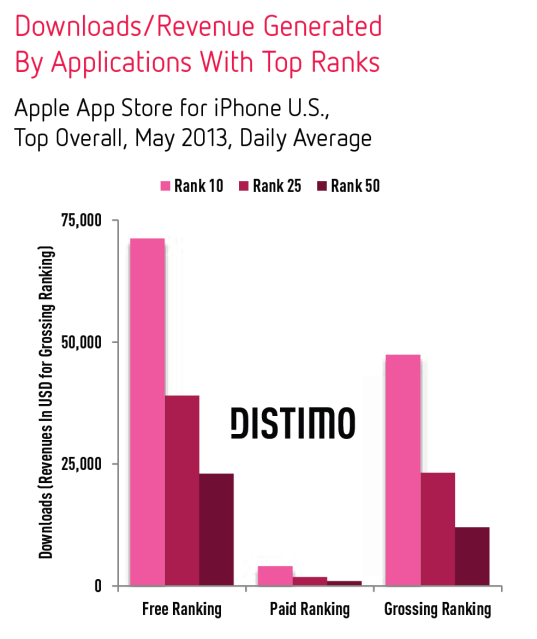

An iPhone app needed 23,000 free downloads per day to reach spot number 50 in the top Free charts in the Apple App Store, says mobile app analytics firm Distimo, based on research performed during the month of May 2013 aimed at discovering what it takes to break into the App Store’s top Free, Paid, and Grossing charts. For paid applications, that number was 25 times lower, at 950 downloads. Meanwhile, to reach the #50 spot in top Grossing charts, an app needed daily revenue of $12,000.

In this analysis, the company looked only at iPhone downloads and revenues, not downloads of universal apps on iPads.

Though reaching the top 50 brings an app greater visibility, getting into the top 10 is more ideal, but a lot tougher, as well. According to Distimo, a free iPhone app in May needed to see more than 70,000 downloads per day to reach a top ten free position, and a paid app need more than 4,000 downloads on average to do the same. To reach the top 10 Grossing chart, an app need $47,000 in daily revenue.

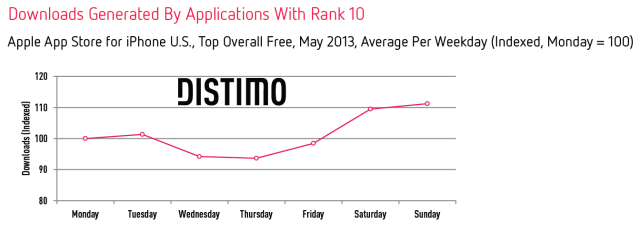

While those are the high-level figures that come by looking back at App Store trends over the course of a month, Distimo also found that on a day-to-day basis, the numbers required to break into the top charts vary. For example, on weekdays (M-F), significantly fewer downloads are needed to reach a top position for free iPhone apps, and on Sunday, that number is 11 percent higher. Apps needed the fewest number of downloads on Thursdays.

Trends were similar for both paid and top grossing rankings: apps required more downloads (or dollars) to break into the top charts over the weekend. (No wonder app launch announcements are always happening on weekdays!)

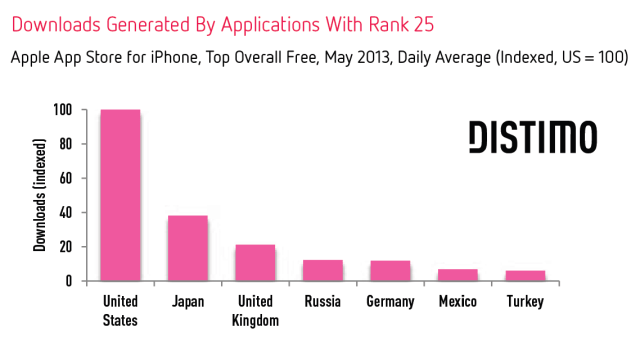

All the above trends, however, only apply to the U.S., as the numbers required to reach the top positions will vary by country. Distimo looked at a sample of other App Store markets, to see how the U.S. data compared, and found that the U.S. is still the hardest to break into among those studied.

In Japan, for example, an app needed less than 40 percent of the downloads that it would need in the U.S. to reach the top 25. In the U.K., that number is only 21 percent.

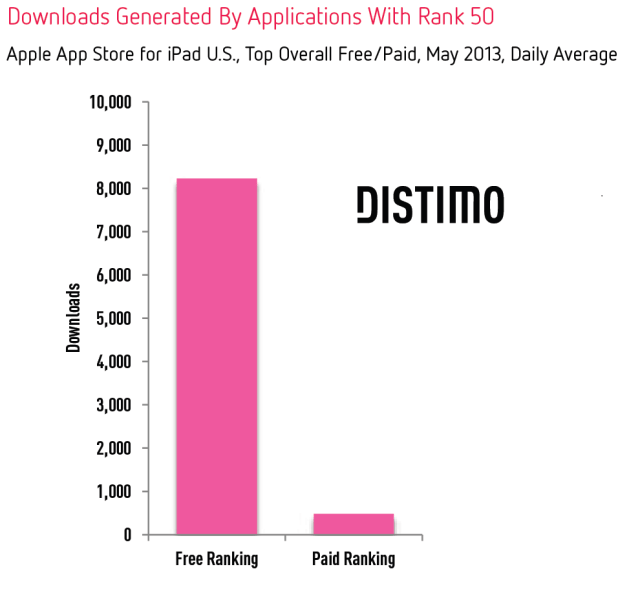

iPad App Store

Though the large majority of Distimo’s study examined the challenges for iPhone apps in particular, the company did offer a brief comparison of other app stores, including the U.S. App Store for iPad. Here, it’s easier to reach the top 50, with only 8, 200 daily downloads on average needed for a free iPad app, and fewer still for paid iPad apps at 480.

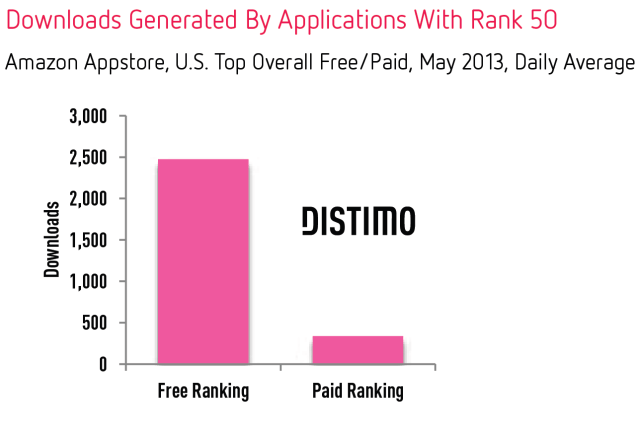

Amazon Appstore

On the Amazon Appstore in the U.S., free apps needed 2,500 downloads on average per day to reach the top 50, which is roughly 9 times less than need in the iPhone App Store. The number of paid apps needed was 2.8 times lower than the iPhone App Store, at just 340.

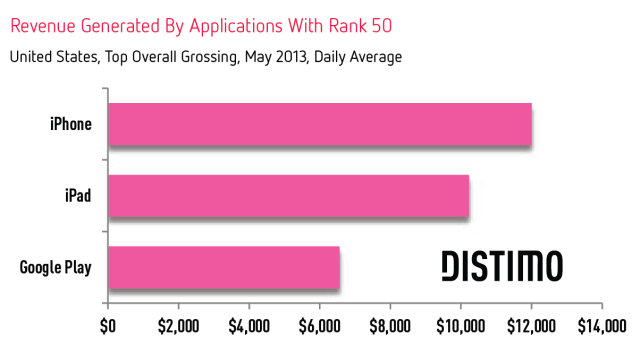

iPhone vs. iPad vs. Google Play

Unfortunately, the report largely skipped over Google Play, which provides apps for what’s now the world’s largest mobile operating system by market share: Android. The report only offered a look into the top grossing charts, but didn’t detail the number of apps required to reach Google’s top free and paid lists.

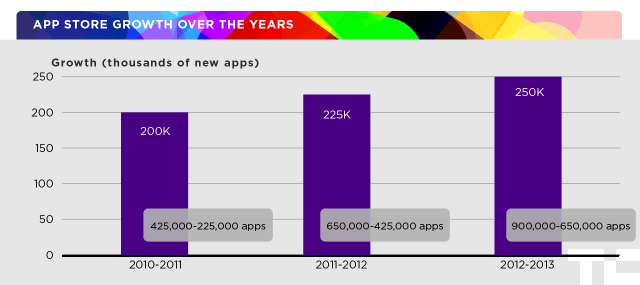

Not surprisingly, Google Play apps don’t need to generate as much daily revenue to reach a top 50 grossing position, but they do need to generate this daily revenue for a longer period of time in Google Play to obtain their position. That speaks to the differing natures of Apple’s and Google’s app stores, namely that the former is more volatile due the ever-increasing number of apps, which was recently revealed to number 900,000. This trend shows no sign of slowing down either, which means breaking into the top charts is going to become even harder over time.

In a report from earlier this year, Distimo found that only 2 percent of the top 250 publishers in the iPhone App Store are “newcomers,” and that figure was only slightly better (at 3 percent) on Google Play. Meanwhile, only 0.25 percent of the total revenue from the top 250 applications goes to new iPhone app publishers, while 1.2 percent reaches new Android app publishers on Google Play.

Even though the app store gold rush as not yet subsided, Apple will eventually have to address some of the challenges facing its third-party developers in the future by offering better tools for app discovery, or risk having them turn their attention to other platforms where visibility and findability is better. To some extent, this is what the Apple’s acquisition of Chomp was supposed to assist with, but to date, all the learnings and techniques from that app discovery startup have not made their way into Apple’s store. Plus, at this year’s WWDC, the only notable improvements to App Store search and discovery were new categories for kids’ apps, and booting out Genius for an “Apps Near Ne” section instead, neither of which are major changes.

Distimo’s full report is available here.