Windows Azure Storage has entered the cloud price wars with a drop in pricing that could be as much as 28 percent for some customers. The pricing goes into effect December 12th. The drop, which follows two price decreases last week from Google and one from Amazon Web services, reflects a price war that is emerging, as the big giants of the cloud fight for their share in the emerging cloud market.

According to the Windows Azure blog, Microsoft dropped storage costs in March by 12 percent. The blog also states that Windows Azure has 4 trillion objects stored, an average of 270,000 requests processed per second, and a peak of 880,000 requests per second.

Windows Azure has been investing heavily in its storage infrastructure. According to the blog, the company has added to its “Geo Redundant Storage” with more than 400 miles of separation between replicas. This issue of redundancy becomes important when you consider the impacts a natural disaster can have on a business. Windows Azure recently announced the deployment of a flat network for Windows Azure across all of its data centers to provide high-bandwidth network connectivity for storage clients. The goal is to enhance the capability for customers to do big data analytics using MapReduce, high-performance computing, etc.

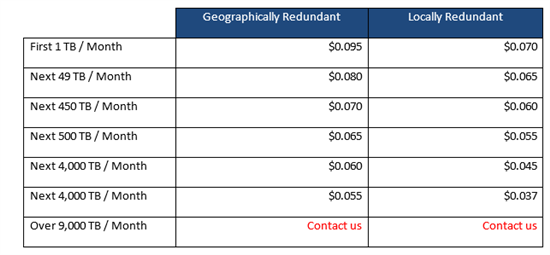

Here is the information on new, reduced pricing for both Geo and Locally redundant storage:

AWS is the clear leader in the cloud services market. It’s in the realm of storage where the company faces its deepest challenges. AWS outages have come with bugs in its elastic block storage infrastructure. Competitors have pounced on that to try and get some attention. In this case it’s pricing that Windows Azure is using to differentiate. I wonder about this tactic, as it is AWS’s differentiation on features and thin margins that have given it such an edge.

With new features, AWS has been able to attract new customers while at the same time leveraging that volume to drop prices and work on the thinnest margin possible.

Google and Windows Azure need more differentiation with features. At that point, the price drops make sense. But for now, it seems more like a race to the bottom more than anything else.