Being first to 4G may not be quite the advantage EE may have hoped. The U.K.’s first 4G network was up and running at the end of October last year but EE, the joint venture combining the Orange and T-Mobile carriers which owns and operates the 4GEE network has consistently declined to break out customer sign ups to 4G — saying only that thousands of customers had signed up for 4G and for a new fiber fixed line broadband product launched at the same time. We now have a little more clarity on how many few new mobile customers EE gained in Q4, thanks to its quarterly results.

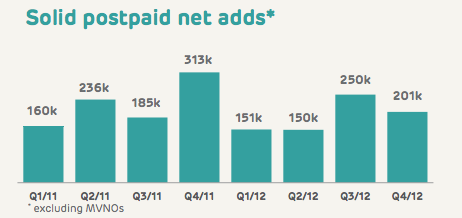

EE still hasn’t specifically broken out 4G vs 3G sign ups (it declined to do so again when we asked, saying this is commercially sensitive information) but reporting its total postpaid net adds, it said it picked up 201,000 in Q4 — down from 250,000 postpaid net adds in Q3, and 313,000 in the year ago quarter:

Part of EE’s problem in attracting 4G sign ups is that the network is still in the process of being rolled out. At the end of the year its footprint reached less than half (43 per cent) of the U.K.’s population. More than half (55 per cent) the population will be within reach of EE’s 4G by June.

“We are seeing solid early 4G momentum migrating Orange and T-Mobile customers to higher value EE 4G price plans in areas where 4G coverage is available,” EE said in its results. It also said more than 10 per cent of its corporate customers are trialling or using 4G, adding that one in four new SME customers are “selecting 4G services”.

Another problem for EE attracting 4G signs is likely to be its pricing and tariff structure — which has been criticised for being both expensive and miserly when it comes to the data limits, with just 500MB on its entry level plan. The company has since increased data tariffs on some plans and added a 20GB plan for “super users“. It has also discounted the cost of its entry level 4G tariff by £5 for the whole of February and March — bringing it down to £31 per month.

In its results, EE notes that: “Early Orange and T-Mobile customers migrating to 4G on EE are showing increases of approximately 10% in ARPU, demonstrating data monetisation” — illustrating the kind of cost premium its 4G pricing structure is creating for early customers. By contrast, rival network Three U.K. has said it won’t be charging a premium for 4G when it’s able to launch its own network, likely to be after Q3 this year.

EE’s results do show it kept customer churn to the same low level in Q4 as the previous three quarters (1.2 per cent) — so 4G may be helping it retain customers. It also said it “successfully upgraded existing customers to higher value plans” — leading to its postpaid access fees increasing 6 per cent y-o-y.

Commenting on EE’s 4G performance, Steven Hartley, principal analyst at Ovum said the results indicate that EE’s 4G customer acquisition has not been as thrilling as it may have hoped. “If customer uptake was far ahead of expectation, then we would hear about it,” he said in a statement. “We therefore have to conclude that uptake has not been spectacular. That doesn’t make it a disaster, just not necessarily fully optimizing its monopoly position.”

EE’s 4G first-mover advantage is fast running out. Rivals are in the process of bidding on new spectrum — and will be in a position to start rolling out their own networks, starting from late Spring/Summer according to telecoms regulator Ofcom.