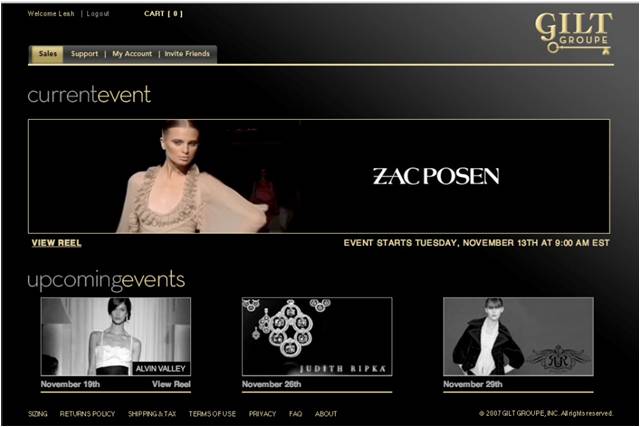

Alexandra Wilkis Wilson walked into famed celebrity designer Zac Posen’s showroom in November 2007 prepared to give the pitch of her life. The Gilt co-founder was attempting to sell Posen and his team on putting some of the designer’s excess inventory on the yet-to-be-launched flash sales e-commerce platform. At the time, the flash sales industry was nascent, so many, including the fashion industry, had no idea what a flash sale was.

Wilson and her CTO at the time, Mike Bryzek, stepped into the meeting armed with a demo, a bunch of mockups, and information (all of which were online). However, they quickly realized that Posen’s office didn’t have Wi-Fi. So Wilson, thinking on her feet, just took a pen and paper and started sketching the idea out. Posen’s team liked what they saw and became the first designer to sell their items in Gilt in late 2007.

Gilt has evolved from a fledgling e-commerce startup trying out a new model to a full-sized company with multiple verticals, $240 million in funding, and over $600 million in gross yearly revenue. Valued at over $1 billion, Gilt just celebrated its fifth anniversary and is about to embark on a pivotal year. Gilt turned profitable on EBITDA basis in October for the first month, and last week the company announced that former Travelocity CEO and Citigroup Exec Michelle Peluso will be taking over the CEO role early next year from current CEO and co-founder Kevin Ryan. And there’s the definite possibility that Gilt will become a public company by the end of 2013.

From Idea To Implementation

Back in 2007, the flash sales model wasn’t necessarily new. European site Vente-Privee was seeing success with buying old inventory from designers and turning it around for consumers to purchase at a discount. Ryan, a serial entrepreneur who was formerly the CEO of DoubleClick (which was eventually acquired by Google for $3 billion), had heard about the European e-commerce site from his wife who was enthusiastically raving about the discounts. His first thought was, why can’t we bring this to the U.S.

“The model created urgency and scarcity, and this seemed like a good business idea,” he explains. “E-commerce can be a tough business, with the challenge of marketing spend, getting people on the site and turning inventory. This model flipped all of that around.” So in April 2007, Ryan, who already had an umbrella corporation called AlleyCorp, decided he was going to start his sixth business, a flash sales site, and hired his technical team, Mike Bryzek and Phong Nguyen. On the fashion side, Ryan recruited Alexis Maybank a few months later (who became CEO) and then brought on merchandiser (and Maybank’s close friend from Harvard Business School) Alexandra Wilkis Wilson. It was a dream team of sorts, with the balance of engineers and product marketing (Maybank had extensive experience at eBay), as well as fashion merchandising (Wilson had worked for LVMH and a number of other well-known design houses).

Maybank recalls hearing about the idea and completely relating to it because it basically put a favorite pastime of hers and Wilson’s — the designer sample sale — online. Traditionally, designers would sell excess inventory from past seasons in huge, sometimes very private sample sales in warehouses in Manhattan (I’ve been to a few myself). For many high-end brands like Gucci and Prada, these invitations were highly coveted.

Vente-Privee was being valued at $1 billion at the time, and the clock was ticking on who was going to be able to bring this to the U.S., says Maybank. “And from our standpoint, missing the holidays would be a big mistake.”

Ryan knew he had to act quickly, and from April onwards set out to build the site, start developing relationships in the fashion world (Via Wilson), and try to get an initial userbase. He says by the time Gilt launched in November 2007, Ideeli had already launched, HauteLook had debuted, and RueLaLa was scheduled to launch.

But early on, Ryan knew that in order to differentiate Gilt from the many competitors that were soon to come, he would have to create a distinctive brand. For Gilt, that was luxury at affordable prices. “It’s easier to move way down than to move up in fashion. And this was a good place to be, because we had higher price margins. But we had to be selective about brands on the site, and the photography and design had to match what our brand was going to be,” he says.

So when Wilson suggested Zac Posen, who is a celebrity favorite, the group thought it would be a great fit as the first designer on the site. Wilson had actually worked with Posen’s team on a project previously so already had an existing relationship with the design house. As mentioned above, Wilson and her team met initially with Posen’s team and managed to succeed in the pitch, but it was generally a challenge to get designers to see the importance of e-commerce, as many high-end designers did not have online retail sites.

“I had many doors closed in my face. The answers were usually no, but sometimes I could get a maybe or ‘come back to me in six months,” she explained. “But I love a challenge and I knew what we were trying to do was revolutionary for the fashion world. Eventually high-end fashion brands would get it.”

Convincing them to sell their luxury goods at a discount was also difficult. However, as Maybank explains, at the time, many of these designers wanted to engage a younger, 20-something audience who were not coming into stores anymore.

As Wilson was shoring up designers and clothing to sell, Maybank was shoring up the actual site for launch in the fall and focused on getting members to sign up prior to launch in early November. Maybank recalls the night the team (which was now up to eight employees) sent out the initial member invites on October 31, 2007. Gilt was then based in the AlleyCorp offices in Chelsea, and Maybank says the team sat in the office until 5 a.m. watching people sign up as the Halloween Parade was going full blast outside of the office.

It’s important to note that this was just the beginning of email-based, e-commerce initiatives. Groupon, Fab, and many others who rely upon email to push deals and sales did not yet exist. Gilt was treading on uncharted territory when it came to the email-push model and attempted to make signups go viral by offering coupons as an incentive to spread the word.

Via Maybank, Wilson, and other founders’ friends and family, Gilt managed to sign up 15,000 initial members prior to the site’s launch in early November.

A few weeks later (and many all nighters under Ryan, Maybank, Wilson and the team’s belts), Gilt launched to the public featuring a sale on Zac Posen apparel. The sale sold out completely. Wilson says that the company made around $13,000 from the sale, which was small, but at the time, seemed large.

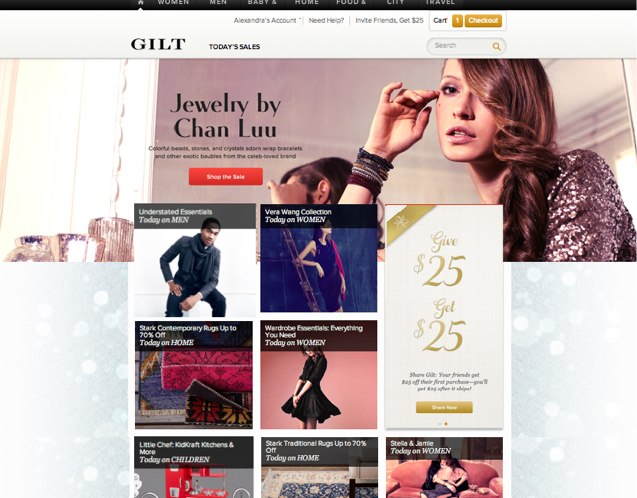

In the early days of Gilt, the site featured one sale a week, but was quickly able to scale to three a week, then four a week and so on. Now, Gilt has dozens of sales in a given day across its verticals.

Maybank says that Gilt was able to benefit from a halo effect of selling high-end designers. While Gilt was not a known brand, when designers like Posen bet on the site, it attracted other designers. Word of mouth brought a well-known diamond and jewelry designer, as well as Valentino, to Wilson, and a month in, she got a call from a high-end shoe brand, Stuart Weitzman, who wanted to sell on the site and basically said “what’s it going to take to get on Gilt.” That was a wow moment for the startup, as many in the design and fashion community quickly went from shunning the idea to actually pitching Gilt.

Another factor in Gilt’s favor was the start of the downturn in the economy. She explains that many brands had more excess inventory than they expected and were looking for ways to offload this. While skeptical at first, designers saw that Gilt was getting traction early on, and some decided to take a risk.

Ron Berk, the CEO of jewelry company Judith Ripka, was one of the first jewelry companies to sell on Gilt. He recalls Wilson pitching him on the idea, and Berk said she was convincing — enough so that Berk realized he wanted to be ahead of the curve and not behind it. He adds that the timing was right for Gilt, as every fashion and jewelry designer was facing overstock issues and looking for ways to get rid of inventory in a smart way. Gilt was not only a vehicle to sell these products, but it still had the luxury brand and promised a younger audience.

One of Wilson’s huge coups in the fashion world was getting famed shoe designer Christian Louboutin to sell his designs on the site. Wilson had been trying to get the shoe designer to sell on the site for nearly a year, and then one day in the fall of 2008, the designer finally agreed. Wilson says they took every pair of shoes Louboutin was willing to give them, and within minutes the sale was completely sold out, unfortunately taking the site down as well with all of the traffic. “It was such a big deal in the fashion world, but we didn’t expect that level of excitement,” she says.

Verticals, Verticals, Verticals

By December 2007, Ryan realized that this startup idea was going to stick. The site was seeing consistent growth, and most of the sales were selling out. Until that point, he was bankrolling Gilt himself, spending around $25,000 of his money per week. It was a good point to start to take institutional investment, and in December Gilt raised $5 million in funding from Matrix Partners.

Nick Beim, then a partner for Matrix (he recently moved to Venrock) said that Ryan, a long-time friend of his, came to him to hear out the offer for investment in the promising startup. Beim wanted to meet with the team and was immediately impressed with Maybank, Wilson, and the rest of the core team members.

“Investing is a conviction sport, and I developed a strong conviction in that meeting,” he says. “I was impressed with Alexis’s knowledge of e-commerce and Alexandra’s astounding insight in the fashion space, plus they had two technical founders. It’s unusual to see a team of that breadth.”

He adds that from the technology standpoint, Gilt appeared to be a powerful business model that offered the potential for two things that VCs investing in e-commerce rarely see: rapid viral growth and high customer monetization. The Series A round, recalls Beim, was exceptionally competitive, and he felt fortunate to be chosen as an investor. He also firmly believed that Gilt would be an e-commerce powerhouse and ended up spending 40 percent of his time over the next two years helping the company hire and scale.

Armed with this new cash, Ryan, Maybank, Wilson, and the team set out to hire and venture into new verticals. “We always knew we would expand into other verticals and designed the website initially with men in mind thinking that we would attract them at some point,” explains Maybank. But it happened a lot sooner than Gilt thought and by March 2008, a little over four months after launch, the site’s email list was already 25 percent male.

Within months, the site started to expand to kids clothing and products, as well as home goods. Maybank and Wilson say that they would always test products out before launching a full-fledged vertical, and were surprised that as they continued to test out men’s clothing, kids items, and home goods, the response was overwhelming.

In the first full year of operations, Gilt had projected $5.5 million in revenue, but ended up posting $38 million, thanks to the site’s rapid expansion.

Part of this expansion meant bringing on new, experienced e-commerce and branding leadership. In the fall of 2008, Susan Lyne, previously the CEO of Martha Stewart Living Omnimedia and a former exec at ABC, joined as CEO, replacing Maybank as CEO. Conversations between Lyne and Ryan started taking place during the summer of 2008 when Lyne had left the media business but she wasn’t looking actively for a new job.

She tried Gilt for the first time, and started buying immediately — she was hooked. At one of the many lunches Ryan and Lyne shared when talking about the possibility of Lyne joining as CEO, he said “We’ll know within a year whether this will be game-changing. Will you give a year of your life to this?” Lyne saw how much she was buying as a user after joining the site only weeks earlier and realized Gilt had tremendous potential.

She says she saw the value in what Gilt was trying to do — what she calls the “second wave of e-commerce.” “This is experiential shopping that took place offline, but had not been replicated online until Gilt,” Lyne explains.

Since the day she started working at Gilt, Lyne says there hasn’t been a moment where she has doubted the model. She adds to Ryan’s belief in verticals, saying that when the company started investing in verticals, this was a key turning point for Gilt as a business.

Travel And Gilt City

Toward the end of 2008, Ryan started thinking about the opportunity to extend Gilt’s model into travel, with an emphasis on luxury hotels and experiences. He saw that there were a number of luxury brands in travel, including the Ritz-Carlton, Starwood and others, but no one had been able to monetize excess inventory from hotels. It needed a home with the right brand that didn’t distort the hotel chain’s brand.

“People thought I was crazy because no one had ever sold travel on the same site as clothing,” he explains. So he decided to start Jetsetter as a standalone brand, with a different stock option pool, brand name, etc. Jetsetter launched in 2009 led by Drew Patterson, the former Vice President of Marketing at Kayak.

Travel is a different beast, and Ryan started to see the challenges of managing a travel business. Margins are lower, cash flow dynamics are different, and dealing with hotels is a whole business in and of itself. He says that revenue has been steadily growing over the past few years, and the site now pulls in $70 million to $80 million per year in gross bookings. Today, Jetsetter is just under 10 percent of Gilt’s total business.

Along the way, Ryan decided to raise more capital to fund this expansion to verticals and add new inventory to the mix. In August 2009, Gilt raised $43 million from Matrix Partners and private equity firm General Atlantic, and did another $35 million from the same investors nine months later.

As you can see, Ryan, Maybank and the team are bullish on testing out new models and verticals. While men’s clothing, kids items, and home goods were all a success, some verticals didn’t hit the mark.

Gilt launched Fuse as a more affordable vertical for women’s clothing. Gilt saw that some of its younger audience was browsing not buying, and the startup thought that this was because there weren’t enough cheaper items on the site. It turns out, explains both Maybank and Ryan, that there were simply too many sections for women to go to within Fuse and the main women’s vertical. Another reason the vertical failed is that many of the younger visitors would actually start buying on the main site once they started getting an income.

The company also tried to get into full-priced retail with the launch of Park & Bond, a retail site for men’s clothing and accessories. Eventually sales weren’t as strong for full-priced clothes, and Gilt recently absorbed Park & Bond into its standalone men’s vertical. Ryan adds that Gilt Taste, a marketplace for artisan foods and groceries, hasn’t performed as well as expected, either, and the company has limited its investment in the vertical to only four employees.

Gilt City has met a different fate.

Around the end of 2009, Gilt started to pick up on the Groupon-opportunity of offering daily deals on local services, businesses, and more. But Gilt wanted to be thoughtful about jumping into this business while still remaining focused on its luxury brand. In April 2010, Gilt launched Gilt City in New York as a more luxury-focused Groupon. Instead of offering a deal for a local spa, Gilt offered deals for the most exclusive and luxurious spas in Manhattan at a higher price point. Gilt also purposefully didn’t push many deals at once.

Gilt City, said Ryan, steadily grew, and the company decided to invest more in the venture, adding more cities. Last year, Gilt bought BuyWithMe, a daily deals site, to add more cities and scale. “BuyWithMe had the cities that we didn’t have. The reason we bought it (the acquisition price was “a couple million dollars”) was to get access to the company’s mailing list,” he explains. Unfortunately, Ryan says he didn’t feel that expansion into other cities was the best move for Gilt City, and was forced to layoff a number of BuyWithMe employees shortly after the acquisition.

While many thought that the layoffs symbolized the greater weakness in Gilt’s daily deals site, Ryan maintains that City is Gilt’s fastest growing vertical– Q1 revenue was up 84% over Q1 2011, and Cyber Monday brought a 89% increase versus same day 2011. In the spring of this year, Wilson joined the Gilt City team, helping with recruiting the right types of deals for the site and merchandising.

Ryan says that by scaling back on individual cities and just doubling down on larger cities where there is a business and demand for local luxury items and businesses, Gilt City has gone back to growth mode. Ryan even says that Gilt is actually seeing meaningful revenue from the business. Wilson tells us that 70 percent of customers who are buying from a particular brand or business are going back to engage with the same brand. And 55 percent of Gilt City customers make purchases beyond the offer. For now, Gilt City is going to continue to operate as is in seven major cities, but the company is going to revisit its strategy in six months.

To manage all these verticals is extremely complex, says Ryan. It’s an art form, he explains, to be able to run each operation. But behind the scenes, Gilt sees lower marketing costs in some situations when Gilt City helps drive sales for Gilt.

The Present And Future

In May 2011, Gilt raised a whopping $138 million in new funding, led by Softbank with Goldman Sachs, New Enterprise Associates, Draper Fisher Jurvetson Growth, Pinnacle Ventures, TriplePoint Capital, Eastward Capital, General Atlantic and Matrix Partners all participating. Pre-money, Gilt was valued at $1 billion at the time. So what was the reason for raising this war chest? Acquisitions and further expansion into new verticals, said Ryan at the time.

International is definitely a focus Ryan is considering. Gilt has a presence in Japan but has not made a decision to have a native presence in any countries outside of the U.S. He says that Gilt thought about whether to open in Brazil, with the rise in e-commerce under way, but to build this from scratch would be a $20 million to $30 million investment. This kind of capital, says Ryan, could be better used toward an acquisition in the country. “It’s possible that in two years, we could do an international rollup,” he adds.

Another opportunity for Gilt could be to help manage e-commerce operations for high-end designers and brands. Ryan says a lot of companies have approached Gilt to take over their e-commerce operations, because Gilt has all the warehousing, design, and technology infrastructure in place. He’s started to have some conversations to pursue this line of business.

It would be a more enterprise angle for Gilt, and the company would essentially manage the backend operations for designers and retailers. Gilt would put items in a warehouse, handle customer support, technology, and more. Ryan says he would charge something like 10 percent of total revenue created, which could be a huge money-maker with little investment on Gilt’s part because much of the costly infrastructure is already in place.

In terms of revenue, Ryan says Gilt is seeing over $600 million in gross revenue. In October, revenue grew almost 40 percent vs. prior year. And the company is now profitable on an EBITDA basis. Sales over Thanksgiving were up 60 percent year over year, and November brought in $70 million in gross revenue, a record-breaking month for sales. He says that when Gilt raised its last round at a $1 billion valuation last year, the company was losing around $50 million a year. Now, the company is profitable, hitting record revenue, and one could assume that valuation would be impacted by this.

A year from now, Ryan’s goal is for Gilt to be the most profitable company in terms of margin percentages.

And then there’s the question of an IPO.

What Gilt Looks Like As A Public Company

The IPO rumors are true. Gilt wants to be a public company, but Ryan is in no rush to take the company on the public markets and wants to be more thoughtful than some of the company’s contemporaries when deciding to file for an IPO. He sees a potential IPO happening at the end of 2013, but says that revenues need to be bigger, though he says that Gilt’s current revenue is four times larger than DoubleClick’s revenue when it went public in 1998. Of course, this is a different climate for tech companies. He adds that it’s not really about profitability (although the company will be profitable at the time of filing).

“It’s more than just a timing issue, it’s whether you think it’s good for the company. Do we want to spend a good part of the next nine months focusing on going public or do we want to build a business?” he says. He doesn’t see Gilt raising any more money between now and a public offering, but if Gilt wanted to make a big acquisition, he would reconsider.

Beim says that Gilt’s main challenge at the moment is “shifting from the primary emphasis on growth to focusing on profitability and predictability of financials, because that is important for a public company.” He adds that what Gilt has in its favor as a company is massive scale.

There are also Ryan’s departure from he company. Ryan spoke frankly of his involvement with Gilt, and the fact that he had always planned to move back to the chairman position (which he had when Lyne was CEO). The fact is, he explains, that Gilt needs a different kind of leader, one that can focus completely on Gilt as opposed to dividing time between many projects, as Ryan has been doing. “I’m barely able to put four days a week towards Gilt, and I’m feeling stretched.”

Ryan has also been focused on helping another one of his AlleyCorp companies, 10gen, a fast-growing enterprise database company. Most recently, 10gen was valued at $500 million.

“We needed someone who has experience with fostering a big brand and is super operational and can manage logistics and merchandising. And this exec has to be financially astute and can speak intelligently to institutional investors when talking about quarterly numbers,” he says.

Peluso, who has been a board member of Gilt for the past few years, fits all that criteria, says Ryan. From 2009 until now, Peluso was the Global Consumer Chief Marketing and Internet Officer at Citgroup. Prior to that, she was the Chief Executive Officer of Travelocity from 2003 to 2009 after serving as the company’s Chief Operating Officer and Senior Vice President of Product Strategy and Distribution. She joined Travelocity following the company’s acquisition of travel deals Site59, a travel site she created and launched in 2000. Peluso also served as a White House Fellow and Senior Advisor to Labor Secretary Alexis Herman and worked as a case leader for The Boston Consulting Group in New York and London.

She explains that very few ecommerce companies evoke emotional attachment from its users, and Gilt is one of these unique retailers. “While there are things we are pulling back on, it’s extraordinary how much success the business has,” she says. “Over the past six months, the executive team has really pulled it together to create a vision of what the company will be.”

Peluso will likely take Gilt public next year, and she’s focusing on making sure that the company is profitable and continuing to grow through the right monetization paths, and becoming efficient operationally. Ryan adds that Peluso was his ideal choice for a number of reasons, but he’s very bullish on the idea that she knows how to operate companies at scale.

Lastly, there’s the question of whether it makes sense for Jetsetter to be part of the Gilt family. Jetsetter isn’t failing like some of Gilt’s other properties that have, but rumors of turmoil at the business have been rampant. Jetsetter’s Patterson was asked to leave the CEO spot earlier this year, amidst a staff exodus.

Ryan explains that when he started Jetsetter, he knew there was a possibility of selling the travel site or finding a partner. That’s why the travel sales site was created as a separate company, with a different option plan than Gilt’s. If Ryan wanted to sell Jetsetter, he could untangle it easily. And now Gilt is looking to sell Jetsetter, for anywhere from $30 million to $50 million. “There’s no clear path to doubling or tripling revenue, and the property is worth more to someone else than to me; these assets could be much more valuable to someone else,” he says

Gilt hired an investment bank and formally put Jetsetter up on the block on September 15, and has already received a number of non-binding bids for the property. The company should be receiving binding bids as well. Ryan believes that Gilt will have a decision by January on whom to sell Jetsetter to and how the arrangement will work.

He adds that he’s not yet sure if it makes sense for Jetsetter, even if it is sold, to leave the Gilt merchandising umbrella. He feels that the cross-promotion could still be good for business development of the site.

In terms of technology, Maybank adds that Gilt is doubling down on mobile and personalization. She says that currently 35 percent of Gilt’s revenue is from mobile devices and expects this to increase. Personalization is “one of Gilt’s biggest challenges and opportunities,” she says, and the site is looking for ways to ensure that the customer doesn’t become overwhelmed with the hundred-plus sales taking place every day.

Already, Gilt has been dabbling in using customer data to alter what sales they see first, and the order in which the sales are presented fluctuates in daily emails, as well. In fact, 3,000 iterations of the daily Gilt email goes to the site’s millions of members every day. But we’re going to see more recommendations and personalization surfacing on Gilt’s site and verticals, says Maybank.

This week, Gilt is releasing a new version its iPad app, which is the first major upgrade to Gilt’s iPad app in over two years. The goal of the redesigned app is to create a more immersive shopping experience and support the more leisurely shopping behavior of the iPad. The app features an all new look & feel, updated branding, plus all new interactions and features. Every screen in the app has been updated. Gilt City has been added to the app, and shoppers can use filters to narrow down sales to only see the sizes, brands, categories & colors desired.

Users can now also shop by category, preview all upcoming sales and set/receive calendar reminders, and access their wait listed items

——

It’s been a bumpy road but Gilt seems to be on a smoother path toward that public offering. As Lyne explains candidly, the executive team has done a lot of hard work this year to make sure people are aligned on decisions and strategy. “It’s a huge challenge to get everyone on the same page on what we are going to do and we are not going to do,” she says.

The IPO market has been rocky with some tech companies performing amazingly well and others faltering. With Gilt, the company has already been through major challenges including layoffs, leadership changes, and the folding of verticals. Despite this, Gilt has continued to grow and record record revenue and retain early employees.

The team has weathered storms, and prepared themselves methodically for the hurricane of an IPO. 2013 is sure to be a game-changing year for Gilt.