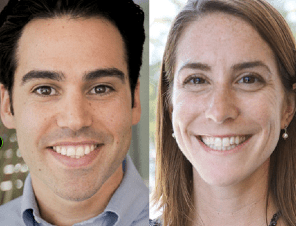

Google Ventures had added two new investment partners to its roster, bringing on Shanna Tellerman and Dave Munichiello to the ranks. The firm is also announcing a new EIR, Nikhil Chandhok, who led YouTube’s Music efforts for four years.

Tellerman previously was the founder and CEO of of Sim Ops Studios (Wild Pockets), a spin-off from Carnegie Mellon University that focused on democratizing 3D game development. Sim Ops was acquired by Autodesk in 2010, and Tellerman worked at the company as product line manager responsible for launching the cloud platform and Autodesk 360 applications.

Munichiello joins Google Ventures from Kiva Systems, where he spent four years at e-commerce robotics company (which sold to Amazon for $775 million). He previously also served in the Air Force and on a joint special-ops team.

GV’s general partner David Krane explains to me, both Tellerman and Munichiello are technical, product leaning and entrepreneurial, which is the general mold of what the firm looks for in an investment partner. In addition to sourcing deals, Tellerman is focusing on working with the Google Glass Collective, investing in consumer and retail startups, and helping match portfolio startups with brands/companies like Burberry, Akamai and others for potential strategic partnerships. Munichiello is focusing his investments across artificial intelligence, security and enterprise. Both will be working on investments for GV across all stages, Krane adds. And Tellerman has already done five deals (undisclosed for now) and Munichiello has closed two and is a board observer at Premise.

Google’s new EIR, Nikhil Chandhok, was previously the Global Head of Product for Music, Paid Content and Live Platform for YouTube, and was on the YouTube team for seven years. In addition to spearheading music, Chandhok was also instrumental in launching YouTube’s iPhone app, the development of VEVO, and launching paid subscriptions, among many other products. It’s unclear yet what Chandhok will be building, adds Krane.

With Tellerman, Munichiello and the addition of former CrunchFund partner (and my former colleague) MG Siegler to its investment team, the firm has added three rising stars in the investment world. As I wrote a few months back, it’s wise for VCs to think strategically about adding younger talent to additional talent expansion, Krane says that the firm will continue to add to the partnership.

Currently, Krane says Google Ventures has $1.2 billion under management, and is just about to enter a new year with a new $300 million commitment from Google (the company) for the fund. But he adds that it’s not unimaginable that the size of the fund will continue to grow as the firm makes more late stage investments like its recent $258 million round in Uber.

Disclosure: Google Ventures is an investor in my husband’s startup, which is currently in stealth.