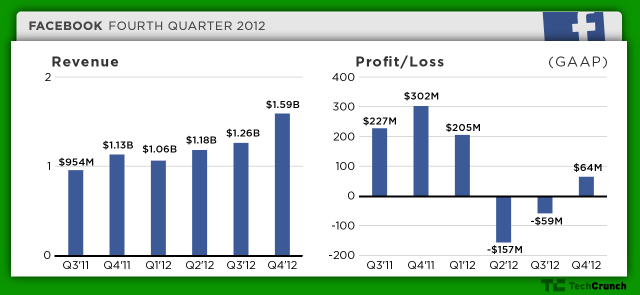

Facebook said its fourth quarter revenue rose 40 percent year-over-year to $1.59 billion. Mobile revenues grew to make up 23 percent of the company’s total and mobile monthly active users rose to 680 million, or up 57 percent year-over-year.

The company beat analysts estimates, but shares initially tumbled by as much as 8 percent in after-hours trading. They’re now down only 0.3 percent to $31.15.

Analysts had forecast that revenue rose 34 percent to $1.52 billion last quarter, according to the median estimate from a Bloomberg survey of analysts.

Facebook also beat analysts’ estimates on EPS and net income with about $65 million in net income to an average estimate of $45.8 million, and EPS excluding certain changes of 17 cents, compared to the forecast of 15 cents a share from the same Bloomberg survey. In the same time a year ago, Facebook earned $302 million in net income on $1.131 billion in revenue.

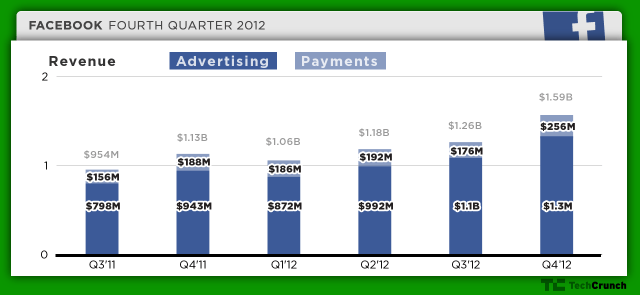

As for the revenue breakdown, Facebook has two primary revenue sources: advertising and payments. Ad revenue was $1.33 billion, up 41 percent from the year before. Payments revenue came in at $256 million, but was essentially flat year-over-year if you factor in some accounting changes that required Facebook to count four months of revenue instead of the normal three for the quarter.

Facebook’s shares have risen 17 percent since the beginning of the year, on bets that the company’s aggressive push into mobile advertising is paying off. Mobile platforms now account for 23 percent of the company’s revenue, up from 14 percent in the third quarter. Facebook has since been much more forceful with putting sponsored stories into the mobile news feed and pushing app install ads. Ad platform Kenshoo told us earlier this month that it’s now seeing 20 percent of all Facebook ad spend going to mobile.

Facebook still has to convince investors that it’s moving fast enough to accommodate a dramatic shift in consumer behavior to mobile devices away from the web. For the first time, Facebook had more mobile daily active users than ones on the web last quarter. Yet mobile revenue is still less than one-third of the size of the company’s web revenues.

At the same time, the company has launched a host of new initiatives in the second half of 2012 that may finally start to show traction. In August, Facebook launched a form of search-based advertising called Sponsored Results in search type-ahead ads after two months of testing.

They also rolled out Gifts last year. You would expect to see this product post its strongest quarter around the holiday season, when friends and family are sending last-minute Christmas gifts. Facebook did a small push around this, with promotions across people’s news feed just days before Christmas. It’s not clear where “Gifts” fall into on the balance sheet, whether that’s in the “advertising” or “payments and other fees” category.

Facebook has also re-oriented the way it deals with developers on the platform, focusing less on monthly and daily active usage and more on revenue per app install. That may not arrest a slowdown in payments and fees revenue, which came in at $176 million in the third quarter, up just $20 million from a year earlier as developers migrated to the quickly-growing and lucrative Android and iOS platforms.