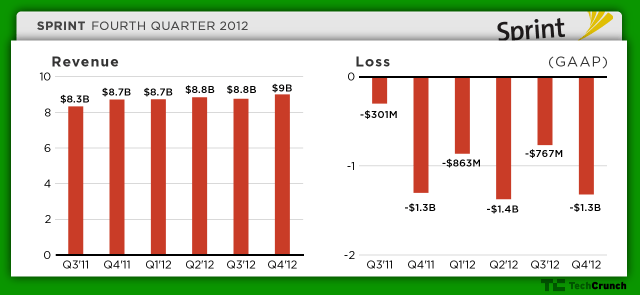

Sprint Nextel, the third-ranking U.S. wireless carrier, has just announced earnings results for Q4 2012, reporting a net loss of $1.3 billion, and a negative EPS of $.44. That’s compared to a net loss of $1.3B and a diluted net loss of $.43 per share in the same quarter last year.

The company says that “$45 million or negative $.01 per share (pre-tax) was related to impacts from Hurricane Sandy.”

Analysts expected a negative EPS of $.37 on the quarter on revenues of $8.9 billion.

Wireless service revenues were $7 billion, while overall revenues were $9 billion compared to last year’s $8.72 billion.That comes out to an operating loss of $758 million.

In terms of device sales, Sprint sold 2.2 million iPhones in the period ending December 30, 38 percent of which went into the hands of new postpaid customers. Sprint has also sold more than 4 million 4G LTE smartphones as a part of its network upgrade.

That’s up from last quarter’s 1.5 million iPhones sold, which has been the flat figure from Sprint for the past three quarters.

This is likely due to the holiday rush, which has contributed to net additions of 401,000 for the company’s post-paid subscriber base. The carrier also added 525,000 new pre-paid subscribers. However, 1.02 million customers left Sprint for greener (perhaps red or blue, even) pastures, which balances out any of the more positive additions Sprint had to report.

As a point of comparison, Verizon sold 6.2 million iPhones over roughly the same period, while AT&T sold 8.6 million. Clearly, even a slight jump for Sprint doesn’t quite match that of its competitors.

Sprint’s rollout of its 4G LTE network began in July of last year and has since grown to cover 58 different markets. This network upgrade is crucial to Sprint’s future success as AT&T and Verizon’s high-speed networks are already developed and operational on a nationwide scale.

Though the company is still struggling, an acquisition by Japan’s Softbank Corp should help with a boost for Sprint. The deal closed for $20.1 billion in exchange for 70 percent of the fully-diluted shares of Sprint stock.

Thanks to the added security of this deal, Sprint recently made a bid to buy out the remaining shares of Clearwire that it doesn’t already own for $2.97/share. However, Dish seems to have made a higher bid of $3.30/share, which could be detrimental to Sprint which licenses Clearwire’s network.