Gartner has this morning published its numbers on the performance of the mobile handset industry in Q3. The topline figure is that the mobile industry overall continues to see pressure from the wider economic downturn, and the gradual move away from cheaper, low-end feature devices: overall sales of 428 million units for the quarter are 3% down on the same quarter last year. But smartphones continue to outshine that by quite a lot: they are up by 47% to 169 million units. In other words, smartphones accounted for about 40% of all mobile device sales in Q3.

Still, that decline of 3% over last year was seen as encouraging by Gartner, since it was still an improvement over Q2, in which 419 million mobile devices were sold.

“After two consecutive quarter of decline in mobile phone sales, demand has improved in both mature and emerging markets as sales increased sequentially,” writes Anshul Gupta, principal research analyst at Gartner. He points out that in China — currently the world’s largest mobile market — smartphones were the biggest driver of sales, with demand for feature devices “weak.” In mature markets, he says that part of the good news story came in the form of new devices, such as the iPhone 5 and Samsung’s Galaxy S III.

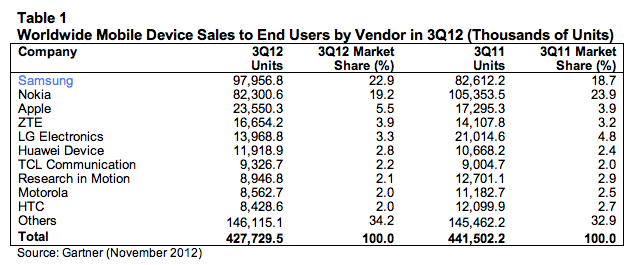

Indeed, with those strong sales for the Galaxy S III, Samsung continues to remain at the top of the pile both in smartphones and mobile handsets overall. Its share of the mobile market for Q3 was 23% compared to Nokia’s share of 19%. As you can see in the table below, it’s a reversal of their positions this time last year:

Rounding out the top five, Apple’s overall share of the mobile market was up to 5.5%, on 23.6 million units.; ZTE remained in forth position with a 3.9% share (16.7 million units). And while it has managed to remain in the top five, LG saw both a drop in both market share and actual sales numbers. These were nearly halved to 14 million units, for a 3.3% share (versus 4.8% last year). Chinese handset makers Huawei and TCL are the ones to watch in the quarters ahead.

Gartner doesn’t break out a list of how individual vendors are faring in the smartphone-only segment, although it does give several details in the report. Samsung has solidified even further its position as the smartphone maker to beat at the moment, accounting for 32.5% of all smartphone sales in the quarter, compared to just under 30% in Q2.

It’s still a two-horse race between Samsung and Apple, with the two accounting for 46.5% of all smartphone sales. But that is actually a much-diminished position compared to last quarter, when together they accounted for 83%. In any case, Samsung is currently appearing to be the stronger horse, with both Apple’s marketshare and unit sales at less than half of Samsung’s.

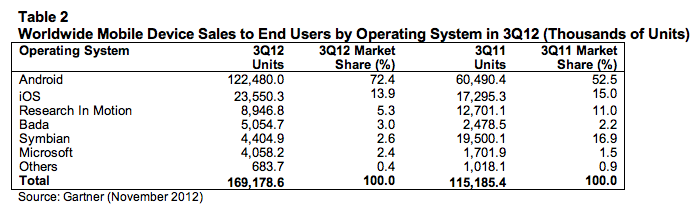

Android overall took a whopping 72% of all handset sales in the smartphone segment in the last quarter, a surge of 20 percentage points over last year. That works out to sales of 122.5 million devices, more than double what Android device makers sold in Q3 2011.

Although Apple’s wider mobile share was up over last year, it is feeling the pinch of competition in the smartphone-only category: its worldwide market share is now less than 14%, down more than 1% over last year, and down by more than 5% compared to Q2. However, in actual terms it also grew its sales numbers (although not by as much as Android): they were at 23.6 million units, compared to 17.3 million last year.

RIM saw declines in both handset sales and market share. Market share has been more than halved to 5.3% on sales of just under 9 million units for Q3.

But perhaps most painful of all is watching that Symbian decline: its share is now just 2.6% compared to nearly 17% last year. Units sold were 4.4 million compared to 19.5 million a year ago. Nokia has been rumored to be phasing out Symbian completely over time. Although it has never publicly said it would do this, numbers like this seem to speak for themselves. This, combined with lackluster sales of Nokia’s Windows Phone devices, meant that Nokia slipped down to number seven in the rankings of smartphone makers, from is position as number three last year (and historically its position of dominating the whole field).

Microsoft, whose OS is being used by Samsung, HTC and others in addition to Nokia, is showing modest gains, as is Samsung’s Bada platform (considered by Gartner to be a “smartphone” platform for these purposes, although Samsung puts it into “feature phone” devices). But in Microsoft’s case these numbers are still not pushing it into the ranks of heavy hitters: it has only a 2.4% share of sales for Q3, on sales of 4 million units. People will be watching closely to see if it manages to boost that in quarters ahead with the launch of Windows Phone 8.

Looking ahead, Gartner predicts that Q4, encompassing holiday sales, will be stronger for handsets, but not as strong as in the past: it expects a “lower-than-usual boost” because consumers continue to remain cautious with spending, and there are other bigger shinier gadgets also distracting them — namely in the form of tablets.

Indeed, that means a win-win for companies like Apple, with its iPad tablets continuing to dominate the tablet market. Gartner says it expects Apple to continue to report Q4 as its strongest of the year. “We saw inventory built up into the channel as Apple prepared for the coming holiday season, global expansions and the launch into China in the fourth quarter of 2012,” Gupta writes.