Fresh from celebrating its fifth anniversary last week, Groupon today reported its Q3 earnings: it’s a mixed picture but shows that Groupon continues to make good on its commitment to take its business beyond daily deals and into a wider marketplace for location-based and mobile commerce. Groupon reported revenues of $595.1 million with EPS of $0.02, missing on sales but beating on EPS estimates, and it announced an acquisition: Korea’s Ticket Monster, for $260 million, to build out its mobile commerce operations in Asia through event ticketing and other commerce services.

Ticket Monster had been owned by Groupon competitor Living Social, a sign of how one daily deals site has not managed to make a go of the international business, and now another will try anew. As part of the purchase, Groupon says it will be acquiring Living Social Korea. (We’re asking if it intends to keep that business fully operational; for now Groupon says that all management staff and brand is coming over to Groupon and there will be further transition plans revealed after the deal is closed.)

The acquisition is being made for $100 million in cash, with the remaining $160 million in Groupon shares, the company says, with the deal closing some time in the first half of 2014.

“We’re also excited to announce today that we’ve signed an agreement to acquire Ticket Monster, one of the leading ecommerce companies in Korea,” said CEO Eric Lefkofsky in a statement. “Ticket Monster has been successful building a mobile commerce business in one of the largest markets in the world. It will serve as the cornerstone of our Asian business, bringing scale and e-commerce expertise to that region.”

Seoul-based Ticket Monster is known locally as TMON, and it has been around since 2010, and sells event tickets but also other products and services. Groupon says it has 4 million active customers and annual billings of more than $800 million today, growing year-on-year by some 50%, with half of its sales are transacted on mobile devices.

Announcing this acquisition seems to set a precedent of sorts for Groupon for laying on significant news during earnings days. One quarterly report for Q1 this year saw Andrew Mason get kicked out as CEO; Q2 saw Lefkofsky finally get appointed as the permanent replacement for that job; and now an acquisition is getting announced in Q3.

In one regard, it seems that the acquisition news is there to offset the rest of the results, which are a mixed bag: analysts were expecting revenues of $615.7 million for the quarter with non-GAAP earnings per share of $0.01. However, they do fall within Groupon’s own estimates for the quarter, which were between $585 million and $635 million. A year ago the company reported revenues of $568.6 million, with an EPS of $0.

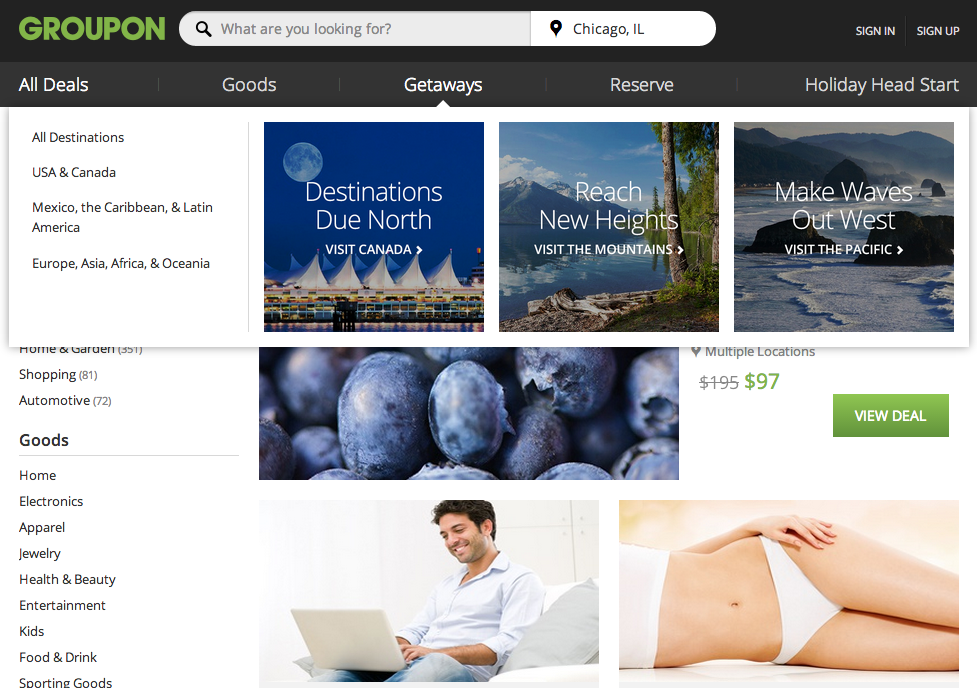

Groupon marked last week’s five-year birthday with a redesign of its website and mobile apps, with the new look promoting the idea that while daily deals remain a mainstay of the company’s business, other products and features are now getting equal footing.

These include premium restaurant dining offers via Groupon Reserve (launched in July) through to travel and its Groupon Goods marketplace. The company is also making a stronger effort to encourage more personalised deals, encouraing users to fill out profiles of themselves with their street addresses to make offers as localized as possible.

The focus on making an acquisition in Asia is also significant in that it shows that Groupon is trying to invest to build out business in that region. The company today noted that while North America and EMEA grew 20% and 12% in gross billings, the rest of the world (including Asia) declined by 13%. In total, gross billings were $1.34 billion, up 10% over a year ago.

Other highlights in today’s earnings:

Deals. Even if Groupon is now doing more than daily deals, these still remain a significant part of its business. They continue to grow in terms of inventory but not necessarily conversion. Groupon says that in North America, its biggest market, it had 65,000 active deals at the end of Q3, up by some 11,000 in the quarter. Gross billings on deals between the two quarters, however, showed a decline of some $50 million. Overall customer spend was also slightly down to $137 from $138.

Customers. These continue to grow overall, up by 10% on last year to 43.5 million.

Mobile. Groupon says that mobile has seen its tipping point, with more than half of all transactions completed on mobile devices in September 2013 in North America, and over 40% on mobile globally. Its apps have now been downloaded by 60 million people worldwide, with 9 million in the last quarter.

Marketplace. Groupon still has work to do in getting more critical mass on its site around the various offerings it places there. It says that some 6% of total traffic in North America was on its marketplace, with those who do go there to search for deals spending 25% more time there than those who do not.

Here’s how Groupon’s earnings have progressed across the last few quarters. If you don’t see Q3, refresh the page and they should populate soon.

I’ll be listening to the call and updating with any additional news.