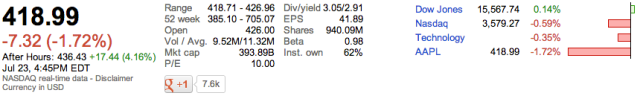

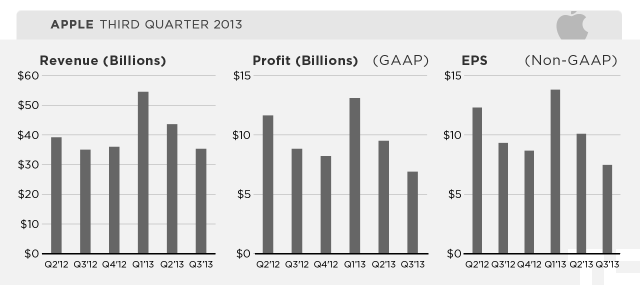

Apple has just released its fiscal Q3 2013 earnings — it reported $35.3 billion in revenue (slightly up 0.9 percent from $35 billion in the year-ago quarter) along with $6.9 billion in quarterly net profit (down 21.6 percent from $8.8 billion in the year-ago quarter), representing earnings of $7.47 per share. Similarly to Q2 earnings, Apple posted a year-over-year quarterly earnings decline (down 19.8 percent from EPS of $9.32).

Apple is still a money making machine, but the company’s growth has slowed. Recently, the Cupertino-based company has tweaked its release cycle a bit. Almost the entire product line was refreshed over the last three months of 2012, pumping sales for Q1 2013 and leaving a void for the rest of the year. The company seems to follow the same pattern this year, aside from the MacBook Air.

As Zach Epstein says on Twitter, Samsung is now the most profitable smartphone vendor in the world, edging Apple with its $8.9 billion in profit. Yet, Samsung recently released its flagship phone, the Galaxy S4, while the iPhone 5 was released ten months ago.

Apple still beat expectations

According to Bloomberg Businessweek, the consensus among analysts was for Apple to report earnings of $7.28 per share on $34.9 billion in revenue. Fortune expected nearly the same with $34.94 billion in revenue and earnings of $7.29 per share.

The company’s cash on hand slightly increased from $145 billion to $146.6 billion.

The company’s cash on hand slightly increased from $145 billion to $146.6 billion. It remains one of Apple’s main asset. It allows the company to spend more time experimenting and preparing new products behind the curtains without having to worry about its resources. Apple beat all of those numbers, even if it means generating less profit.

“We are especially proud of our record June quarter iPhone sales of over 31 million and the strong growth in revenue from iTunes, Software and Services,” wrote CEO Tim Cook in the earnings release. “We are really excited about the upcoming releases of iOS 7 and OS X Mavericks, and we are laser-focused and working hard on some amazing new products that we will introduce in the fall and across 2014,” he continued.

Guidance from its last earnings release forecasted between $33.5 billion and $35.5 billion in revenue and gross margin between 36 percent and 37 percent. While the company used to be shy about its guidance, this time around it was spot on — it probably won’t scare shareholders away.

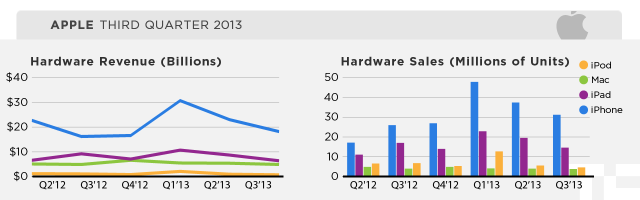

iPad sales are down & old iPhones are more popular than ever

Breaking out the numbers, devices sales were expectedly slow this quarter. It was the first time we’ve seen a yearly decrease in iPad sales, at 14.6 million, yet iPhone sales topped 31 million representing 20 percent growth year over year. Mac and iPod sales were slightly down both quarterly and yearly, which is something Apple seemed prepared for as its other iProducts begin to cannibalize the older series of products. Read more about this in our separate post.

Over the past few weeks, many analysts reported an industry-wide slowdown in smartphone sales. Apple keeps selling the iPhone 4 and the iPhone 4S at a lower price, and it hurts the company’s bottom line. Horace Dediu points out on Twitter that the average iPhone price is now about $580 compared to $613 last quarter. That’s one of the reasons why profit is down but revenue still up year over year.

See more charts about Apple’s no-growth quarter.

Q4 2013 and beyond

For Q4 2013, Apple’s own guidance forecasts between $34 billion and $37 billion in revenue (compared to $36 billion in Q4 2012) with a gross margin between 36 and 37 percent (a flat gross margin).

During Q2, Apple didn’t release any product and expectations were pretty low for the company. This time around, the company unveiled a few products during the traditional and long-anticipated WWDC keynote. The MacBook Air was updated as well as the Mac Pro. But the former was released only a couple of weeks before the end of the fiscal quarter that ended on June 30, while the latter doesn’t even have a release date yet.

And of course, the company hasn’t refresh the iPhone and the iPad since September and October 2012. In other words, Q3 was another quarter without any big new product. Cook hinted that it would be the case during the latest earnings call, saying that new products would come this fall. His quote in the earnings release confirms that. Apple unveiled a radically new iOS 7. It gave commentators hope that exciting new products are right around the corner. When it comes to product innovation, Q4 2013 will be decisive with long anticipated releases.

On the stock market side, Apple (NASDAQ:AAPL) has experienced a pretty good month of July so far. After breaking under $400 a share at the end of June, shares have been trading over $420 for the last few days. Apple shares are currently trading up 4.16 percent in after-hours trading, showing that investors were satisfied with today’s earnings.