Groupon today reported the appointment of Eric Lefkofsky as its CEO, Ted Leonsis as the Chairman of its board, revenue of $609 million in the second quarter, operating income of $59 million excluding stock compensation expenses, and non-GAAP earnings per share of $0.02.

Investors are enthralled, sending Groupon up more than 13 percent in after-hours trading. Let’s unpack all of that, however, to better understand what just happened.

Groupon fired its founder and then CEO Andrew Mason earlier this year, after Groupon reported weaker than expected earnings. Today, Groupon announced that Eric Lefkofsky will take over as its new chief executive. Lefkofsky is best known for his work at Lightbank, the Chicago-based venture capital outfit, of which he was a founder. He was also an early co-founder and investor in The Point, a firm that would eventually be renamed, you guessed it, Groupon.

Lightbank’s website continues to list him as a managing partner. Lefkofsky, a billionaire, is a well-respected member of the Chicago technology scene, of which Groupon and Lightbank are firm centers of gravity. Along with Leonsis, Lefkofsky managed Groupon in the time since Mason was ejected.

That news was coupled with the announcement that Groupon is now authorized to buy back $300 million of its own shares over the next two years.

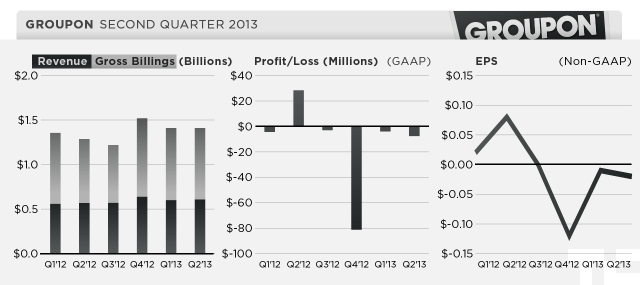

Today Groupon managed to just best market expectations for its quarterly financial performance. $0.02 per share in earnings — excluding certain items — was anticipated and met, and Groupon’s revenue of $609 million was a nibble over expectations.

Active customers grew 12 percent to 42.6 million. Groupon measures its active customers as any user that has purchased a Groupon coupon in the past 12 months. The company’s revenue figure represents a 7 percent increase on a year-over-year basis.

Groupon has cash and equivalents of roughly $1.2 billion, unchanged from the same period a year ago. This provides the firm with ample room to execute its stock repurchase program on a rolling basis over the next 24 months.

The company has confirmed leadership, steady, if somewhat dull earnings, and a declining international business: ‘Rest of World’ revenues slipped 25.9 percent on a year-over-year basis in the most recent quarter. Still, Groupon is now on a firmer footing than it has been this year. Now it must prove that it can at once grow its revenue and achieve GAAP profitability.

Top Image Credit: Bryce Edwards