These days it seems like everyone and their cousin is trying to craft the next smash hit game, but simply bringing a concept to fruition isn’t enough. It’s got to be engaging and well-designed, and that’s exactly what Game Analytics wants to help developers out with.

The Copenhagen-based startup has announced today that it has opened its (what else?) game-centric data analytics platform to the game developing masses. On top of that, it has also locked up $2.5 million in funding from Sunstone Capital, CrunchFund*, and angel investors like HuffPo CEO Jimmy Maymann, former Podio CEO Tommy Ahlers, René Rechmann, and Anil Hansjee.

Game Analytics has been around in one form or another since mid-2011 (our coverage of the then-stealthy venture can be found here), but the road to market readiness wound up being a little longer than CEO Morten Wulff and his cofounders thought. Back then the startup said it would open the service to private testers within five months, but ultimately didn’t hit that stage of readiness until earlier this year. It would seem that time spent behind operating closed doors has done Game Analytics some good though, as Wulff says roughly 100 games have tapped into the GA platform.

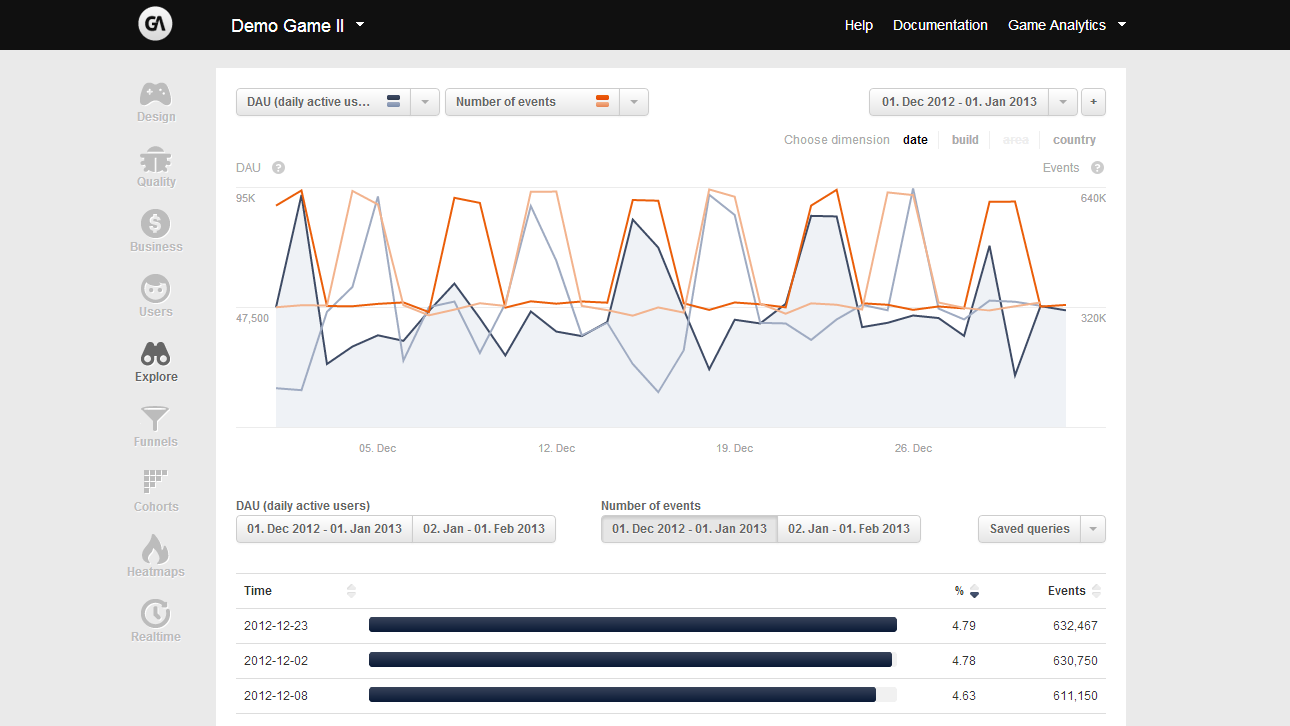

But let’s back up a minute first. As you may have guessed, Game Analytics’ raison d’etre is providing games developers with a highly granular view of what their players are actually doing, and in doing so, helping those developers make crucial design and strategy decisions. GA does this by breaking player actions into discrete, trackable data points — did they complete one step of a tutorial? Data point. Did they just fire a weapon? Data point. Did they just get torn apart by a hideous alien? You see where I’m going with this. All those (user definable) data points then get aggregated and displayed to the curious dev watching the backend.

That data ideally gives the developer in question insight into the experience that the players are having, and lets them know if things need to be changed or rebalanced to make that experience better. Determining the proper level difficulty progression is one example Wulff likes to throw around.

“Let’s say a lot of players are dying on level 2,” Wulff said. “The data raises questions like ‘Is it too difficult,’ and ‘do we need to A/B test alternatives.’” Responses like modifying enemy placement or the level design itself could help retention. After the changes have been made, its possible users won’t quit the game out of frustration any more. GA also helps monitor how players move through the game and what items to players buy — potential boons for developers honing their monetization strategy.

Wulff was adamant in positioning Game Analytics as a cross-platform tool for developers creating game on the web, mobile platforms, and even potentially consoles. A slew of dev tools are already available for iOS and Android coders, as well as SDKs for game engines like Corona, cocos2D, and (perhaps most notably) Unity. In fact, Unity seems to have a few extra frills as far as analytics go — a GA plugin lets developers view a 3D heatmap so they can better understand what’s happening to players and where. It’s precisely this focus on supporting game developers of all stripes and making nice with key middleware providers that Wulff hopes will set GA apart from the crush of competitors that are waging war out there.

After all, the landscape has changed a bit since Wulff started Game Analytics. It’s hardly the only one to bring a more data-centric view of games to developers — Polish startup Use It Better kicked off its own public beta last August to largely positive feedback in a bid to provide its own game-centric analytics, while players like TalkingData have embarked on a similar mission and could give GA some healthy competition in Asian markets. And that’s not to say anything about more entrenched analytics players like Kontagent and Mixpanel, though the latter tends to focus on an area much larger than just games.

Another part of Game Analytics’ appeal to developers is its curious freemium approach — its free tier offers developers the ability to track 20 million data points a month, with paid tiers bumping that limit as high as 1 billion per month for larger studios.

Now that Game Analytics has some capital to work with, it’s looking at amping up its marketing efforts and opening up a North American office in either San Francisco or Vancouver. Curiously, the startup’s international expansion isn’t just limited to North America though.

“We’ve just hired a guy to being setting up an office in China,” Wulff noted. “It’s a booming market, and we see plenty of opportunities there.”

*Disclosure: TechCrunch founder and current columnist Michael Arrington is a general partner at CrunchFund.