Oracle this afternoon announced the financial results for the third quarter of its fiscal 2013, a report that seems to have disappointed stock market investors who were projecting a stronger performance from the company.

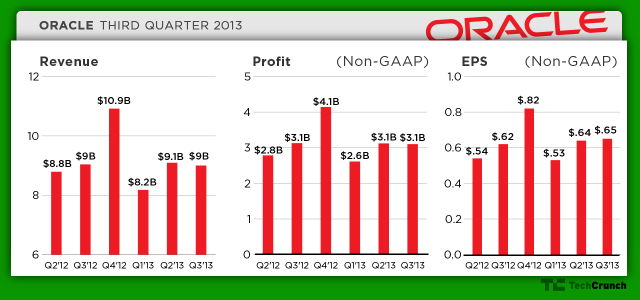

The enterprise-focused software and hardware technology giant said it earned $9 billion in revenue during the quarter, reflecting a sequential decrease from the second quarter of 2013, when it earned revenues of $9.1 billion, and a year-over-year decrease from Q3 2012 when it made revenues of $9.04 billion.

In regards to profit, Oracle reported GAAP net income of $2.5 billion for the third quarter, and non-GAAP net income of $4.2 billion. That reflects GAAP earnings per share for the quarter of 52 cents and non-GAAP EPS of 65 cents.

Both at the top and bottom lines, those results did not meet the expectations of Wall Street analysts. According to FactSet, the analyst consensus was that Oracle would post Q3 revenue of $9.37 billion and non-GAAP EPS of 66 cents.

Oracle’s stock took a quick and steep fall just after the Q3 earnings report was released. Within the first minutes that the earnings results hit the newswire, Oracle’s stock was down 6.8 percent in after-hours trading.

For its part, Oracle is looking at the silver lining, emphasizing the quarter’s strong points in its prepared earnings release. Oracle’s president and CFO Safra Katz is quoted in the press release accompanying the Q3 results as saying: “Our non-GAAP operating margin increased to a Q3 record of 47 percent, and we expect it to reach an all-time high for the fiscal year. Both operating cash flow and free cash flow were at record levels for a Q3, with operating cash flow of $13.7 billion over the last 12 months.”

Here is Oracle’s Q3 report compared to its recent past performances in visual form, courtesy of TechCrunch illustrator and graphic designer Bryce Durbin:

Updating.