Facebook has been making some efforts to grow new business areas beyond advertising in areas like Gifts and Facebook Credits in apps, but so far the company has failed to convert that into meaningful growth. The company today reported Q4 revenues of $256 million for payments — which includes services like Facebook Credits and its new Gifts service, “and we expect revenues to continue to remain very small given current run rates” in 2013.

During the conference call, CEO Mark Zuckerberg acknowledged that new services like Gifts are not yielding nearly as much as its core revenue driver, advertising. “I think [Gifts] can be great revenue opportunities longer term but for right now it’s about building out great experiences around these,” he said on the call. Later in the call it was noted that services like Gifts and Promoted Posts accounted for less than $5 million of revenues, and that it “expect it to remain small” in 2013 given current run rates.

Facebook’s users have been changing their access point from the web to mobile, and that’s troublesome for its payments business. Facebook grew fat in part thanks to its 30% tax on game payments in its web canvas. But few users play and pay for games on its HTML5 mobile gaming platform where it can collect the same tax. Instead, users are playing Facebook-connected iOS and Android games, where Apple and Google get to collect the tax instead.

Facebook has been trying to get around this by introducing ways of making payments in its own apps more convenient and seamless to use. For example, in the last year, the company has introduced carrier-billing into its in-app payments with the promise that this would boost the number of people buying credits in apps for virtual goods and other services. For now that is either simply making up for attrition in other areas, or not having a meaningful enough impact to move the needle.

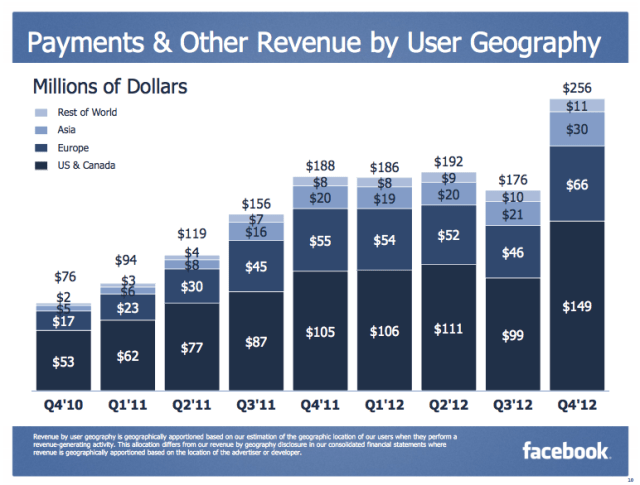

While the $256 million payments revenues makes it look like Facebook saw a 45% increase on Q3’s payments revenues of $176 million, it actually includes 24 months of “historical transactional information” that it’s using to count towards future refunds and chargebacks, worth some $66 million. “Adjusting for the $66 million of revenue in the extra month of December, Payments and other fees revenue would have been essentially flat year-over-year,” it noted.

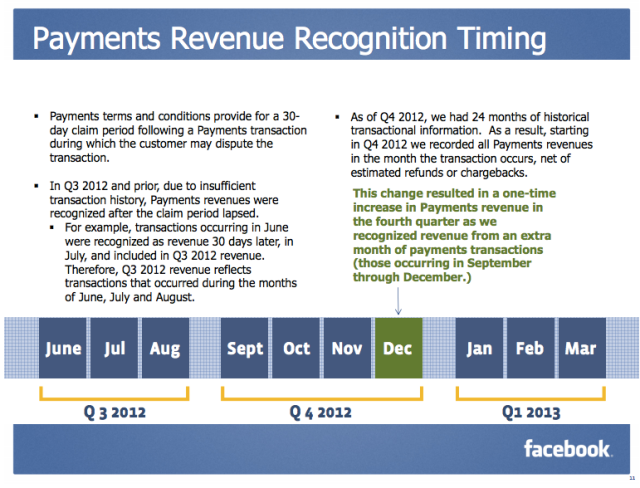

From Facebook’s 10-Q from the end of October 2012, the company warned investors of how this extra charge would result in a payments boost:

Facebook Payments became mandatory for all game developers accepting payments on the Facebook Platform with limited exceptions on July 1, 2011. Accordingly, comparisons of Payments and other fees revenue to periods before this date may not be meaningful. Our Payments terms and conditions provide for a 30-day claim period subsequent to a Payments transaction during which the customer may dispute the virtual or digital goods transaction. To date, we have deferred recognition of Payments revenue until the expiration of this period as we were unable to make reasonable and reliable estimates of future refunds or chargebacks arising during this claim period, due to lack of historical transactional information. In the fourth quarter of 2012, we will have 24 months of historical transactional information which we currently anticipate will enable us to estimate future refunds and chargebacks. Accordingly, in the fourth quarter of 2012 we expect to record all Payments revenues at the time of the purchase of the related virtual or digital goods, net of estimated refunds or chargebacks. We anticipate that this change will result in a one-time increase in Payments revenue in the fourth quarter.

Here is how Facebook represents the concept in the payment charges in its earnings presentation:

It also provides a geographical breakdown of how payments spread out across different markets. It looks like it’s spread out the $66 million across all four major regions, but the salient point here is that more than half of all Payments revenues are coming from the U.S. and Canada, at $149 million, those from Europe remain in number-two at $66 million, Asia is next at $30 million and revenues from emerging markets are negligible at $11 million.

More to come. Refresh for updates.