register, power, or an internet connection. This is hardly a major concern, though.

In addition, it means it won’t work in those old-school “knuckle-busters” which are sometimes (well, rarely…but it happens!) still used here and there when paying a vendor who’s away from a register, power, or an internet connection. This is hardly a major concern, though.

Wallet Card: Good For Google. Good For You?

At the end of the day, the Google Wallet Card is a better deal for Google than it is for consumers, at present. The company benefits by gaining additional insight into consumer spending behaviors, which helps it to build a better profile on Wallet users, which it could then use to sell more targeted ads.

Sellers also benefit when users pay with Google Wallet, as it allows them to gain access to your email address. They can associate that with other data they have on file for you, if you’ve shopped there before.

Consumers using the Google Wallet platform have some conveniences, though. The Wallet app integrates various loyalty programs and merchant offers, and some Android-based phones with NFC can be used to tap and pay at point-of-sale. But these benefits are all features in Google Wallet, the app, not the Card itself, which is really meant to be just a fallback when NFC is not available. If Google ever gets to the point where a Wallet Card could be instantly funded from your connected payment sources on the fly, like online, then the Card would be more interesting.

But for now, it’s still unclear why a consumer would want to or need to use their Google Wallet plastic card today.