French accelerator TheFamily has received an undisclosed investment from Index Ventures – although this is believed to be ‘just under’ one million Euros. The investment means Index takes a stake in what is emerging as a quintessentially French accelerator. TheFamily takes a tiny one per cent stake in its startups (in exchange its access to mentors, events and contacts), runs myriad events and mentoring sessions, and plans no to run intensive workshops in a French castle.

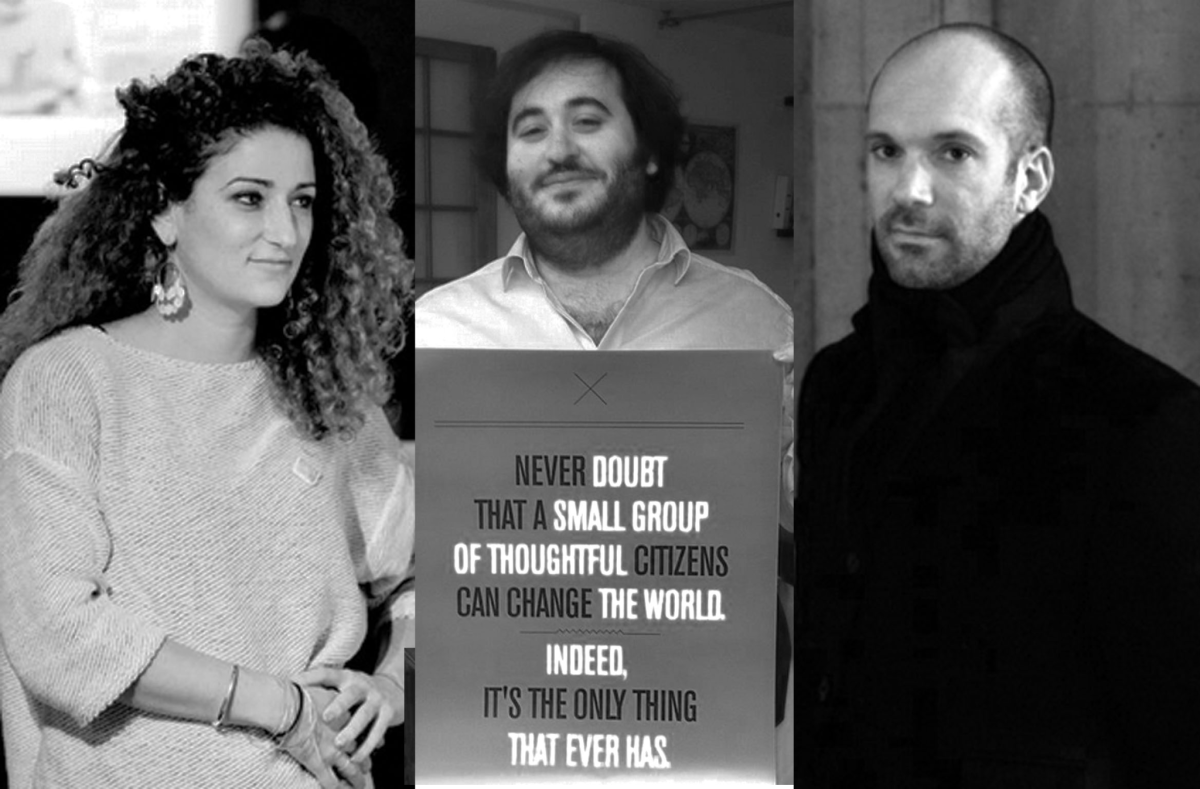

CEO and co-founder Alice Zagury, is also emerging as a power-player in the French startup scene. Zagury was the first to run LeCamping, the Paris-based accelerator which deploys public funds, but left out of frustration with the pace of the project. She says “Our current goal is to develop the best program ever for startups. With this new partnership, it’s all about being surrounded by passionate and experienced people to help us achieve our mission: to design a strong educational system and develop more unfair advantages for startups that do not exist in France.” TheFamily was founded by Zagury and co-founders Oussama Ammar and Nicholas Colin.

TheFamily was started in January this year and opened in March. Instead of offering a traditional coworking space, it runs a house in Paris where startups can work and live, and also provides accommodation for visiting investors. The atmosphere, says Zagury, is closer to a French intellectual salon than an accelerator – though the companies do actually execute as well as talk…

By operating at this tiny 1 per cent stakeholder level, what TheFamily hopes to achieve is not simply a return for its investment, but to re-build the entire French eco-system and partner with other accelerators. Zagury says “We have a vision, we work with all the other incubators and the local VCs, and schools. We try to align the interests of all the actors of the ecosystem rather than working alone”.

This kind of ‘grande vision’ is needed. The French startup ecosystem is receiving a pummelling from two sides. On the one hand French entrepreneurs have been taking the two hour train ride to London, where entrepreneurs are ironically offered a far better business environment than in France, and Berlin on the other, where the city’s drastically lower cost of living enables many new bootstrapped startups to be spun up.

So far TheFamily says it has received 800 applications and taken on 30 startups, some of whom have either had follow-on funding or exit offers.

“My feeling is that we are revolutionaries. Right now we might be frustrated but the time will come for change and that is what we are fighting for. The ecosystem is growing. I see more and more entrepreneurs traveling the world and coming back. Yes it’s hard but it’s changing. We are still here because the best is yet to come. France is a hard place – if you can make it in France, you can make it anywhere,” says Zagury. And that’s from a local.

Most entrepreneurs in France are coming out of management schools, but TheFamily hopes to mix this up by encouraging entrepreneurs to come from other schools of life – in particular women and minorities who are often cut out of French business life. In recent years France has become famously stratified to the point where its leaders are ill-equipped for the modern world.

Zagury correctly points out that French government officials rarely even seems to know what a startup is: “A startup is not a small company, it’s an organisation in search of a scalable business model,” she says. “In France everything is designed by politics. We, at TheFamily, just don’t count on governmental policies to change the ecosystem — we are privatizing it! We hope to be an inspiration for the next generation of policies and we are always ready to keep the dialogue open with lawmakers.”

TheFamily also aims to accelerate past LeCamping as the centre of the startup ecosystem in France. The latter aims for 50 startups a year, but TheFamily is aiming for 100 a year.

It will also offer accommodation in a castle in Normandy to accelerate companies: “At the castle you can focus on your startup in the most beautiful countryside. It’s a real unfair advantage. There is an atmosphere there that France is known for – good food, better quality of life and being able to enjoy your work in a spectacular environment,” says Zagury.

The Index investment does not mean it will have any exclusivity in terms of deal flow. Instead, Index is investing in the actual organisation of the Family in order to kick-start the French ecosystem in a manner which seems appropriate to the country and culture.

Commenting on the investment, Martin Mignot of Index Ventures said: “Alice, Oussama and Nicolas, form both one of the most unlikely and most complementary team we have ever come across. The result of putting three extraordinarily different personalities to work on a project as wide-ranging as transforming the startup ecosystem in France, is that you get incredibly bold and innovative ideas that have never been tried elsewhere.”

So why did Index invest in The Family? Mignot goes on to explain:

“We’ve been following Alice since the early days of Le Camping and have been very impressed by what she achieved there in her four years at the helm, so when we heard she was working on a new project we paid attention. And when we first saw the deck we immediately liked how original the vision was: they didn’t set out to start yet another Y Combinator copycat, but really thought hard about what was unique about the French startup ecosystem and how they could build a program that really leverages local assets (strong engineering talent, branding DNA, humanist culture) and help entrepreneurs overcome the many hurdles they face there (government interference, inward-looking and exclusive education).

Let’s take one of their many projects, buying a castle in the French countryside to rent out to startups who want to run sprint development sessions: this idea is as crazy as it is brilliant, and it’s a good reflection of how bold their vision is and how deeply they can shake and improve the local ecosystem.”

Does Index hope to invest in companies from their portfolio?

“Absolutely, and this is one thing we like about their model of low-touch, low-cost (they only take a 1% stake in companies joining their program). It allows them to get involved with a large number of startups early on, and makes it attractive to seasoned entrepreneurs who tend to be weary of giving away too much of their companies to the more traditional accelerators/incubators. However, it’s important to highlight that we don’t have any sort of exclusivity over their portfolio companies. An accelerator is only as good as his standing with VCs so it has to offer an equal access to everyone.

The question remains, how will this fit with Index’s investment into Seedcamp, based out of London?

Mignot says: “TheFamily and Seedcamp are very different beasts and actually very complementary. Seedcamp helped Alice and her team a lot to set up the program as they see it as a really good source of quality candidates. While TheFamily is about helping team go from 0 (a team with an idea) to 1 (a product with some metrics), Seedcamp is about going from 1 to 10 (a validated model which can be accelerated with more seed money from angels and VCs).”

Personally I think TheFamily may be offering Europe a brand new model: an eco-system defining model which underpins the structure of the whole thing. It’s small stake means even Angels can do follow-on investment as well as larger investors. It will be fascinating to see what they come up with.