The assets of mobile messaging startup Just.me are for sale. Yet when founder Keith Teare called me to discuss the news, he argued that it’s not a failure.

“I feel like Just.me is not successful, but it is not a failure,” Teare said. “I don’t feel defeated — I feel like we’re in the middle of a process.”

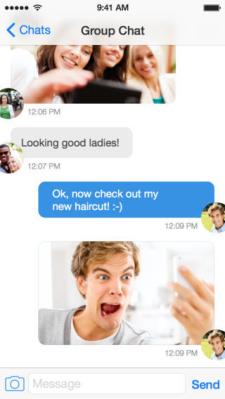

In fact, Teare said that Just.me has attracted 458,000 unique users on iOS, Android, and the web since it launched in April, making it the biggest startup to emerge from his incubator Archimedes Labs, as well as “the best startup I’ve ever done.” (Teare’s past includes founding or co-founding the EasyNet Group and RealNames Corporation, as well as TechCrunch.)

Despite all that, Teare said there are two big issues that are causing the sale. First, he said that Just.me’s initial funding included $1.5 million in debt from Hercules Technology Growth Capital. The debt, combined with the fact that having hundreds of thousands of users, means Just.me is still “pre-traction measured by the meaning of the word ‘traction’ in the current mobile landscape,” made it impossible for the company to raise more money. As a result, it has now run out of cash and can’t pay its debts or cover its costs.

Hence the sale. Teare said Just.me is selling off its assets in five “buckets” — a non-exclusive license to the source code, the product and the infrastructure, a patent application for an advertising system that connects brands and consumers via direct messages, the Just.me domain, and the company’s physical assets. They’re being sold separately, Teare said, in the hopes of maximizing the money raised. Unless that amount exceeds $1.3 million, it will all go to Hercules.

And here’s one more twist: Teare told me, “I fully intend to be the winning bidder for everything.” In other words, he’s hoping to raise money for a new company unencumbered by the debt, which would then buy the assets and continue running the Just.me service without interruption. But in the meantime, he needs to hold a real sale to show that he’s not just giving himself a sweetheart deal, and also in case he doesn’t succeed in raising that money.

Just.me’s situation is unusual because of the debt raised early on (Teare said that the money seemed necessary at the time, but he added, “Would I advise early-stage companies against taking debt? One hundred percent yes.”). Nonetheless, he argued the situation speaks to a broader trend of startups struggling to raise money after their initial funding. The idea of a “Series A Crunch” (or a Series B, depending on what kind of round you raised first) isn’t new, and indeed it’s something that Teare has been giving talks about.

“I escaped London in 1997 because it was hard to raise capital,” Teare said. “It’s like Silicon Valley has become Europeanized. Now you’ve got to bootstrap very effectively or you’ve got to get huge growth.” And that’s a problem if you have a big idea: “It’s very hard to cheaply build anything significant in a multi-platform, mobile world.”