Editor’s note: Tadhg Kelly is a veteran game designer, creator of leading game design blog What Games Are and creative director of Jawfish Games. You can follow him on Twitter here.

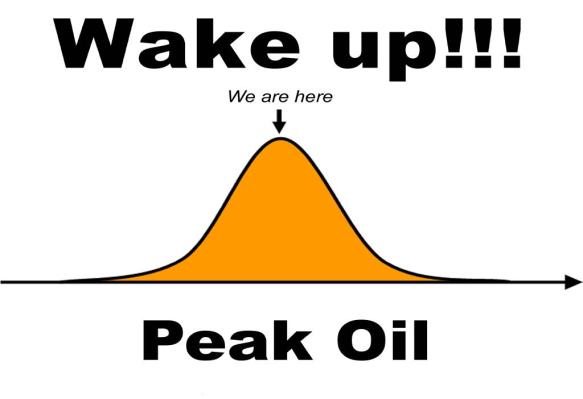

I was not particularly surprised. I’m talking about this week’s Zynga, OMGPOP and Tapjoy news, but not in a haughty-told-you-so sort of way. I’m wondering whether they are canaries in the coal-mine, symptomatic of a larger shift in mobile gaming. I’m wondering whether the mobile market has hit a peak, and whether that means its tone is about to shift. I’m wondering whether mobile gaming has passed a point where it is no longer cost-effective to create lowest-common-denominator games, and whether we need smarter approaches.

Before The Peak

Before a peak is reached, games always seem like a business in which the most important skill to possess is the ability to rush.

Usually it starts with an unexpected novelty, such as when Facebook turned on its API, Apple surprised everyone by releasing an App Store or Nintendo invented the Wii (or more up to date, the microconsole idea, which I think is the next one). The novelty often seems unproven, leading to a wait-and-see attitude from most astute observers. Developers tend to not like making games for platforms that don’t seem validated yet for fear of wasting money, but there are always some early movers. They are the people who realize that there may be an opportunity in the new market that others don’t see, and they leap before they look. In so doing, they prove the novelty’s validity for others.

The novelty phase then leads to a low-hanging fruit phase as reports of early success surface. A couple of key games show that there is a new kind of interaction or other game mechanic that seems to work in that space, and they nail its possibilities (your Flight Control or Mafia Wars moment) in a way that opens a lot of eyes. Where last year the skeptical games executive may have scoffed at the idea that Facebook would ever go anywhere, this year he’s suddenly leading the charge to get on there as fast as possible.

During the low-hanging fruit phase a lot of obvious game concepts are explored, often little more than re-skins or clones of other successful games. The size and scope of the market start to be wildly exaggerated, but also the sense of optimism. A gold rush mentality takes over and developers start inventing genres on the fly, such as “endless runner”. These are usually good times for those who execute at speed and do it well, and they lead to some outsized successes (your Angry Birds or FarmVille moment) that achieve cultural critical mass. Folks start talking up their game science, their playbooks and their mechanics decks, and more and more people pile on.

However then the problem becomes one of discovery and – like any gold rush – that leads to a third phase where it’s better to sell shovels rather than do the mining yourself. Marketing tools, sharing plugins, advertising solutions, customer acquisition, monetization tools, game engines and many more services explode. In the old days we might have called that publishing, but these days we call it APIs. Regardless, there seems to be more reliable money to be made in servicing developers than the market directly, and many companies strive to fill those niches. This is where success stories like Applifier come from, as well as the thinking about what it really takes to get up to the top of the iOS charts.

Nonetheless it still seems relatively straightforward. The next phase, the peak, is when the business stops being simple.

Peak

Up until the peak there may be many roads to take and many avenues to success, but the product itself is usually pretty obvious. Whether we mean farming games, casual games or casino stuff like bingo, these are all the kinds of game that are broad. Some may be very smart, others as dumb as a post, but none of them represent a complex conversation with customers. Like selling brands of soap, what the game is and how it plays are questions of mass appeal, and the most repeatable road to success is about maximizing commercial advantage.

But when customers’ platform amnesia starts to wears off, everything starts to change. This is the peak.

Customers start to notice that they’re being offered the same product over and over. They start to become sensitive to the vagaries of the platform and then less inclined to just jump into a game willy-nilly. They start to develop deep loyalties to certain games, and certain game makers. They start to get slightly bored of watching the same ludemes endlessly recycled and want to be delighted all over again. They start to find the non-mechanical aspects of a game, such as its fiction or aesthetic, more appealing. In short they start to become somewhat like any media audience, which is to say complex and hard to read as one whole bloc.

Whether searching for complex games like Star Command, retro games like Knights of the Old Republic, elegant games like Dots or arty games like Year Walk, they start to drift away from the center. Bit by bit, day by day, the cost of being in the center seems to get that little bit tougher and cracks start to show. Even selling shovels to help others get to the center starts to get icky and layoffs begin. Developers start asking whether there really can be a meaningful return ever generated for any company paying $4 per quality customer install.

Take Zynga for example. Zynga was a great company in the days when social games were all about being fast movers and fast followers, but those times are past. Now it’s facing the much harder task of operating in mature markets where growth is not as explosive, and unless it can figure out a third way such as the real-money gaming or trying to develop some wacky hits like a MOBA it’s probably got a long road and many more layoff rounds to come. These are non-simple choices, in a no-longer-simple landscape.

I also think similar forces are at work at Tapjoy and other plugin providers. Aside from the fear of another AppGratis situation, there are a lot of competitors selling very similar products with a limited range of tactics at their disposal. And, not unlike the days when Facebook was full of wild west plugin solutions, it seems to me that a great shakeout of these services is looming. They all essentially say they can find you quality users through cross promotion and pay-per-something advertising, but actual accounts of success or failure in those networks produces wildly differing impressions.

After The Peak

The frustrating aspect of peak oil is that we’ll likely only know that we hit the peak after the fact. All the indicators tend to trail where the market actually is, and this is why crashes happen. The same is true of any gold rush or any stock market bubble. We can only sense what might be going on from watching canaries and reading runes, and by the time the real information comes in the fight-or-flight decision point is usually long past. In games, as in many areas of life, if you wait too long to know what you should do, your hesitation kills you. That’s why it’s entirely possible that – even though Clash of Clans and Candy Crush Saga may be making dump trucks of money – peak mobile has actually been reached.

If I’m right then the next sign to look for is just how dependent success becomes on relationships. It starts to feel as though that succeeding on a platform is about who has the strong partnership with the platform holder, who has the inside track, who has the deals in place to guarantee prominent placement on the front page, the top shelf, or the prime location, then that’s a big indicator. Similarly if the platforms start to talk up their exclusives in order to get prominent placement, it says a lot.

Like I said, this is when the games business stops being simple. Influencers start to matter as much as outlets or process because customers want delight, but don’t want the cognitive load of dealing with overwhelming choice. Trust assets become more important, whether in the official guise (like the old official Nintendo magazines, or the Editor’s Choice on the iOS App Store) or among communities. Getting on the radar of a hot blog, getting in tune with a motivated tribe of customers, or even building that tribe to begin with, are the factors that start to determine your success, but to do so you have to learn to speak their story and language.

One example is the importance of art. Most games look like other games, but some manage a wow factor. In console gaming that factor is usually wrapped up with over-the-top graphics (which we’ll no doubt see a ton of tomorrow when the E3 press conferences begin), but in mobile it’s often associated with a certain style. The App Store editors, for example, seem to love cute paper-cut-out graphics and style apps like Musyc or Paper. Therefore to get noticed by them your probably have to speak to those values. Factors like this start to matter and, depending on the platform, the customer either starts to become more sophisticated and driven by marketing stories, or grows jaded. For mobile developers the question of which way the market will go is particularly pertinent.

The peak came at various speeds to console gaming, PC gaming, indie gaming, flash portals and social gaming. Each market had its own traits and its own kind of customer, so each peak looked different. PC gamers, for example, became a highly engaged audience with and dense cultural conversation. Nintendo gamers developed lifelong brand loyalties that few companies could ever hope to match.

Facebook gamers, on the other hand, just don’t care. Facebook games may have accelerated in user adoption faster than any other platform to date but they also hit their peak very early. Rampant cloning and platform changes that up-ended free virality channels were largely to blame, but efforts to make that market more sophisticated have not exactly taken off. The so-called “midcore” social game customer (a half way point between the traditional casual and hardcore archetypes) sort-of exists, but not at the same scale as a Zynga. Meanwhile Zynga competitors like King seem to be doing really well from going back to basics with simple casual games.

For mobile, it really could go either way. Somewhat like the PC world, there is a vested interest from app store like Apple, Google and Amazon to ensure that they keep pushing great content. Great content drives platform adoption, which in turn drives a whole host of other benefits. It works to Steam’s advantage to have games like FTL, and likewise it works to Apple’s advantage to have great games like Star Command.

Yet at the same time we’re talking about gaming on mobile phones. Those little screens may always be perceived as only for frivolous gaming (such as Warner’s Heads Up game) or playing Sudoku on the bus, but it’s hard to see that they will ever become venues for more immersive games. Can we pragmatically expect the audience of mobile games to develop strong cultural identities and communities? Or will phones always seem just that little bit lightweight for those kinds of game? (And will tablets prove different in this respect?) And if they do, does that mean mobile’s peak will be more like Facebook’s, stalling and settling into fixed patterns and jadedness?

Nobody can say for sure. But it does feel to me that mobile seems to have crested, and mobile game makers are heading toward non-simple times.