We now have a foil for all the young consumer startups trying to raise their first venture rounds. Snapchat, an increasingly popular mobile app that auto-deletes photos shortly after viewing, is about to close a big new round of funding from Benchmark Capital. We’ve been chasing for the last week or two, but Om Malik has published first — with a few different details.

We hear from industry sources that the company is raising “north of $10 million” at a valuation loosely around $70 million from Benchmark Capital, with terms getting finalized now. Partner Mitch Lasky is joining the board. Om is reporting that it’s an $8 million raise at a roughly $50 million valuation, with partner Matt Cohler instead joining the board. On that point, our sources say Lasky is the lead because of the Los Angeles roots he shares with the Snapchat founders. The many other investors trying to put in money didn’t have the same connection to the team, and Lasky’s LA track record is looking pretty good right now. He was an early investor in cloud gaming service Gaikai, which sold to Sony this summer for $380 million (one of the larger tech exits to come out of the region recently).

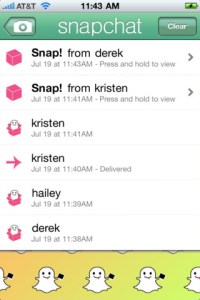

Back to SnapChat. The big deal is that the company enables easy photo-sharing with heavy privacy controls. If you share a photo you can set it to self-destruct up to 10 seconds later. If your friend takes a screenshot, the app will tell you so. The company resists the idea that the main use case here is sexting, for what it’s worth. But whatever it is that users are doing, there’s some good data on the results. It is consistently one of the most popular apps on iOS devices, it’s gaining on Android, and because it allows optional Facebook login, we can also see in AppData that it has more than 1.7 million Facebook users per month, around 100,000 of whom come back every day.

Back to SnapChat. The big deal is that the company enables easy photo-sharing with heavy privacy controls. If you share a photo you can set it to self-destruct up to 10 seconds later. If your friend takes a screenshot, the app will tell you so. The company resists the idea that the main use case here is sexting, for what it’s worth. But whatever it is that users are doing, there’s some good data on the results. It is consistently one of the most popular apps on iOS devices, it’s gaining on Android, and because it allows optional Facebook login, we can also see in AppData that it has more than 1.7 million Facebook users per month, around 100,000 of whom come back every day.

The small company hasn’t shared much about its future plans (like around monetization), but the growth story and the engagement help explain all the VC interest.

It previously raised around half a million dollars from Lightspeed Venture Partners.